What the SEC’s 2024 PvP Comment Letters Mean for Year 3 Disclosure Preparation

The third year of the SEC’s pay vs. performance (PvP) disclosures has been shaping up to be business as usual—mostly. Unlike 2022, the rule is no longer new, and there are established understandings and best practices. And unlike 2023, there has been no major batch of C&DI releases, much less a second major batch that modified and expanded upon the first. But that doesn’t mean the process is fully on autopilot.

For one thing, investor or proxy advisor scrutiny could be around the corner. Nobody is looking to overhaul their voting procedures on a dime, but the new—and annually expanding—data provided by the PvP disclosure seems difficult to ignore. We’ve had multiple conversations this year with institutional shareholders who are seeking to understand the disclosure and how they might think about it in the context of say-on-pay. You may not be feeling shareholder pressure this year, but maintaining a clean and clear disclosure will be beneficial as views evolve.

For another, SEC scrutiny isn’t letting up, even as the agency tackles numerous priorities. Just as it did last year, the SEC has taken up a broad review of PvP filings and has issued dozens of comment letters to companies whose disclosures fell short in some way. Nothing in these comment letters implies anything new about rule interpretations. Rather, they reinforce the importance of getting the disclosure right, down to the small details.

We looked at 30 of these comment letters filed between August 15 and October 16, 2024. They include a total of 62 concerns raised by SEC staff. Here’s a summary of the key themes.

