2021 Group Five Stock-Based Compensation Financial Reporting Benchmarking Results Plus Our Take on What’s Ahead in 2022

Every fall, Group Five publishes their annual stock-based compensation administration and financial reporting study. We participate in the latter and, for the eighth consecutive year, were the top-rated financial reporting service provider.

We flashed the high-level results in October. So I’ll offer some additional detail, then use the majority of this post to focus on a few equity compensation financial reporting themes we’re expecting to see in 2022:

Theme 1: Continuation of the shift toward relative performance metrics

Theme 2: Forecasting in response to uncertainty

Theme 3: Automation in response to internal turnover

Theme 4: Employee stock purchase plans as a staple equity compensation vehicle

Theme 5: Introduction of ESG reporting to the 10-K and implications for finance functions

But first, let’s cover the Group Five results.

*****

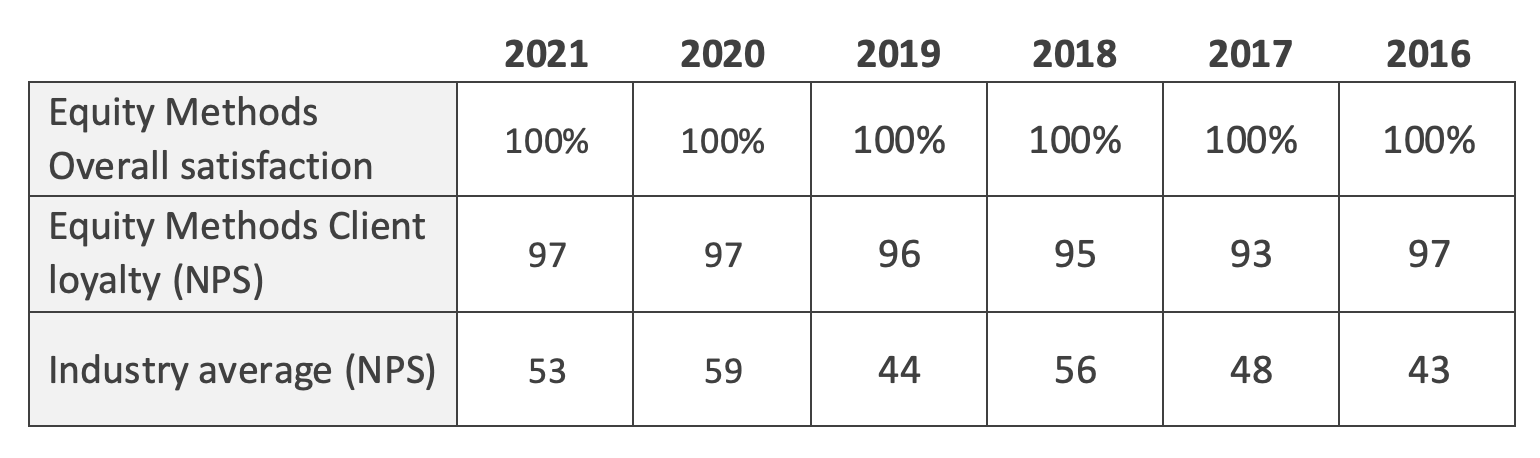

We’re elated to have earned the highest overall satisfaction and loyalty ratings among the financial reporting service providers for eight consecutive years. Group Five uses the Net Promoter Score (NPS) to measure client loyalty. Our NPS is 97 and the industry average is 53:

