The Proxy Statement’s New Role

The proxy statement is changing in ways that have deep implications for how investors consume corporate information. These changes, largely driven by Dodd-Frank, are giving rise to a “new normal” of risks and business imperatives. Here’s an overview of what’s happening, along with our thoughts on how finance and HR leaders can stay ahead of the curve.

The Proxy is Getting Bigger

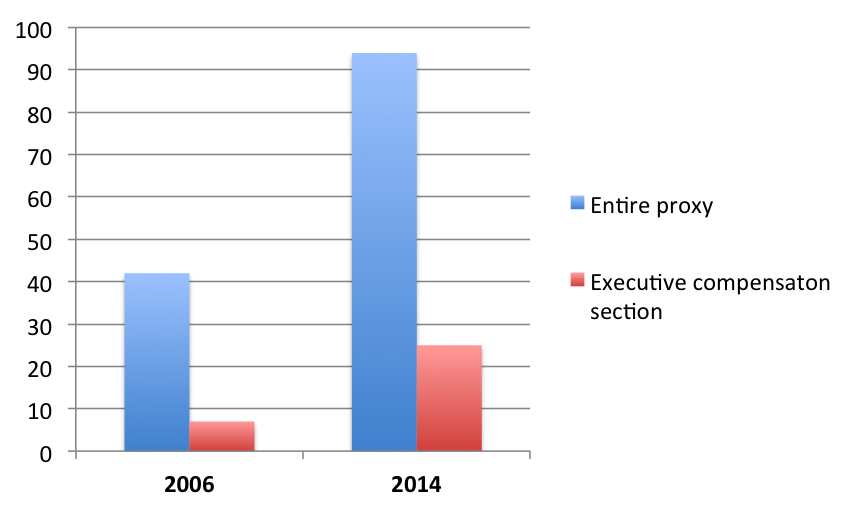

The emerging regulatory philosophy toward compensation disclosure in the proxy seems to be: “If we give it to them, they will use it.” More and more must be disclosed so that investors can approach and consume from the banquet table of disclosure data. This proxy trend stands at odds to how we see 10-K disclosures evolving, in which tables and graphs are taking the place of sheer disclosure volume. The page count of the proxy alone is proliferating. Cisco’s, for instance, grew 124% in eight years. During the same period, the executive compensation section nearly quadrupled.

Cisco Proxy Page Count

Leading this expansion in size (and complexity) is the Compensation Discussion and Analysis (CD&A) section of the proxy. The yet-to-be-implemented portions of Dodd-Frank (pay ratio, clawbacks, and pay-for-performance disclosure) will only further this trend.

The Proxy Is Becoming a Ledger

The precisely specified tables in the CD&A began the proxy’s transition to a numerical document. Pay-for-performance and pay ratio disclosures will both require numerical modeling based on detailed data analysis. Before long, the proxy will look less like a narrative to investors and more like the 10-k—full of tables developed using detailed calculation methodologies.

Accounting Conventions Are Influencing Proxy Calculations

The proxy and ASC 718 accounting are becoming more interdependent. For instance, a too-high accounting value for TSR awards will force a tough decision. Option one is to issue fewer units in order to stay within a target total compensation value. Option two is to issue units based on an alternate determination of value and disclose a higher value in the Summary Compensation Table (SCT) than the compensation committee had targeted. While a slight majority of companies pick option one, simply understanding the relationships between accounting values and proxy disclosures is half the battle.

Another example is with performance-based awards that have successive one-year grant dates. The proxy follows the accounting rules, such that tranches without a grant date are not recorded in the SCT until the grant date occurs (unless the service inception date precedes the grant date). We have seen this particular case lead to unplanned volatility in the SCT; although not avoidable, a better understanding of the numerical relationships would have facilitated better expectation-setting.

An Interdisciplinary Response Is Required

Our most successful clients have deep relationships across their executive compensation, accounting, legal, and investor relations functions. For example, executive compensation needs to be able to call accounting and ask, “What would the accounting impact be if we issue this new award design?” Similarly, investor relations and executive compensation must work together on investor outreach and embedding feedback into plan design.

A cross-functional approach is also important to designing effective controls behind the calculations. The pay ratio rules state that the ratio will be “filed” with the SEC rather than “furnished”, meaning that companies face increased liability in relation to this disclosure. And, while the SEC’s pay-versus-performance rule is still in the proposal stage, the SEC has expressed an interest in deeming some or all of this disclosure “filed” as well. Given the growing numerical basis of the proxy, companies will need to treat their proxy like they treat their 10-k, incorporating automated calculation procedures, layers of calculation review, and strong backup for the different tables and metrics developed.

Use Modeling to Inform Decision-Making

Part of the new normal is better decision support via a more disciplined approach to modeling. Pay ratio is a good example. A simple “straight to the goal” approach is easy—but will this yield a biased result that can turn into a lightning rod in the media? There are many different ways to compute the median employee (which we expect will be the key driver of this disclosure). Companies are best served by testing multiple techniques before honing in on a specific one.

Here’s another example: Modeling the expected cost of a TSR award not only helps avoid cost surprises, but also exposes ways to adjust the design so that more awards can be granted for the same cost. Sometimes the exercise works in reverse, by looking for ways to enhance the perceived value of the award at a relatively modest incremental financial accounting cost.

While modeling can aid decision-making, it can also help set expectations with compensation committee members. For example, we often model how stock price changes might drive swings in the Summary Compensation Table values so that committee members can be adequately prepared. This modeling is most powerful with TSR awards, but is needed with many non-TSR awards as well.

Companies Face a Stark Choice: Minimalism vs. Storytelling

As the proxy becomes more numerical, should companies include only what they are required to disclose without any extra narrative? Or should there be a concerted effort to provide a plain-English narrative or series of supplementary disclosures to contextualize the required disclosure?

On the one hand, investors might not care about the proxy. (This argument suggests investors care almost exclusively about cash flow, earnings quality, market expansion, etc.) In that case, any extra narrative might hurt more than it helps. Companies taking a minimalist approach would look to “check the box” (i.e., comply) but not do anything more than they need to.

On the other hand, companies might look at the proliferating disclosure requirements and conclude they leave too much room for confusion and spin. To counter this, they would manage perceptions via narrative discussions, supplementary disclosures, and more nuanced analytics.

On balance, we tend to favor performing supplementary analytics as part of an internal, pre-disclosure assessment process. For example, a retail bank might calculate a pay ratio of 400, which could be construed as excessive by the media and certain investor groups. A more nuanced analysis, however, might show that this bank has a larger retail segment than most of its peers and that its branch workers are paid above market rates.

The next five years will redefine the proxy and its utility to investors. The trend clearly favors a more comprehensive and numerical disclosure. It remains to be seen whether or not investors can use all this information, but in any state of nature, there are new risks materializing that all organizations will encounter. A more analytical and model-based approach is the best bet for managing the complexity that lies ahead.

Was this post helpful? Join our mailing list to receive alerts of future articles!