Comment Letter Recipients and Issues

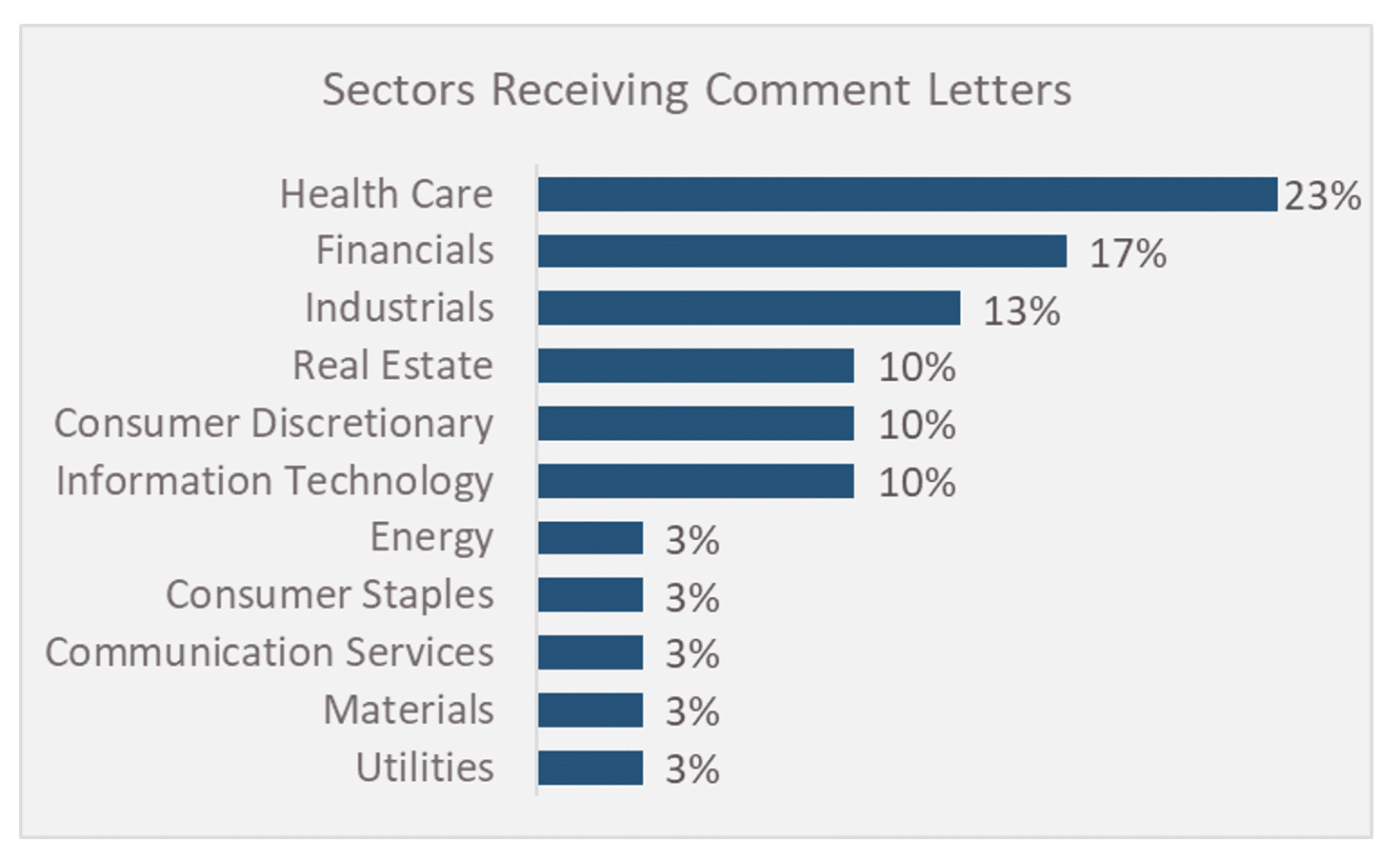

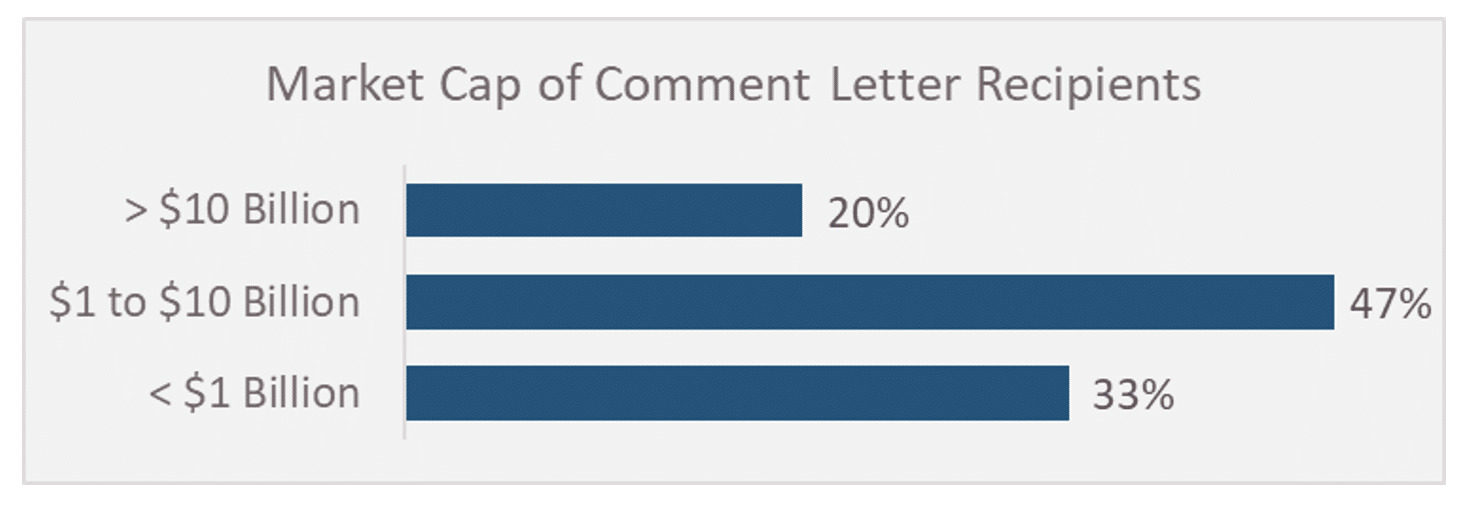

The 30 letter recipients span all sectors, with a larger share from health care and financials, and a wide range of market capitalizations from $150 million to tens of billions:

Last year, we identified three kinds of comments:

- Calculation problems (issues with the numbers)

- Presentation problems (something is unclear as presented)

- Disclosure problems (a component is missing or incorrect)

This year, we find that disclosure problems dominate, with a handful representing the other categories.