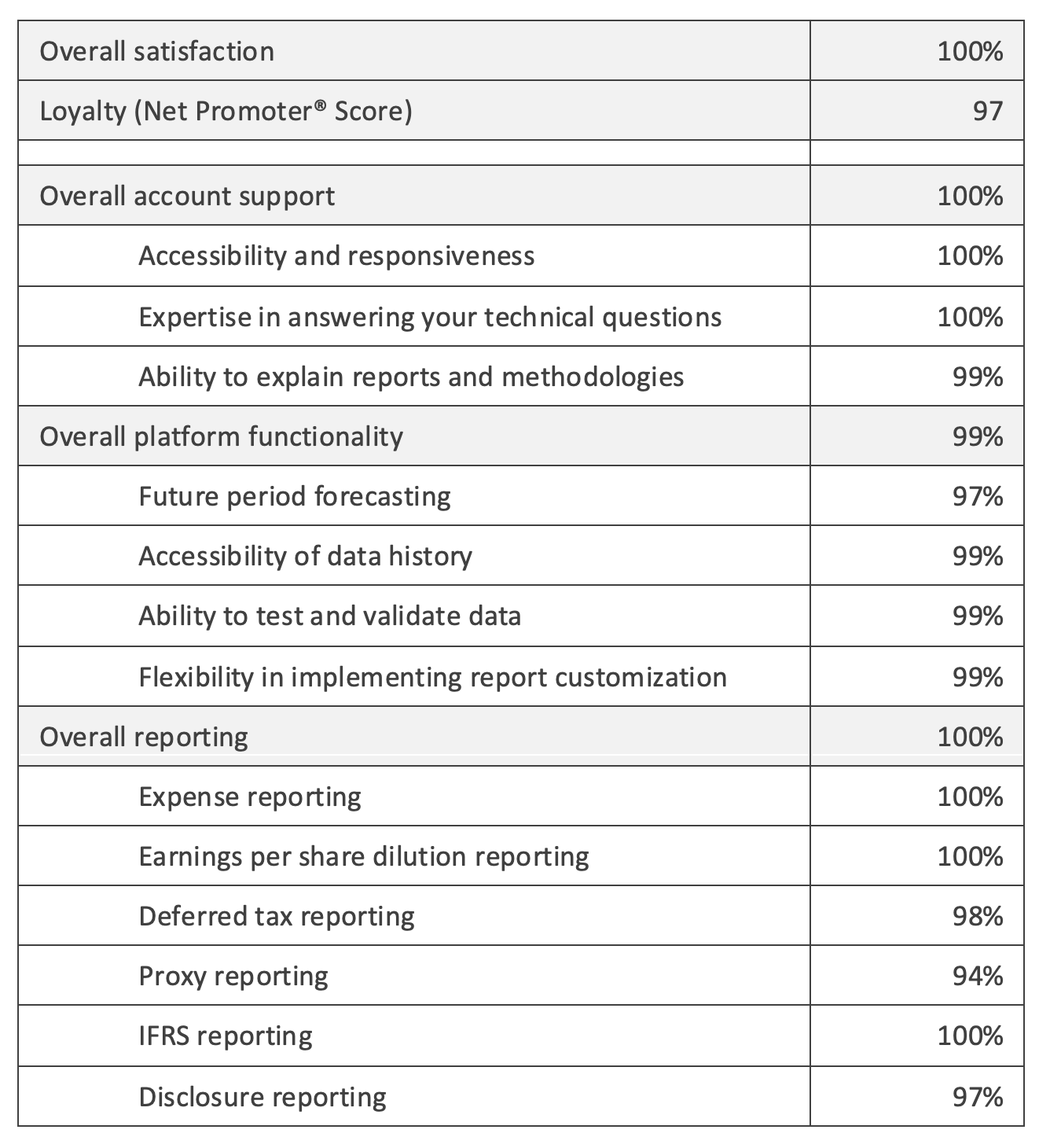

Here’s a more detailed breakdown of the 2021 results:

2021 has been a tough year for our clients, who are grappling with labor market shocks, hybrid work arrangements, and ever-increasing demands for robust internal and external reporting. It’s such an honor to play a role in our clients’ financial reporting processes for stock-based compensation.

In addition to ever-increasing business as usual reporting, this year we spent a lot of time helping our clients launch and report on new employee stock purchase plans (ESPPs). We also helped them handle the equity in complex acquisitions and spinoffs, implement modifications to outstanding equity awards, and design and account for outsized CEO mega-grants. On top of all that, we worked with our clients to expand the breadth and depth of forecasting in response to heightened market uncertainty.

And that’s just our public company clients (the pubcos, as we endearingly call them). On the non-public side, special purpose acquisition companies (SPACs) made headlines after the SEC retooled the SPAC warrant accounting model this March. And with more companies staying private and wielding greater power in the labor markets, other pre-IPO topics like granting practices and profits interest programs occupied much of our clients’ attention.

It’s always so touching to read the open-ended comments our clients share. Here are a few that really bring home that our “why” is to serve you:

- “They are always available to help with any questions we have. They are the best service provider we’ve ever used.”

- “Equity Methods took our unreliable process and made it world-class. They have gone over and above and are experts in their field.”

