Get Ready for Big Changes in Deferred Tax Accounting

We’ve been actively watching FASB’s deliberations pertaining to forthcoming revisions to ASC 718. As we help organizations unpack what the changes are likely to mean for them, much of our time has been spent on the tentative revisions to the deferred tax accounting model.

We’ve been actively watching FASB’s deliberations pertaining to forthcoming revisions to ASC 718. As we help organizations unpack what the changes are likely to mean for them, much of our time has been spent on the tentative revisions to the deferred tax accounting model.

At this writing, it appears likely we’ll see an exposure draft that eliminates the APIC pool and causes windfalls and shortfalls to flow through the P&L. To help you prepare, here’s a refresher on the current deferred tax model, along with an illustration of exactly what it means to eliminate the APIC pool and an introduction to the concept of tax settlement forecasting.

The Current Deferred Tax Accounting Model

The basic mechanics of tax accounting for equity awards entail setting up a deferred tax asset (DTA) based on the cumulative book expense for awards that are expected to result in future tax deductions, and reversing that DTA when settling the award for tax purposes. Differences between these respective measures of value (taken at different times) are typically recorded in additional paid-in-capital (APIC). There are also a host of specific rules and issues that layer on top of the basic mechanics.

The adoption of ASC 718 in 2004 required companies to recognize in their financial statements compensation cost arising from the issuance of share-based compensation instruments under a fair value methodology. In contrast, the tax code per the Internal Revenue Service (IRS) has always treated share-based payment awards as an expense.

Whereas ASC 718 requires measuring compensation cost using fair value principles and recognizing this cost over the requisite service period (generally the vesting period), the tax deduction is only recorded on a company’s tax return when a settlement event occurs (a “taxable event”). The tax benefit that the company receives at settlement and recognizes in its tax return is generally equal to the intrinsic value of the award on the date of the settlement event.

The crux of the DTA issue in ASC 718 is that expense under GAAP (also called “book rules”) is calculated and allocated differently from under tax rules, thereby creating a requirement to reconcile between the two sets of rules. A key principle of ASC 740 is that the tax benefit of a deduction that is available for both book and tax purposes, but differs in terms of timing (a so-called temporary difference), should be recognized on the books at the same time as the book expense.

This is accomplished by recording a DTA on the balance sheet. The DTA represents a future deductible amount that will produce tax savings at a later date. At the same time the DTA is recorded, a deferred tax benefit is recorded in the income statement, which reduces current period tax expense. At the close of each reporting period, the balance in the DTA should be equal to the cumulative recorded compensation cost for outstanding awards multiplied by the relevant corporate tax rate.

When an award is settled and the actual tax benefit, if any, is realized, the DTA is reversed from the balance sheet. The difference between a DTA and the actual tax benefit results in a “tax windfall” (aka excess benefit) if the DTA is less than the benefit; a “tax shortfall” (aka deficiency) arises if the DTA is greater. Tax windfalls are added to, and tax shortfalls subtracted from, the APIC pool. The APIC pool is the off-balance sheet pool of excess benefits that can be used to absorb tax deficiencies, and it’s inflated by tax windfalls.

A World Without the APIC Pool

The appeal of the APIC pool is that it buffers the income statement from both positive and negative hits stemming from DTA reversals. Settlements will almost always occur at amounts greater than or less than the initial fair value. In other words, windfalls or shortfalls are inevitable. Buffering the P&L from windfalls and shortfalls is desirable in our present-day world where essentially any budget-to-actual variance—even favorable ones—is frowned upon.

How to Prepare

We encourage companies to prepare for the upcoming changes (assuming they go through as planned) in two ways. First, streamline and automate tax reporting. Corporate tax departments are busy and have many competing priorities, which for some companies has caused deferred tax tracking to decline into manual tracking and non-streamlined processing. In our recent survey of stock-based compensation accounting practices, we found that tax processes are usually shared between corporate accounting and corporate tax. In practical terms, shared processes are at greater risk of encountering handoff fumbles. If tax accounting is going to more formally run through the income statement, now is a critical time to inject automation into tax accounting.

Second (and the key theme of this article), if tax accounting is going to cause more P&L volatility, an entirely new category of forecasting is needed. We call this “tax settlement forecasting.” Let’s start with the basics of forecasting future ASC 718 expense.

ASC 718 forecasting has three steps:

- Build a waterfall of expense quantities over time.

- Layer in hypothetical future grants.

- Run scenarios to model the uncertainty related to performance outcomes and forfeitures.

Scenario analysis is so important because the sheer quantity of variables essentially forces recurring budget-to-actual variances. It’s a tool for socializing the scope of potential variances and the sensitivities of different variables on the final outcome.

Similarly, tax settlement forecasting means imposing stock price and settlement timing scenarios on the pool of outstanding awards. This helps you understand the scope of windfalls and shortfalls that [in an APIC Pool-less world] are expected to run through the P&L over the next one to five years. Stock options amplify the complexity since they can be in- or out-of-the-money and may be exercised at employees’ discretion, both of which make predicting timing difficult. Therefore, assumptions are typically made about the frequency of exercises for options that are vested and in-the-money, and options are assumed to automatically exercise (if in-the-money) or expire (if out-of-the-money) at the end of the contractual term. Companies can seek assistance from valuation experts when developing the rate of exercises for option awards. Naturally, restricted shares are assumed to lapse on the legal vest date.

