In a Crisis, Convertible Bonds Can Be an Attractive Way to Raise Cash

The Wall Street Journal, Barrons, and the Financial Times have all recently taken note of convertible bonds’ rise to prominence. Evidently more than half of April capital raises—versus the usual 20%—were in the form of converts. That’s the largest share of the bond market in recent memory.

Convertible bonds are debt instruments that promise a specific cash flow stream. As we explain in our booklet, if the stock price goes up, holders can convert the bonds to equity and capture this upside. If the stock price goes down, the bonds pay out like debt based on the principal value and the company’s available capital. The benefit to companies is that they can borrow at a lower interest rate. What’s more, if the stock price increases, companies often can retire the debt early by forcing conversion—getting rid of future debt payments.

In today’s economy, convertible bonds offer a unique value proposition. Here’s why:

Companies need cash. Perhaps more than ever, companies have seen a rapid decline in available cash. Brick-and-mortar stores have closed, restaurants are committed to carryout, and travel is down. Meanwhile, production in many industries has been cut to the bone—and for energy companies, the prices they’re receiving for their product is at historic lows. All this happened suddenly, leaving companies with little room to prepare.

Even so, companies still need cash to operate and many companies have discovered that their reserves aren’t sufficient to cover their needs. As the economic impact continues to unfold, we expect more companies to do what they can to get cash, including going to public and private markets for new issuances.

Equity is unissuable. “Buy low, sell high” makes sense for investors and companies alike. By issuing low-priced equity, companies can dilute the holdings of existing shareholders. Companies going through the math will quickly determine that these issuances are quite unfavorable. Others may find that the number of authorized shares is simply insufficient to raise the amount they need at current prices.