- “So flexible! They will jump on any little hiccup or odd thing that we send their way. The reports are 100% designed together in a collaborate space. Plus their plan/forecast files are top notch.”

- “Equity Methods is a unicorn in my opinion. They provide a valuable service at a fair price and they have the flexibility to handle our complicated awards and one-off situations. They really give us back valuable time when we need it most.”

- “Equity Methods is by far the best vendor I have worked with for any service. The communication is timely, they are focused on service and delivered all of what they promised with our equity accounting and reporting.”

From all of us to all of you, thank you for your recognition. We’re honored to support you.

With that, let’s look at some themes ahead in 2022.

Theme 1: Continuation of the Shift to Relative Awards

At least in the equity markets, economic catastrophe was averted in 2021 as inflation and government stimulus fueled a precipitous rise in security prices for most companies. But that hasn’t made compensation goal-setting easier as general levels of uncertainty remain at protracted levels. With today’s inflation worries and supply chain disruption, setting earnings three years into the future can feel like a guessing game.

As a result, the adoption of relative performance awards is spiking. In 2020, approximately 57% of the S&P 500 used a relative TSR (rTSR) metric in their long-term incentive plan (LTIP). In 2021, the number climbed to 72%. We expect to see that number exceed 75% in 2022. Relative financial metrics appear in 22% of cases where a financial metric is adopted, with the most common flavors being relative return on capital and relative EBITDA growth.

We’ve covered in many other settings why relative metrics simplify performance goal-setting and focus performance on the factors within management’s control by filtering out macroeconomic noise. Let’s look at some of the implications this trend has for financial reporting leaders.

- LTIPs are becoming more complex as more metrics get included. Financial reporting processes need to be able to handle multi-metric awards, including cases where a metric like TSR modifies one or more financial metrics.

- An rTSR metric can often yield a sizable fair value premium, especially if there is a wedge between the grant date and performance measurement starting date. While that’s mostly a problem for the executive compensation function to work through, they’ll be particularly interested in pressure-testing the valuation and experimenting with tweaks that yield more palatable results.

- Relative financial metrics are especially hard to implement since income statement data across companies is less comparable than stock prices. The task of normalizing earnings and calculating award payouts typically falls on finance’s shoulders. Here are some tips if those shoulders happen to be yours.

- Relative performance needs to be tracked for purposes of computing diluted EPS (contingently issuable shares), apprising the compensation committee of progress, and certifying the final payout. This issue brief shares some tips and best practices.

And for a basic overview on the valuation of awards with market conditions, check out our introduction to Monte Carlo simulation.

Theme 2: Forecasting in Response to Uncertainty

Insofar as economic uncertainty and disruption are macro themes for 2021 and the indefinite future, forecasting is one of finance’s most powerful solutions. Scenario-based forecasting helps color the range of future possibilities to set expectations and avoid surprises.

