Maintaining Pay Equity: Analyzing the Impact of New Hire Pay

Pay equity is about rewarding people fairly based on their role and the value they create in the organization, regardless of gender, race, ethnicity, or other unallowable factors. Although regular pay equity audits are a great way to proactively identify and address inequitable disparities in compensation, they’re not a one-and-done effort because several factors can disrupt pay equity in a company. One of those factors is new hires. In this article, we’ll unpack the impact of hiring on pay equity and steps organizations can take to remediate any issues that arise.

How New Hires Can Disrupt Pay Equity

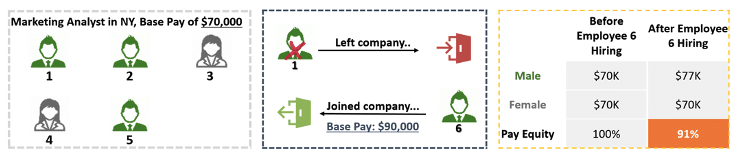

To understand how new hire pay can affect an organization’s pay equity, let’s start with a simple example. Suppose we’re analyzing pay equity for marketing analysts within a company. Further assume that all five employees in this role (three males and two females) are located in New York and are paid $70,000 a year. For simplicity, we assume that they all have similar levels of professional experience, performance, and productivity. Based on these assumptions, the company has achieved 100% gender pay parity for this role.

Two weeks later, employee #1, who is male, decides to quit. The company is short-staffed and needs to hire a replacement very quickly to support its business operations. Unfortunately, it isn’t possible to hire someone else at the same pay rate of $70,000. Instead, the company hires a new male employee who has a comparable level of experience—we’ll call him employee #6—at a higher pay of $90,000. With this hire, the gender pay parity in this role drops to 91%, with male employees making more money on average than their female colleagues.

What if the new hire were a female? The answer is that there would still be a pay gap based on gender, which isn’t allowable under federal and state laws.

The graphic below illustrates this dynamic.

This example is basic to illustrate our point. In reality, though, the math isn’t so simple. There are multiple other factors at play, and pay itself has multiple elements. That’s why statistical modeling techniques like multivariate regression are so helpful in identifying pay equity issues.

Using High-Powered Analytics to Identify Root Causes of Pay Disparities

Now suppose a pay equity audit does indicate statistically significant pay disparities. The questions to answer are:

- Which employees are driving the pay disparity?

- What compensation element(s) are driving the pay disparity?

Let’s break these down one at a time.

Which employees are driving the pay disparity?

When we help clients perform pay equity audits, we analyze the output of the modeling to form a hypothesis on what could be driving any observed disparities. We then run a series of analytics to test and confirm the hypothesis. This is critical because if a gender or racial pay disparity is driven by a systemic cause, the best response is to address the cause rather than play whack-a-mole by making pay adjustments to a few employees.

One indication that hiring is the cause is the “tenure coefficient” in the regression analysis, which measures how pay changes as tenure increases. A low tenure coefficient is an indicator of pay compression, while a negative tenure coefficient is an indicator of pay inversion.

- Pay compression occurs when there’s a small difference in pay between employees who have been in the job for a while versus those that are new to the role

- Pay inversion occurs when newly hired employees are paid more than incumbent employees. We often see pay inversion in tight labor markets like the one during the Great Resignation. These days, we see pay inversion crop up in fields with high demand for talent (such as roles related to artificial intelligence), or in companies where annual merit increases aren’t keeping up with the market

One of the outputs of a regression analysis are the coefficients of the different explanatory variables used in the model. These coefficients quantify each factor’s impact in predicting employee pay. Tenure in the position and/or company often impact pay, so it’s common to include these tenure variables in the analysis alongside other explanatory factors like role and location. The logic is simple: Generally, we would assume that a longer tenure leads to higher pay. Without getting too technical, this means that we’re looking for a positive tenure coefficient in the regression model, which would indicate that every additional year of tenure in the company leads to an increase in pay. In contrast, a negative tenure coefficient means that if two employees are in the same role, the employee with longer tenure receives lower pay. This indicates pay inversion, as we discussed.

Pay inversion becomes a pay equity issue when a higher proportion of new hires belong to a specific gender and/or racial background, while incumbent employees belong to a different gender or race. Another possibility is that the pay disparity is concentrated within the new hire cohort, meaning that discretion and negotiations during the hiring process are driving pay variances for employees in similar roles. This can then manifest as a gender or racial pay gap if employees of a particular demographic are systematically benefiting from pay variations. In any of these cases, if the pay disparity is driven by new hires, the remediation strategy should center around addressing this population. More on that later.

What compensation element(s) are driving the pay disparity?

Assuming that the pay disparity issue is determined to arise from new hire pay, the next question to answer is what compensation elements are driving this. The two common culprits are base salary and stock-based compensation. Base salary is straightforward as it’s easy to compare the cash amount between new hires versus incumbent employees. Stock-based compensation, however, can be substantially more complex.

There are various ways that companies can convert stock-based compensation into a dollar value, such as using the target dollar value, accounting grant-date fair value, or potential realizable value. There’s also a question of which stock-based awards will be included—the most recent grant only, all grants issued over the last trailing 12 months, all grants vesting in the next year, or all unvested and outstanding grants? In addition to these, adjustments may need to be made to normalize the value of stock-based compensation granted to new hires versus incumbents. The chosen methodologies are critical as different approaches to quantify stock-based compensation can yield wildly different pay equity outcomes.