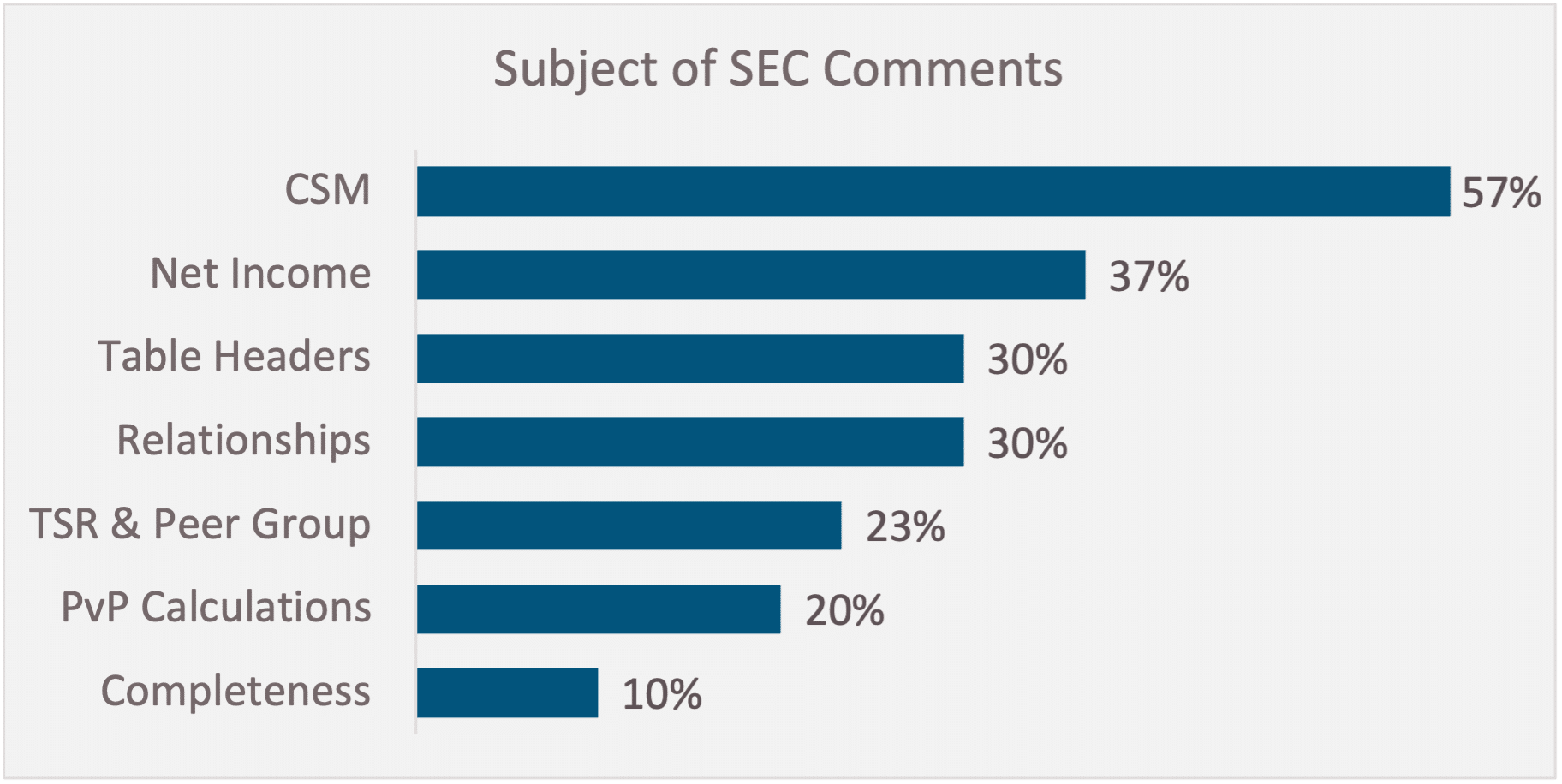

The SEC’s comments break down by topic area as follows:

Calculation and Presentation Problems, and the Importance of a Robust Process

We saw a decline this year in comment letters highlighting calculation issues and presentation issues, which is encouraging but expected. The short runway for the first disclosure sent many companies scrambling, unsure of certain interpretations. By the second disclosure, the dust had settled.

