Equity Methods at the 2024 Equilar Summit

Equity Methods was once again a sponsor of the Equilar Summit, which took place June 5-7 in Boston. At this year’s event, the 15th that Equilar has hosted, we participated in three sessions. Here are our takeaways from those sessions, as well as from others we had the opportunity to attend.

Striking the Right Balance: Discretion in Incentive Plans—Taboo or a Must?

Shaun Bisman (Compensation Advisory Partners), Jennifer Connor (Motorola Solutions), and Liz Herron (KeyBank) shared their experiences working with executive incentive plans containing different varieties of discretion.

Discretion can solve important compensation objectives. However, the devil is in the details. Proxy advisors and shareholders tend to frown on discretion because it can signal a compensation committee’s willingness to bend the pay-for-performance framework, so it’s critical to avoid misuse. For example, discretion shouldn’t consistently be positive only, used without a clear rationale, or used to push payouts above target.

This last point is especially important in that payouts above target will draw considerably more ire, especially if shareholder return was flat or negative. It’s also worth noting that discretion in long-term plans can have adverse and tricky accounting consequences, so most discretion takes place in the annual plan.

That said, there are best practices for using discretion in ways that will minimize governance concerns. One such practice is to have a plan component or modifier that is explicitly tied to a more discretionary factor, such as an individual performance score. In these cases, the best governance involves real—albeit qualitative—structure around that discretionary element, such as a balanced scorecard.

Another practice is knowing when to change plans entirely in the face of a major external change that moves the strategic goalposts (as the bank failures of 2023 did in the regional banking industry). In these cases, it’s not that there’s a discretionary adjustment to old metrics after the fact, but rather a switch to new quantifiable goals in light of new imperatives. Even so, the disclosure burden is extremely high since skeptical shareholders may assume plans aren’t set to be changed and there’s an automatic reboot available by redesigning the following year’s plan.

In short, discretion isn’t taboo. It shouldn’t be the fundamental base of anyone’s plan, but it’s an important way to fine-tune plans to circumstances.

Strategic Equity Planning: Navigating Shareholder Approval and Long-Term Incentive Design

Mark Breer (Microsoft), Ken Foulks (ClearBridge), Shalom Huber (Skadden), and Shannon Nelson (Blackrock) explored strategic equity planning, which has become increasingly important as more companies encounter share price headwinds and escalating share burn. It’s also an easily misunderstood topic given similar but substantively different viewpoints across proxy advisors and large institutional investors.

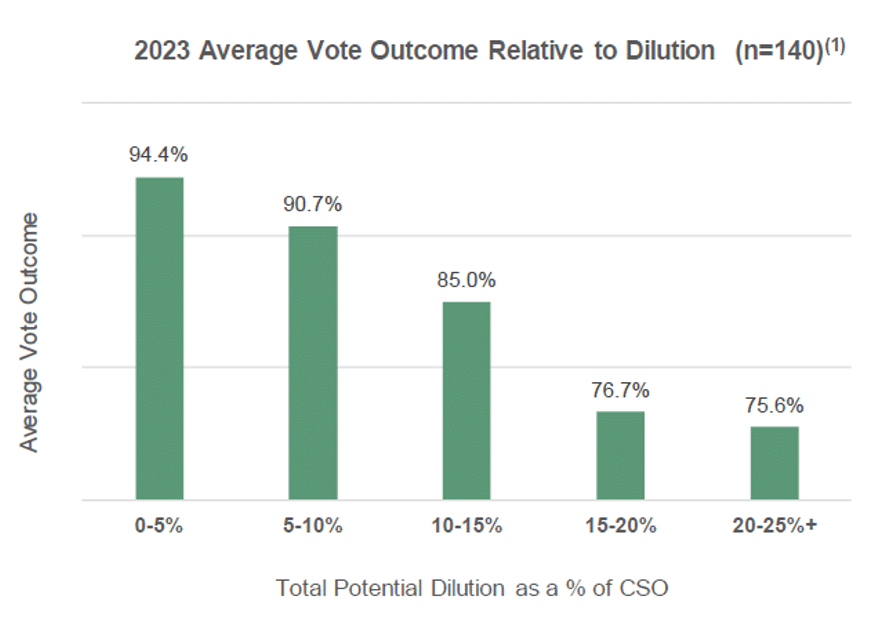

The panel began by emphasizing that most shareholders and proxy advisors want to vote in favor of share proposals because they support the premise that broad-based equity granting is healthy. While a proxy advisor like ISS uses a quantitative approach to evaluate proposals, the more general rule of thumb is that voting outcomes are correlated with the level of dilution, as the following chart shows.