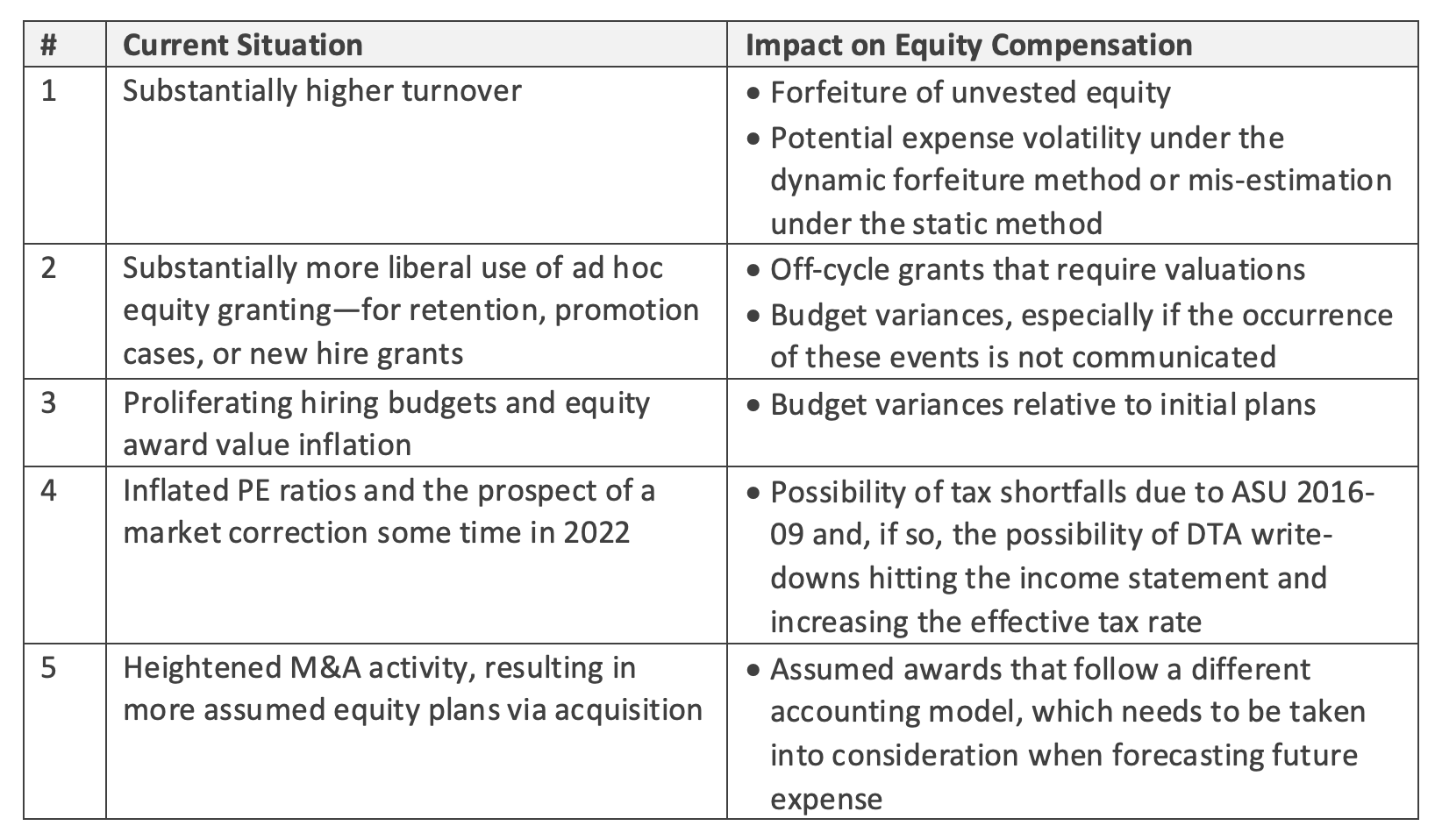

Let’s look at some of the ways in which macroeconomic uncertainty and complexity are specifically impacting stock-based compensation:

We’ve published extensively on forecasting best practices and run a webcast on the same. We’ve also honed in on tax settlement forecasting given ASU 2016-09’s unique effect on the income statement. Here are a few tips and best practices to consider:

- Granular forecasting models are critical to a robust variance analysis. Granularity means building forecasts at the person or department level, combining future expected awards with currently outstanding awards, and updating the model regularly to reflect recent activity.

- Variance analysis can be automated and trended. As employee populations get larger, it can be tough to identify the root causes behind variances. Many stock compensation variables move in offsetting directions. Running fluxes on variance drivers can also be interesting to see whether there are any patterns to consider when re-forecasting.

- The dynamic forfeiture rate method works much better than the static method during periods of intense change or uncertainty. If you haven’t evaluated this transition, now may be the right time.

- Invest in management dashboards and visualization to help your senior leadership team understand the trending and moving parts. Stock compensation can easily become a black box given its complexity, but this can be avoided through concise analytics and dashboarding.

We expect the pressure surrounding robust forecasting to tighten given the volatility in both the equity and labor markets. We’re also seeing investors pushing back on non-GAAP earnings metrics that exclude stock-based compensation once firms reach large cap sizes, further prompting a need to understand and model future trends.

Theme 3: Automation in Response to Internal Turnover

Our value proposition has never been one of replacing staff. Rather, it’s about allowing our clients’ staff to shift their focus to higher-value activities—analysis, internal reporting, cross-functional collaboration, or new and emerging accounting standards. But as the Great Resignation has taken hold and no company has been immune, the need for automation couldn’t be higher.

To be sure, automation may involve engaging a third-party organization like ours. Or it could occur internally using technologies like Access or SQL. The answer will in part depend on the complexity, materiality, and availability of internal resources.