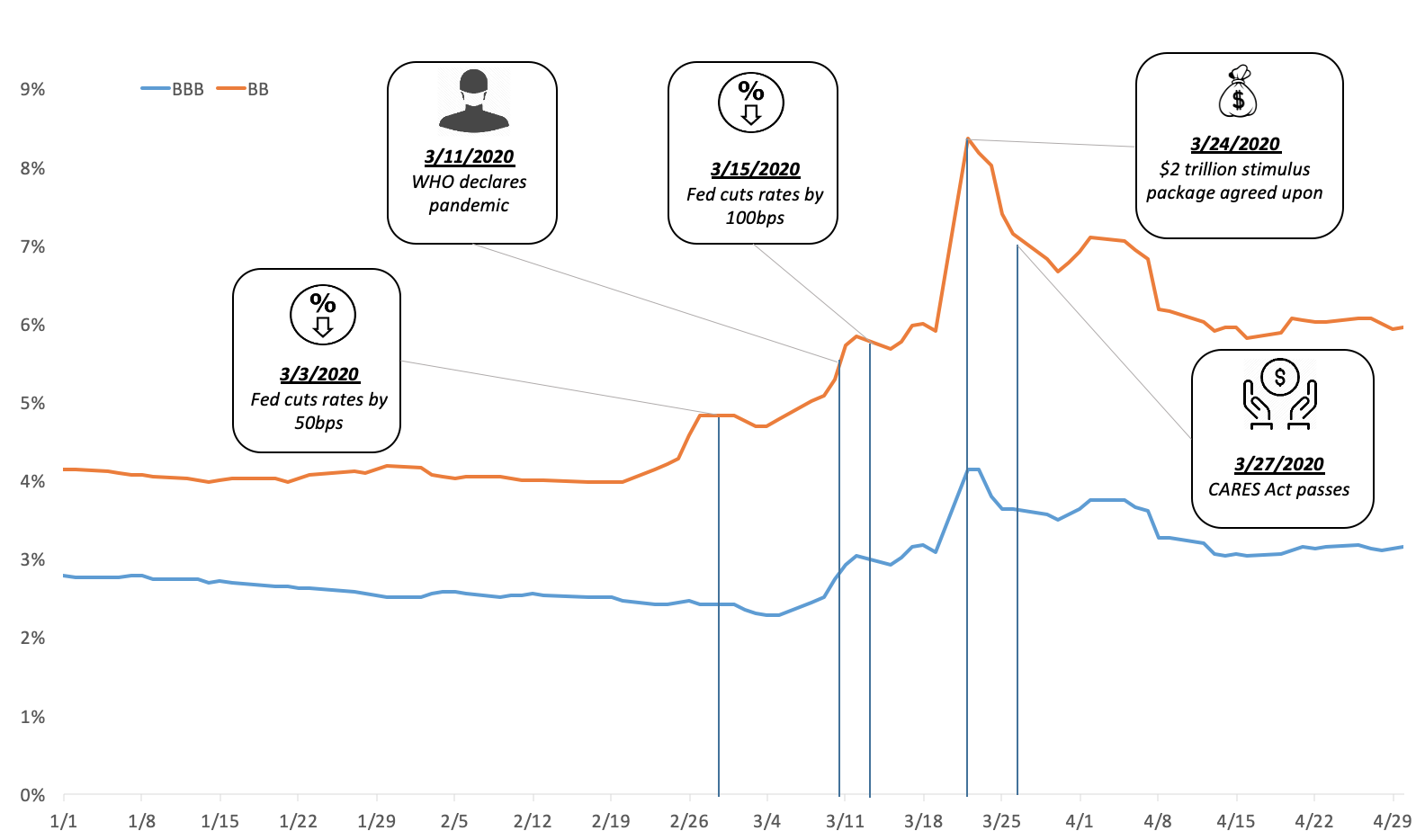

Borrowing is expensive. Although the Federal Reserve has lowered its core interest rates to near zero, there’s been a dramatic flight to quality. As a result, we’ve seen the required returns on government bonds—effectively certain to pay out—go down. Meanwhile, returns on corporate bonds, even controlling for credit rating, have gone up.

Figure 1 shows the trend by comparing the movements in BBB (investment grade) and BB (non-investment grade) interest rates from the beginning of this year.

Figure 1: Movements in BBB and BB Interest Rates, January-April 2020

Figure 1: Movements in BBB and BB Interest Rates, January-April 2020

Note that bond agencies have also been downgrading companies at their fastest rate since 2008, potentially raising borrowing costs even more. The exposure to high interest rates can be especially unsettling when cash flow is uncertain.

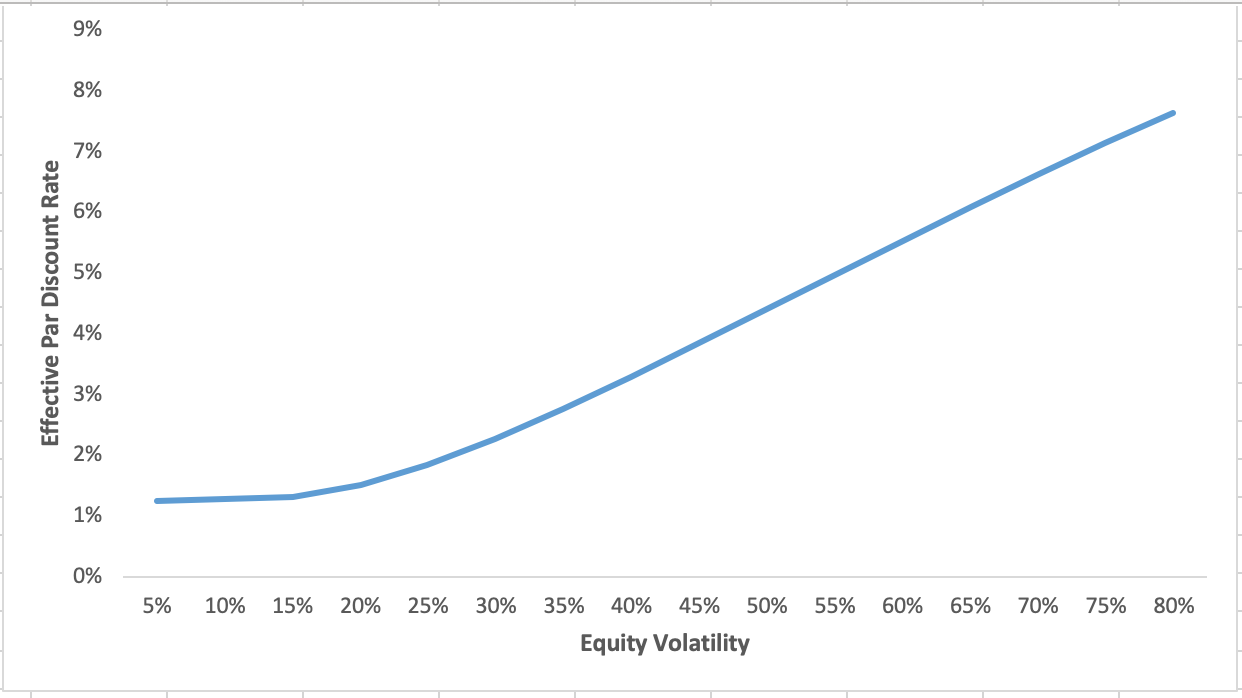

Volatility is high. Volatility is a measure of uncertainly about future stock prices. The more volatile the company’s stock, the greater the interest savings on a convertible bond, as Figure 2 shows.

