Net Settlement in the UK Is Now More Complex

For employees in the UK, the way share-based payments are settled can lead to significantly different tax treatments. Net settlement, where a portion of shares is withheld to pay for taxes and never delivered to the employee, will now generally lead to less deductibility than sell-to-cover transactions, where all shares are delivered to the employee and a portion is then sold in the market to cover taxes.

Before 2023, His Majesty’s Revenue and Customs (HMRC) directed UK companies to report shares withheld as part of a net settlement transaction, so-called “cash canceled shares,” as a separate item from the net shares delivered to the employee. Now, there’s more clarity on the tax deductibility of those withheld shares. These developments apply to all types of awards (e.g., stock options, restricted stock units) for tax returns filed after July 6, 2023.

HMRC Updates

To understand the new two-part deductibility in the UK—bifurcated between shares delivered and cash canceled shares—we’ll start with the HMRC manual and its explicit guidance on net settlement events. Then, we’ll turn to the Corporation Tax Act (CTA) for additional guidance.

First, we have the deduction limitation on shares netted for taxes from the HMRC Business Income Manual (BIM) 44410.

When a share option is exercised, the employer may retain a proportion of the shares in order to settle the tax and National Insurance liabilities of the employee. These are known as Net Settled share options. A Part 12 CTA09 statutory deduction will be available to the employer in respect of any shares acquired by the employee, but no statutory deduction under Part 12 CTA 09 is available for the proportion of shares retained by the employer.

The underlying source of this conclusion is CTA S1038A(2), which denies the employer a tax deduction for the shares not acquired by employees.

For the purpose of calculating any company’s profits for corporation tax purposes for any accounting period, no deduction is allowed in relation to—

- the option, or

- any matter connected with the option,

unless the shares are acquired pursuant to the option.

However, CTA S1038A(7) separately allows a tax deduction for all shares subject to taxation for the employee per the Income Tax (Earnings and Pensions) Act 2003 (ITEPA 2003).

Subsection (2) does not disallow deductions for—

- amounts on which the employee is subject to a charge under ITEPA 2003,

- amounts on which the employee would have been subject to a charge under ITEPA 2003 had the employee been a UK employee at all material times, or

- if the employee has died, amounts on which the employee would have been subject to a charge under ITEPA 2003 had the employee been alive.

Thus, a tax deduction is available to employers for the netted shares up to the amount of stock-based compensation expense recognized on them, which is typically the grant-date fair value. However, the deduction is further limited to the intrinsic value at settlement, which is the actual amount subject to tax under ITEPA 2003. To summarize, the maximum deduction allowed for the netted shares retained by the employer is the lower of (1) the stock-based compensation expense related to the shares retained by the employer and (2) the intrinsic value on the settlement date.

Rationale and Impact

As stock-based compensation (known as stock-based payment or SBP in the UK) expense becomes more material, tax authorities are paying more attention to the tax relief that companies take. Recently, HMRC emphasized that only shares actually delivered to employees are available for the employer’s tax deduction. This affects companies that use net settlement since, by definition, shares retained by the employer are never delivered to the employee.

Sell-to-cover settlements aren’t affected by the new guidance because all shares are delivered to the employee, and only then is a proportion of shares sold through a broker to cover the employee’s income tax.

Net Settlement Example

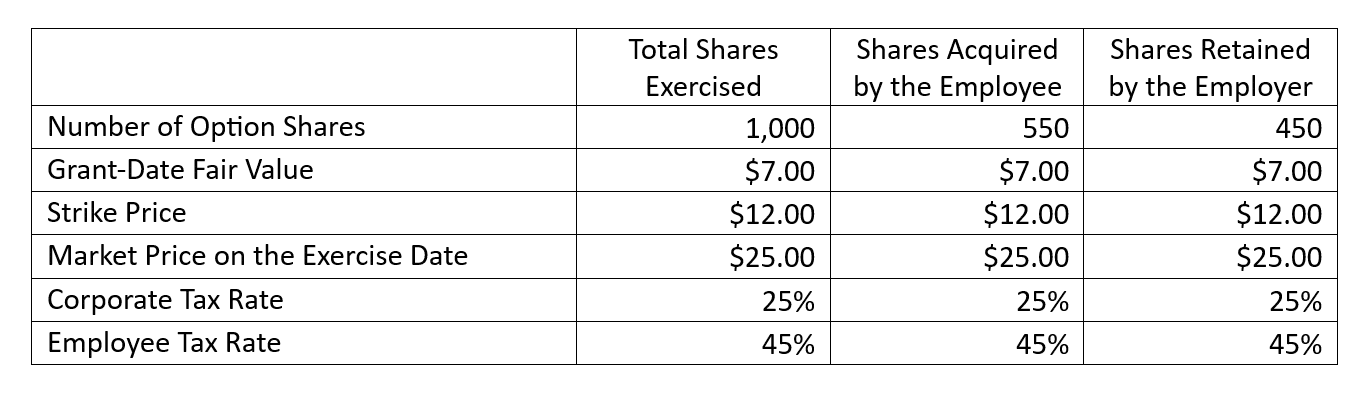

Let’s walk through a net-settled exercise, implementing HMRC’s clarification. Consider 1,000 stock options exercised at $25, with a strike price of $12 and, therefore, an intrinsic value of $13 per option ($13,000 in total). The grant-date fair value being expensed is $7 per option, which was determined using an option pricing model.