Much has been written about the dangers of spreadsheet-based processes. We’ve shared our thoughts as they relate to stock compensation, and there’s no shortage of more general literature touting the benefits of automation.

Rather than restating the benefits of automation, let’s focus on where automation can be most critical in reducing key person risk or manual processing risk. One way to find out is by asking the following questions:

- How many distinct award types and situations are there? Customized retirement eligibility provisions, cash-settled awards in countries where equity is hard to pull off, and multi-metric performance awards are a few examples of heterogeneity that can spell risk in a manual process.

- Are modifications frequent? These require special handling and can even change the amortization schedule, introducing additional process risk. The determination of incremental cost also requires careful valuation analysis.

- Are forecasting revisions and scenarios becoming more commonplace? Manual processes are fine for one-off requests, but once these requests become institutionalized, you’ll need automation to achieve greater accuracy, consistency, and repeatability.

- Are the different elements of stock-based compensation (expense, tax, EPS, disclosure, etc.) disconnected? A disconnect between tax reporting and expense is especially risky since tax should be a mechanical derivative of expense.

- Are there multi-metric performance awards or liability-classified awards that need to be updated in Excel? Frequent fair value and multiplier changes that are done manually can create risk over time, especially as the cumulative catch-up adjustments get larger near the vesting date.

- Do you maintain an ESPP with favorable provisions such as resets, rollovers, and contribution changes? ESPP reporting has become such a hot-button issue that it’s the focus of our next theme.

Automation is sort of like cybersecurity: everything is fine until one day when it isn’t. Best-in-class accounting functions will look around the corner to see how needs are evolving so they can get ahead of risks. With so much labor market turmoil and the loss of institutional knowledge, the benefits of automation have grown for many companies in 2021.

Theme 4: Employee Stock Purchase Plans as a Staple Equity Compensation Vehicle

ESPPs have made a seismic comeback after dwindling during the adoption of ASC 718 in 2006. ESPPs are cost-effective, incredibly diverse in how they can be structured, and all but certain to be approved when put to a shareholder vote. Employees like them too, if the plan has favorable provisions.

Of course, this is referring to the modernized version of ESPPs, where a 15% discount and lookback feature are just the beginning. We’ve covered ESPP design topics extensively, including in this Workspan article, this blog post on ESPP trends in the tech sector, and this webcast. The more generous the ESPP provisions, the higher the income statement cost—but our experience is that this lets companies shrink their RSU granting and experience large upticks in the perceived value of the equity program.

We’ve seen this trend for a few years, but 2021 was a breakout year for ESPPs. They’re most prevalent in human capital-intensive sectors like technology and life sciences. Even so, we’re seeing companies in other sectors launch ESPPs so they can stand out to talent. In tech and life sciences, a generous ESPP is becoming table stakes.

What does this mean for ESPP financial reporting? A lot. ESPPs are more complex to account for than any other equity vehicle we work with. This is in part due to the numerous provisions and design flexibility. It’s also linked to the scale of ESPP programs, wherein they must be made available to all employees (within a corporate legal entity). The more favorable provisions include modifications that go into effect by sudden moves in the share price or participant elections.

Here are some insights to consider if you’re planning to roll out an ESPP or are coming up to speed on an existing one:

- Program design should be informed by robust modeling. With so many design variables and levels of employee participation, the cost range can be wide. Design modeling lets you set expectations internally while picking the most favorable design that still fits your accounting budget. Resets, rollovers, and contribution rate changes are just the beginning.

- Employee-level accounting is critical. Historically, ESPP financial reporting would be handled on a pool basis whereby all employees within an offering would be treated in a like manner. However, forfeitures, contribution rate changes, differential levels of participation, and reset and rollover modifications make pool-based accounting incredibly imprecise.

- Forecast purchases using payroll data. Employees participate in an ESPP via payroll deductions and their eventual share purchase occurs at the end of an offering period, at which point it’s reflected in the stock plan system. However, the expensing must begin at the start of the offering period. This means payroll data needs to be married with stock plan data to streamline the amortization all the way through the eventual purchase.

- Forecast future ESPP expense under a wide range of scenarios. There are numerous moving parts at any given point in time. Think about the possibility of share price increases and decreases, employees joining new offerings, employees increasing or decreasing their subscriptions, and the option valuations underpinning the program. Scenario-based forecasting helps avoid surprises and set expectations.