But as you can see, even proposals in companies suffering from extremely high levels of dilution have average passing rates above 75%. That’s not to say a share proposal is a walk in the park. First, some proposals do fail, and failure has existential consequences. Second, a proposal may skirt by, but with demerits levied against directors or on the say-on-pay vote.

Shannon said that BlackRock voted against 17% of the 1,050 plans proposed in 2023 even though their goal is to approve plans. (By comparison, ISS voted against more than 30% of plans.) BlackRock is particularly sensitive to “disqualifying features” like an ability to reprice without shareholder approval and evergreen provisions.

A common question is how important it is to secure ISS’ vote. The answer varies because many institutional investors don’t follow ISS voting recommendations. However, the statistics are pretty compelling that losing ISS can cost between 10% and 20% of the votes. That might not matter if the goal is simply to pass, but if the goal is a clean win with approval above 90%, it’ll be important to calibrate the request around ISS’ voting policies and scorecard model.

The panel moved on to discuss burn rates. The annual burn rate is the ratio of the shares granted in a year to the total common shares outstanding. Burn rates will worsen during periods of declining stock prices since more shares are required to deliver the same total value. Be sure to develop robust share pool forecasting models so you can gauge how sensitive the pool’s duration is to changes in the stock price, performance award payouts, and employee movement.

ISS and others evaluate share pool requests in the context of plan features. For ISS, plan features are an important factor in their voting formulation. Plan features include change-in-control equity vesting provisions, share recycling, minimum vesting, acceleration discretion, dividend treatment, director compensation limits, and clawback linkage.

The panelists ended with a handful of tips:

- Invest in a clearly drafted and granular disclosure. Explain the rationale behind the proposal, proactively provide dilution and burn rate information, and highlight new and positive governance practices

- Engage with shareholders both prior to and after filing the proxy proposal

- Identify each class of participants, the approximate number of persons in each class, and the basis for their participation

- Proactively include the Equity Compensation Plan Information table in the proxy

- If the plan is being amended or restated, describe the material difference(s)

Pay vs. Performance Year 2 Lessons Learned

Brad Hayes and Will Main (Equilar) hosted a town hall-style discussion covering the new developments and challenges that came as part of the second year of the SEC’s pay vs. performance disclosure rule.

The major theme was that companies generally adhered to the decisions made in the first year of the filing requirement. Company selected measures (CSM), the performance element disclosed in the main tabular disclosure, were mostly consistent with last year. The selections continued to be dominated by earnings-based metrics (EPS, net income, etc.).

After a review of data, the panel shifted to a discussion around the impact of the new C&DIs provided by the SEC between years one and two of the disclosure requirement. In general, while the C&DIs resulted in additional disclosure detail requirements and some valuation changes which influence compensation actually paid (CAP), the main focus of the challenges continued to be the actual process for performing, auditing, and automating the CAP calculation.

Overall, we are working with our clients to ensure they have airtight reporting processes that consider updated SEC guidance and market best practices, in addition to crisp analytics that explain the key drivers behind the results. We are also actively monitoring investor sentiments and the extent to which proxy advisors and other institutional investors consider pay vs. performance results in their say-on-pay assessments.

Award Design: Pay Delivery Efficiency

David Outlaw hosted a lively roundtable session on pay delivery efficiency.

Pay efficiency can mean many things, such as delivering more compensation for lower cost, creating more upside without creating downside, or taking various approaches to stretch your share pool further. Even the idea of lower cost can take several forms: accounting expense, Summary Compensation Table disclosed value, value under ISS-specific conventions, and more.

However a public company defines pay efficiency, no two cases are the same. Some companies are facing severe share pool constraints while others are solving the opposite problem of under-investing with their equity. Some have executives who are very interested in, and receptive to, novel award designs and features to make pay packages more efficient. Then there are companies that are expending a lot of energy on even the most basic change management.

The universal takeaway is that one size cannot possibly fit all. Even unique or novel solutions aren’t always right for all companies. Instead, compensation professionals must be good stewards of their company’s resources and construct efficient pay programs. In an era of belt-tightening amid new macroeconomic challenges, it’s the thoughtful and agile compensation functions that will win the day.

Where SEC Rule-Making, Shareholder Reporting, and Plan Design Collide

Takis Makridis, Dan Laddin (Compensation Advisory Partners), and Mark Breer (Microsoft) hosted this session on the intersection of SEC rule-making, shareholder reporting pressures, and internal strategy.

At the outset, the panel noted that strategy can be influenced by external forces like regulation and analyst expectations, but is also a function of internal planning and decision-making. The compensation strategy may adapt in light of external forces, but ultimately needs to reinforce the organization’s plan for winning in its buyer markets.