The remaining calculation and presentation issues highlight the need for a robust process to develop the PvP disclosure. Most companies have a decent process for building their other executive compensation disclosures, like the Summary Compensation Table (SCT) or the various equity tables. However, these tables mostly involve collating a handful of data points each, so some companies’ processes remain manual. PvP is a different challenge altogether, requiring dozens or hundreds of tranche-level calculations. The math itself may not be rocket science, but a lot of moving parts means a greater risk of failure for companies who try to do it manually.

Indeed, examples of calculation problems flagged by the SEC include cases where:

- The SCT total doesn’t tie to the equivalent portion of the PvP disclosure

- SCT elements like pensions or all other compensation are handled incorrectly for PvP compensation actually paid (CAP)

- Inconsistencies exist between CAP in the PvP table and the line-by-line reconciliation in the footnotes

Further, there are several examples of presentation problems. Many of these relate to headers in the footnote reconciliation table. The SEC reiterates that the phrase “year over year” is vague or misleading, particularly for values that don’t represent a full year (such as the change in value of vested tranches). The commission also cites other examples of mismatched headers or chart labels throughout disclosure elements.

All of these issues are symptoms of a process that is less robust than it ideally would be. Programmatic processes ensure that elements tie to each other, and multiple layers of review (both internally and with external advisors) can catch mismatches in numbers or labeling. We expect that these types of issues will continue to decline in prevalence as PvP processes settle into a steady state.

Disclosure Problems and Managing Changes

The bulk of the SEC’s comments this year cover issues of missing or incorrect disclosure elements. In some cases, this may reflect a misunderstanding by the company that was present in their first disclosure and was simply called out for the first time this year. In others, companies may have changed an element of their disclosure and missed something in doing so.

Some of the most common problems flagged in comment letters include:

- Company-Selected Measure (CSM). For CSMs that aren’t GAAP figures, there must be an explanation of how the CSM figure is calculated from GAAP figures. Further, this explanation must be in the proxy and not incorporated by reference from another filing like an earnings release.

- Net income. This figure must be GAAP net income, not an alternative like net income attributable to shareholders.

- Relationship disclosures. It’s critical that the company disclose all of the required relationships: company TSR vs. peer TSR, as well as CAP vs. each of TSR, net income, and its CSM. These may be accomplished via graphs, narrative, or a combination.

- TSR peer group. If the TSR peer group changes from one disclosure to the next, there must be a footnote explaining what changed, why, and what the TSRs for each year would have been absent the change.

In many of these cases, catching an issue can be trickier because there’s nothing wrong—it’s that something isn’t there that should be. In many cases, the best way to catch these issues is with fresh review from experts, either legal counsel or other external advisors. However, many issues arise from making a change (such as to the TSR peer group or the CSM). In these cases, it’s critical to take a step back and consider what additional elements are triggered by such a change.

Parting Thoughts

The third year of PvP disclosures promises to be business as usual. Still, business as usual for SEC filings means high levels of scrutiny and care, with potential repercussions for failing in this. The SEC was very collegial in its first year of comment letters, even using that review process to inform its C&DIs. Over time, expectations naturally ratchet upward, such that problems with the PvP disclosure will be met with the same gravity as problems with other proxy disclosures. A robust process for PvP analysis and change management is critical to minimize these potential issues and keep your team focused on other issues that concern boards and investors.

If you have any questions on this topic or would like to discuss your specific circumstances, please contact us.