We predict ESPPs will become even more popular. They’re not for every organization, especially where most employees earn too little to set aside part of their paycheck for an ESPP (though multiple fintech companies are trying to solve this problem). However, when it fits the demographics of your employee base, an ESPP can be a key asset in the competition for talent.

Theme 5: Introduction of ESG Reporting to the 10-K

Our last topic is the onset of ESG reporting in the 10-K. To date, we’ve focused on the SEC’s human capital management (HCM) 10-K disclosure that went into effect in 2020. This past September, we ran a webcast looking at results from the first year of mandatory disclosure. The webcast built on a report published earlier in the year on these same disclosures.

Our first-hand experience advising companies on this disclosure was extremely varied. Large caps tended to view ESG reporting (in the 10-K or any financial document) as a vehicle for telling a differentiated story in pursuit of alpha (finance parlance for excess returns). Smaller companies tended to view this as a check-the-box exercise. And, as is typical in the first year of any new regulation, there was considerable variation regardless of firm size or industry.

Here’s where it gets interesting and why we think ESG reporting in the 10-K is something to watch. The SEC has stated an intent to modify the existing HCM disclosure and introduce a disclosure requirement on climate-related risks. The HCM revisions are likely to impose specific ratios and calculations given the SEC majority’s opposition to the principles-based approach taken by the prior administration.

ESG-related disclosure is important to different pockets of investors. The passive institutional funds (which represent the vast majority of voting power) have declared that this is the most important issue to them. Activists have conveniently found ESG to be a lightning rod to suit their agendas.

This might sound strange given what all of us learned in school, which is that investors buy and sell in response to earnings—future potential earnings, actual earnings misses, etc. The problem is that passive investors cannot buy and sell in response to quarterly earnings data. Their sole recourse is their proxy vote, where they vote to reject or reelect directors and to reject or accept shareholder proposals. In this regard, the proxy has become a much more important filing than ever before. As one CFO put it to me, “the proxy is the report card for my boss’ boss” (he was referring to the lead independent director who reviews his boss, the CEO).

If more disclosure on human capital and environmental topics is coming down the pike, here are a few things you can do to prepare:

- Review disclosures from leading companies within and outside your industry. Monitor trends such as the disclosure length, level of detail, topics prioritized, mix of qualitative assertions and quantitative data, and forward-looking commitments. We discuss these different attributes in our HCM report.

- Identify a set of basic metrics, aspirational metrics, and bleeding edge metrics, then begin test-driving them. Basic metrics are ones you already compute and monitor regularly. Aspirational metrics are those that are important and within reach, but not yet rigorously back-tested and forward-tested. Bleeding edge metrics are ones that would be very helpful, but would take time to develop given current system limitations. This issue brief covers some of the various metrics we help companies compute in the human capital space (the “S” of ESG).

- Invest in the systems and processes needed to execute against aspirational and bleeding edge metrics.

- Document insights from shareholder engagement meetings. Make sure there’s alignment across accounting, investor relations, legal, and HR as to what investors are asking for in outreach sessions.

- Loop internal audit into the calculation procedures. 10-K disclosure of non-financial metrics will be inherently risky since they’re unlikely to go through much of an external audit process in the way financial statement data does. And yet the presence of these metrics in a document filed with the SEC carries risk. Your internal audit function will become a critical stakeholder.

- Analyze the sensitivity of various human capital and environmental metrics. There’s nothing worse than to begin disclosing a metric only to experience a major blip that’s unexplainable. Back-test metrics over time and study the variables that can cause positive or negative spikes.

I mentioned earlier that ESG reporting is a differentiator for many large companies and a perfunctory exercise for many smaller companies (with abundant exceptions). We think this will change. Hopefully, earnings and other fundamental financial data will remain the driver of asset values, but we think investors of all shapes and sizes will embrace the opportunity to grade companies in more varied ways. After all, they have nothing to lose by pushing for a more flexible report card.

Now is a good time to begin preparing for the onset of ESG reporting in otherwise traditional financial reporting.

In Closing

We’re so grateful for the opportunity to serve our clients and deliver best-in-class financial reporting. Our most sincere thanks to our clients who generously gave their time to Group Five’s benchmarking process.

Read the summary report to learn more about this year’s results.

Visit our knowledge center for more on the above topics.

Tell us about any other topics you’d like to see us cover.