For companies with limited cash flow, the cash from the exercise of options is a material consideration. When modeling the timing of exercises (and the corresponding cash inflows), best practice is to use an analytical approach that relates option moneyness to the current stock price and expected trajectory.

A material input to any tax forecasting effort is the stock price on settlement date. This drives the actual tax benefit to be recorded on the income tax return as well as the direction and size of windfalls/shortfalls. Forecasted stock prices are typically available from Financial Planning & Analysis (FP&A) or similar groups in the organization. They’re usually provided in quarterly or monthly increments, and some organizations maintain a “favorable,” “moderate,” and “unfavorable” set of scenarios.

Careful consideration should be given to market and performance awards. Multipliers, if applicable, should be tied to the expected payout on the settlement date, which may be different from the current multipliers being used for expense and diluted EPS purposes.

Finally, there is the marriage between forecasting expense and forecasting tax settlement. Finance and tax departments are also asked to help with Schedule M-1. This reconciliation process requires providing an explanation of the difference in book expenses and tax expenses. Having an accurate measure of both will limit noise when the actual M-1 is completed.

What It Can Look Like

Tax settlement forecasting is part of management accounting, which means the optimal format and work product will differ by organization.

A basic template might show the P&L impact of settlements with a waterfall of outstanding awards by grant year and expected settlement date, and might be sliced by award type or other relevant indicative data. A separate summary can be produced to illustrate the waterfall actual tax benefits for the income tax return, or both summaries can be combined to form what we sometimes call a “super table.” In any event, the right answer will depend on the informational needs of an organization and how it prefers to consume that information in form and in substance.

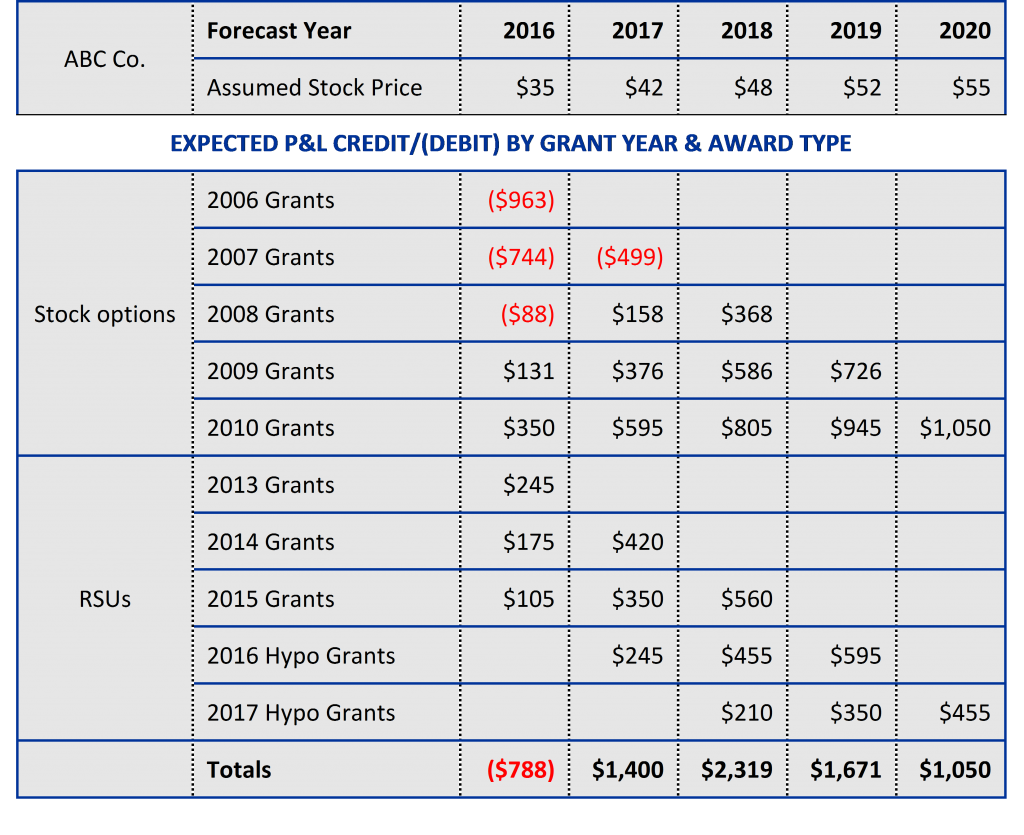

Below is a basic example of a waterfall template showing the P&L impact of expected settlements:

The above illustration reflects only one expected stock price trajectory, but we suggest running the model for three different stock price scenarios in order to unearth the sensitivity of P&L values to stock price movements.

Closing Thoughts

While there are various elegant technical accounting arguments supporting the elimination of the APIC pool, what we mostly hear from our clients is concern about adding even more volatility to the P&L just when the appetite for forecast variances has hit bottom.

The increased volatility may be inevitable, but tax settlement forecasting is one way companies can get used to potential future outcomes and illustrate the contingencies inherent in their forecasts. The use of stock price scenarios will be especially helpful in this process. As accounting becomes more fair value based and the income statement becomes a more fluid construct, our view is that analytical modeling and preparation may be the best line of defense.

Was this post helpful? Join our mailing list to receive alerts of future articles!