Figure 2: Interest Rate Savings Based on Volatility

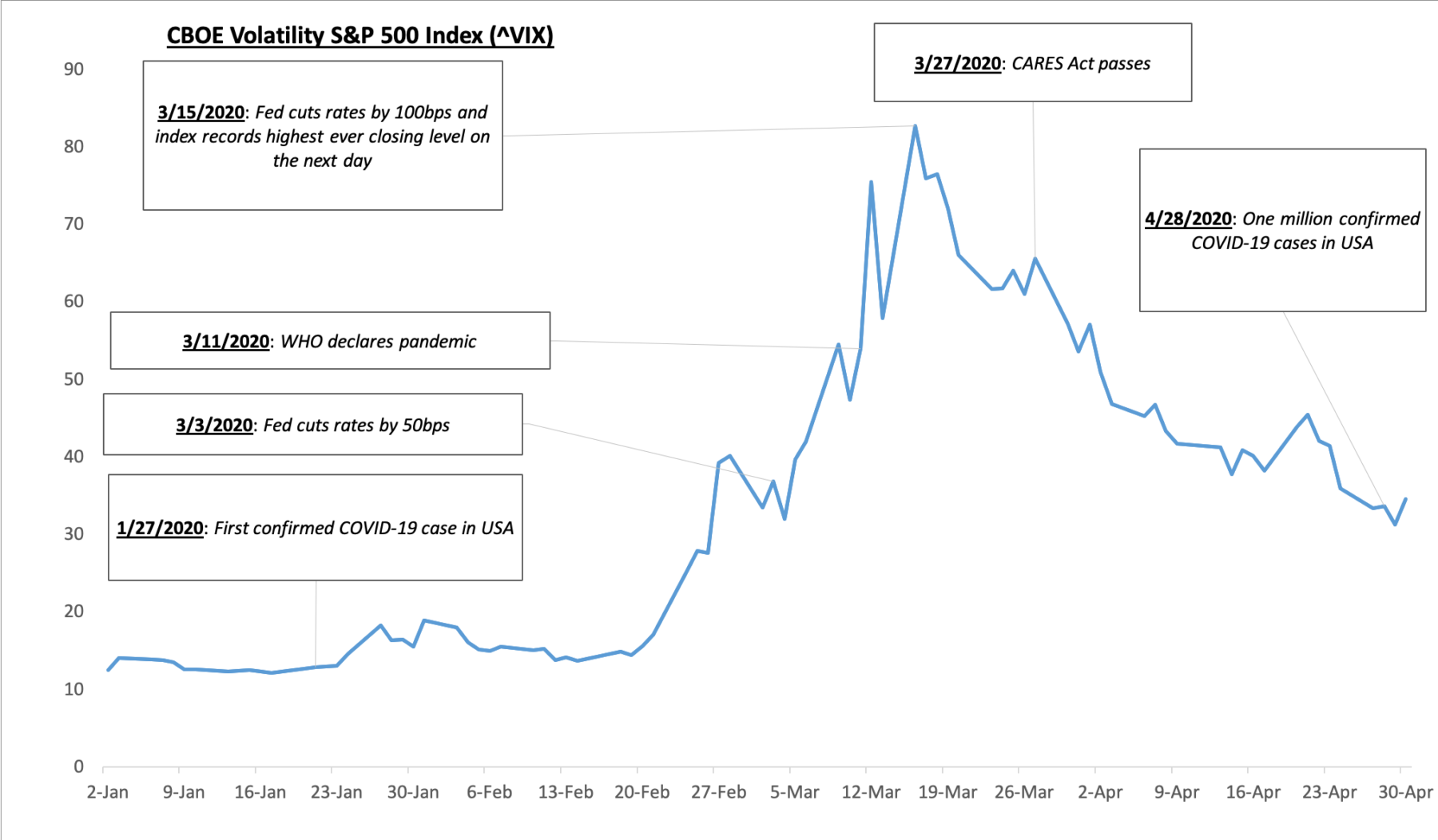

Said differently, although the option value of the conversion feature lowers the effective interest rate, the amount of savings depends on the company’s stock volatility. Under current economic conditions, volatilities are quite high. Figure 3 shows how the CBOE Volatility Index, or VIX, has moved based on short-term S&P options.

Figure 3: CBOE Volatility S&P 500 Index, January-April 2020

Figure 3: CBOE Volatility S&P 500 Index, January-April 2020

The same pattern is present in long-term options, meaning that companies using converts may get substantial interest savings over fixed bonds.

Investors fear missing out. Although issuing convertible bonds in a down market can help companies save on interest, investors also benefit because they can get closer to market returns in a recovery. This can be very appealing to investors eager to avoid falling behind in an up market.

Of course, companies should be aware of the downstream implications of convertibles. First, these bonds will dilute shareholders if the company increases in value. Beyond that, accounting classifications can vary depending on what the conversion and other features look like. Special terms can sometimes result in embedded derivatives and features which are marked-to-market. Other cases may at least require an upfront accounting for the conversion feature and bifurcation. In addition, future EPS may rely on the if-converted method which can be confusing, especially with multiple issuances. The upshot is that while these financings are attractive, being careful about your issuance can further improve the usefulness of this unique and important financing tool.

If you have any questions about convertible debt—or any other financings—please contact me.