Before diving deeper, we want to define two key terms related to stock-based awards:

- New hire grants are stock-based awards issued when an employee joins the company. Often, the value of the new hire grant is larger than those issued to a similarly situated incumbent employee to attract new employees (e.g., the new hire grant value is three times that of an incumbent’s award). The vesting timeframe can also be over a longer period

- Refresh grants are stock-based awards issued to incumbent employees on a recurring basis (e.g., annually or every two years) to motivate and retain employees. An employee that received a new hire grant may not necessarily be eligible to receive refresh grants, depending on the company’s philosophy and compensation strategy

Below are two scenarios that illustrate the complexity involved when layering in stock-based compensation in pay equity studies.

Scenario 1. Company A issues refresh grants every March. To be eligible to receive the grant, an employee must be hired before September of the prior year. In addition to the refresh grant, the company issues new hire grants that are double the value of the refresh grants to all new hires.

As the new hire grant is twice the size of the refresh grant, we would typically annualize the value to facilitate comparability. Even so, if we take a trailing 12-month timeframe, the value of stock-based awards to certain newly hired employees may still appear inflated compared to incumbents as the former group may have received a new hire grant when they joined, plus a refresh grant in March. While it’s okay to have that difference because that’s how Company A’s compensation policy and granting practices work, this might show up as pay inversion in the pay equity analysis. In this case, care must be taken to ensure we’re thoughtfully capturing the value of stock-based compensation.

Scenario 2. In this scenario, Company B issues new hire grants to all onboarding employees. However, refresh grants aren’t issued consistently. For any given year, an incumbent employee may be eligible to receive a refresh grant depending on their performance and role criticality, as well as the financial prospects of their business unit. This scenario is complex because in the absence of a recurring annual refresh grant, an apples-to-apples comparison between new hires and incumbent employees is impossible. In such cases, the best solution may be to analyze the new hire and the incumbent employee population separately. Otherwise, combining these two groups will skew the outcome of the pay equity analysis, and lead to misleading remediation possibilities.

Given the complexities involved, there’s no one-size-fits-all approach. When we encounter these challenges, we brainstorm with the company and its legal counsel on the best path forward. This ensures that the approach is tailored to each company’s compensation philosophy and granting practices.

Once we’ve zeroed in on the compensation elements driving the pay disparity, it’s time to formulate a strategy to remediate the issue.

Remediation Strategies to Consider

Assuming the analytics show that the new hire group is the source of pay disparity, strategies to address the issue will likely involve a combination of the following.

Adjust the HRIS data and/or the pay equity analysis methodology to account for specialized skillsets of new employees

When a company is rapidly hiring for a particular role or business unit, it may take a while for the job architecture to catch up and reflect the specialized skillsets and responsibilities of new candidates. This can then explain why these new roles command a pay premium. Because the statistical modeling in a pay equity analysis primarily uses data from the HRIS to explain pay, it’s important to ensure that the information in the system reflects reality so that the results are reliable. This also supports why human review and judgment are critical when evaluating how reasonable the outcome of the analysis is.

Establish well-defined pay guidelines for new hires

There’s a strong body of academic research that shows that men, particularly white men, are more assertive pay negotiators compared to women and people of color. If there’s a gender or racial pay disparity within the new hire cohort, establishing compensation guidelines with more limited discretion from hiring managers can be an effective strategy in curbing pay inequities within this group. There also needs to be approval and monitoring of the exception handling process to avoid a situation where every case becomes an exception.

Setting pay fairly for new hires can be challenging, particularly when there’s a mismatch in external market pay expectations versus the pay of incumbent employees. To help our clients navigate this and avoid pay inequity issues down the line, we’ve developed a web-based tool called EquityTraq. EquityTraq uses the company’s current data and a custom-calibrated regression model to help predict a fair pay range for new hires (as well as newly promoted employees) based on the factors expected to impact pay. Companies will also be able to compare the proposed new hire pay with the market range data (if available) for similar positions in the company and the actual pay for incumbent employees.

Perform regular external pay benchmarking

Some of the issues noted above are related to new hires starting at a higher pay that reflects current market rates. Meanwhile, incumbent employees’ wage progression, via annual merit increases, isn’t keeping up. One solution is to keep external compensation benchmarking up to date. This makes it possible to easily flag employees who fall below the pay range, and make adjustments before widespread problems arise.

Implement targeted pay adjustments to incumbent employees

If a pay inversion is causing gender or racial pay disparities, targeted pay adjustments to incumbent employees will become necessary to close the gap. A tenure-based analysis can be deployed to pinpoint cohorts that would most benefit from a pay adjustment. Understanding what these are will help companies allocate spend more efficiently. For instance, if the drill-down analysis reveals that the gender or racial pay gap is most pronounced for cohorts with three to five years of tenure, then the company can prioritize pay adjustments for employees in this tenure cohort.

Regularly monitor pay equity results

Pay equity is a journey. Regular monitoring via annual pay equity audits keeps pay disparities from lingering so you can remediate them in a timely manner. That said, too-frequent monitoring could be counterproductive.

Ultimately, there are numerous ways in which pay decisions for new hire employees can impact pay equity outcomes. If you ever encounter issues or are unsure about the analysis or remediation strategy that makes the most sense for your organization, please don’t hesitate to reach out. We take a collaborative and pragmatic approach in developing models customized to each company’s unique job structure and compensation practices, and would love to discuss your specific situation.