Starting with regulation, the panel discussed pay vs. performance, clawbacks, 10b5-1 revisions, the new Item 402(x) disclosure, SAB 120, and CEO pay ratio. They graded each item in terms of how “spicy” its impact has been. Pay vs. performance earned both red and green chili peppers to signify how it created immense pressure in the first year but failed to impact plan design.

Clawbacks are expected to be spicy in very particular ways. One, recovering equity from inactive employees may prove very challenging. It’s not yet clear how eager companies will be to invoke the cost exemption when they run into recoupment challenges. TSR metrics will be another challenge (see our article on our experience in running event studies). Finally, and most importantly, a playbook is necessary to spell out what will be done and by whom in the unfortunate event a restatement does occur.

Other rules like the 10b5-1 revisions, CEO pay ratio, and Item 402(x) proxy table aren’t expected to have a significant impact on plan design, reflect growing complexity in the proxy. SAB 120, the FASB revision and close cousin to Item 402(x), is thornier because it applies to all award types and lacks clean, bright-line triggers like the -4/+1 framework behind the Item 402(x) table.

The discussion then turned to a host of investor topics which, by definition, are all spicy. The panel began with dilution. Unlike the share plans session covered earlier in the day, here the focus was on investors probing harder on dilution and factoring dilution into their enterprise valuations. Investors measure dilution differently and the notion that they overlook stock-based compensation because it’s a non-cash expense is misguided.

It’s no surprise that investors care deeply about pay-for-performance disconnects. Although a broad topic, the panel looked at a few dimensions. TSR metrics give rise to valuation premiums, and these premiums have been creeping up. Financial metrics don’t require upfront valuation, but involve tough goal-setting decisions. Goal rigor isn’t a new topic, but it’s been especially hot as proxy advisors focus on declining year-over-year goals and payouts that are consistently above target. In a related vein, equity modifications can create major surprises in the summary compensation table, in addition to triggering shareholder backlash.

Navigating the Future: Firsthand CHRO Perspectives

Susan Wetzel (Haynes Boone) moderated a fireside chat among four CHROs: Linda Bukata Aiello (DraftKings), Lisa Buckingham (US Soccer Federation), Kelley Morgan (T2 Biosystems), and Michelle O’Hara (SAIC).

Fittingly for 2024, the discussion started with AI and how CHROs see it impacting culture, morale, and productivity. Employees are uncertain and often scared of how AI may reconfigure workplace operations. Clear and frequent messaging is important, especially on how AI is being deployed to improve and customize the employee experience journey.

Another hot topic has been whether companies (and employees) should be speaking out on social issues. This should be a values-first decision: Is the company in the business of weighing in on social issues? Either way, speaking out shouldn’t happen on a whim or in a moment of passion. The HR and legal functions should clearly establish and communicate who is authorized to speak on the company’s behalf.

A third hot topic is diversity, equity, and inclusion, especially in the wake of the Supreme Court’s decision on college admissions. In today’s contentious environment, companies run the risk of flip-flopping based on how the political winds are blowing. The best advice? Start with the necessary business outcomes and work backward from there. Every and any HR initiative should tie back to the organization’s strategy for winning in the market and the talent profile needed to accomplish that.

Finally, there’s culture. Culture isn’t just the CHRO’s job, it’s a responsibility of every leader in the organization. Practically, however, boards of directors are just beginning to add culture to their charters. Whether a board formally adjusts its charter or simply expands its scope, gone are the days where board-level HR interest begins and ends with executive officer compensation. Plan for compensation committees to ask for more varied information on employee engagement, attrition, training, safety, and related broad-based human capital topics.

Keynote on Information Security

Rachel Wilson, Wealth Management Chief Data Officer of Morgan Stanley, kicked off the conference with an overview of the state of play in information security. The goal, Rachel promised, was to help attendees sleep worse at night.

The information security landscape has become even more complex due to the growing power of non-state actors, certain governments masquerading as non-state actors to avoid sanctions and international condemnation, and AI’s exponential expansion of the threat vector.

HR and compensation leaders have a role to play in the information security puzzle. Corporate insiders are generally presumed to be those with nonpublic financial or legal information. However, data breaches are becoming more common and now must be reported. As such, it’s important to remember the broader principle: No employee in an organization can trade when they possess material nonpublic information.

One high-profile company that suffered a data breach tasked internal employees with building a portal that allows consumers to check if they were among those breached. The employees building that portal thought it was okay to trade on the knowledge of the breach since they weren’t formally designated as insiders. While the SEC’s new disclosure rule will shrink the time between detection and disclosure, there’s still considerable (nonpublic) nuance that may be gleaned after the initial SEC disclosure is made.