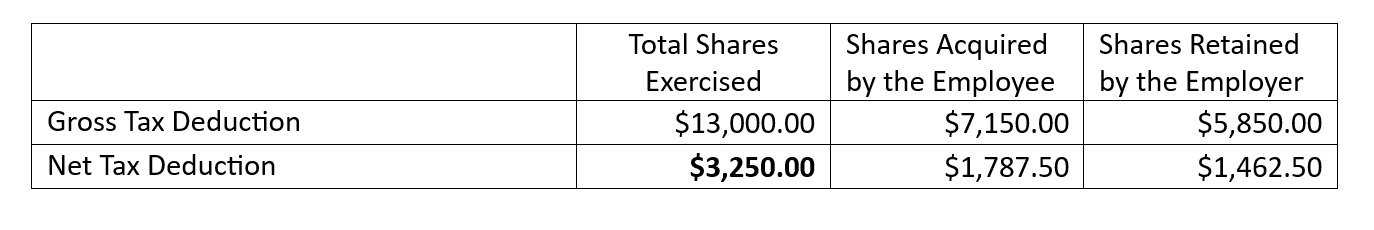

Under historical practice, the employer’s gross tax deduction would be $13,000. The net tax deduction would be $3,250 after applying a 25% corporate tax rate. This is because companies could still take the full tax deduction, regardless of how many shares were netted for taxes.

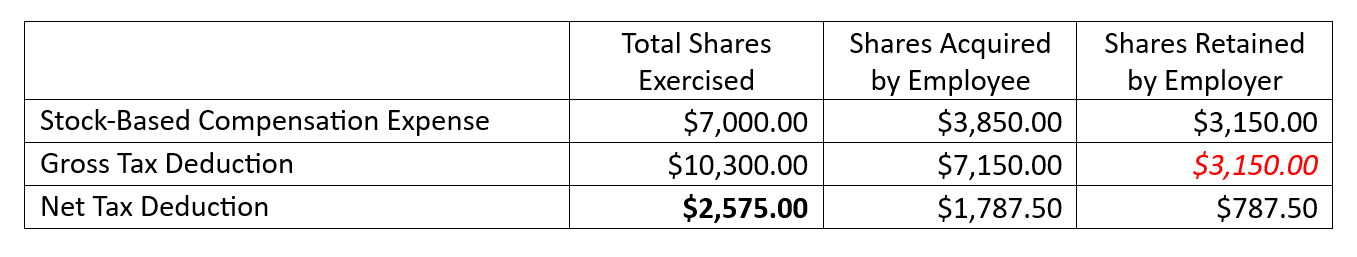

With HMRC’s clarification, companies need to adjust the tax deduction for the shares retained for employee tax purposes. Let’s assume a marginal individual tax rate of 45%. The deduction for the netted shares cannot exceed the stock-based compensation expense, in this case, $3,150 (45% multiplied by 1,000 options and $7 grant-date fair value).

The final after-tax deduction becomes $2,575 once we apply the 25% corporate tax rate. The net effect of the updated tax rule is to lower the deduction by $675—that is, the difference between the $13 intrinsic value and $7 grant-date fair value with the 25% tax rate applied.

Assumptions

Before Applying the HMRC Update

After Applying the HMRC Update

The amount in red is the lesser of the expense recognized and the intrinsic value on the exercise date.

Essentially, no windfall can be recorded on the retained shares. This contrasts with sell-to-cover transactions, where employers can record the full deduction even when the intrinsic value on the exercise date is higher than the grant-date fair value.

Considerations and Takeaways

HMRC’s clarification naturally affects the deferred tax asset (DTA) recorded by companies. Under IFRS, the DTA for share-based payments is generally based on the expected value to be delivered to the employee and, therefore, remeasured using the market price as of the reporting period end date. However, the DTA for expected net settlement shares is limited to the lower of the grant-date fair value and the intrinsic value at the end of the reporting period.

Bifurcating the DTA buildup for expected net settlements is very challenging. Is the settlement method for every employee reasonably known in advance? For employees who are expected to net settle, is their applicable tax withholding rate known in advance to estimate the number of shares that will be netted?

Even with good estimates, a true-up to actual withholding results is needed. That means settlement type and the number of shares withheld need to flow from the stock plan administration system into the tax benefit reporting process. In our experience, gross shares exercised are readily available for tax accounting, with net share information being more difficult to obtain. As a result, companies will need to carefully upgrade their processes to split awards and correctly calculate both the DTA and the ultimate tax deduction.

Parting Thoughts

Companies with robust financial reporting systems should be able to manage this bifurcated tax accounting for net settlement transactions. Some companies may decide that switching to sell-to-cover avoids this complexity altogether.

If you decide to offer net settlement in the UK, we recommend working closely with tax advisors to consider any practical difficulties around amending tax returns. We’ll continue to monitor best practices for companies affected by the guidance from HMRC, as well as any comments submitted to HRMC and their responses.

Please don’t hesitate to contact us if you have equity recipients in the UK and awards with net settlement provisions. With the new guidance already released, now is the time to determine whether your recent tax returns, current deferred tax asset balance, and ongoing tax reporting processes are in compliance.