Clawbacks: Demystifying the Event Study

The SEC’s new clawback rule requires public companies to take back incentive-based compensation awarded in error due to a material misstatement in the financial statement. But how much to claw back isn’t always obvious. It depends on what the payout should have been had the financials been stated correctly in the first place. Finding that out can get complicated, especially if the incentive measure is total shareholder return (TSR) or stock price.

The most common method is to use an event study, which aims to isolate the stock price impact of specific events. In this article, we identify the key steps of an event study. Then we look at how those steps play out in a pair of hypothetical situations, one involving a Big-R restatement and the other a little-r restatement.

A Seven-Step Approach

Here are the basic steps of an effective event study.

- Determine the vesting subject to clawback. Be pragmatic and focus on what you need to see. If your company didn’t have any awards vested based on prior TSR awards, for example, you needn’t go through this exercise at all. Similarly, if your company had a return 30% above its nearest peer, the restatement’s impact may not have been enough to trigger a clawback. By analyzing the subject award vesting and the potential clawbacks based on moves in the stock price, you should be able to quickly frame the analysis.

- Identify key dates. You’ll need to know the specific event or events that could have affected the stock price related to the misstated financials. These may include the release of any misstated financials, the announcement of the determination that the financials were misstated, and the release of the restated financials. Other news or events may have caused price movement as well, such as announcements that the company was expecting higher revenue or relevant industry analysis.

- Collect data. This includes historical stock price and trading volume data for the company’s stock, along with data from indices or other stocks that can serve as a control for explaining ordinary stock price moves. The data typically covers a period both before and after the event in question. Data sources may include stock exchange records, financial databases, and other relevant sources.

- Calculate excess returns. The primary goal of an event study is to determine the excess returns associated with the event. Excess returns are the difference between the actual returns during the event window and the expected returns based on the stock’s historical performance and market trends. Various methods can be used to calculate these excess returns, the capital asset pricing model (CAPM) being a common choice.[1]

- Conduct statistical analysis of returns. Test whether the excess returns are statistically significant (think t-tests). If the excess returns are significantly different from zero, it suggests that the event had a material impact on the stock price.

- Establish causation and control for contemporaneous events. Although the stock likely moved when news of the restatement came out, that doesn’t mean the restatement news was the only cause. Consider what other news came out, the impact of that news, and the impact of other similar events to determine what component is likely due only to the misstated earnings.

- Make a determination. Based on the analysis in step 6, determine how much of the return you should attribute to earnings and the resulting clawback.

Now let’s see what these steps look like in action.

Case 1: Close Enough Corporation

Little-r restatement

Beginning in January 20X4, Close Enough Corporation (CEC), a leading provider of horseshoes,[2] introduced a new product: jewel-encrusted luxury horseshoes. The company recognized revenues on the sale. However, some of these horseshoes were custom designed and shipped directly to customers.

In filings for the first and second quarters, CEC hit street earnings per share (EPS) expectations. In the third quarter, the horseshoe maker exceeded consensus EPS estimates by $0.02.

As they prepared for their 10-K, management realized that custom orders were recognized on order rather than delivery due to a miscalculation in the company’s analysis. This didn’t materially impact the financials prior to the 10-K. But the company and its auditors determined that the cumulative impact of this would result in a material impact if the error continued in the 10-K filing.

The company filed its annual report with a small-r restatement covering the prior three periods, in which they announce EPS of $0.01 below street expectations. (Note that as part of this disclosure, the third quarter should have exceeded EPS estimates by only $0.01.)

1. Determine the vesting subject to clawback

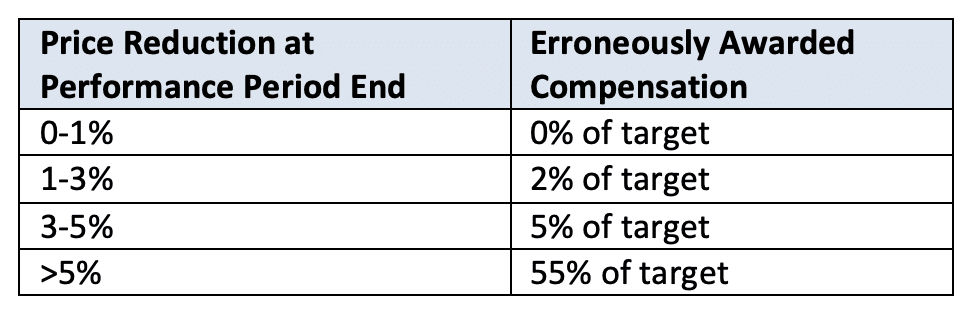

CEC looks at the clawback impact of various price returns on its relative TSR award:

Based on this, management determines they’re at significant risk of a clawback and decides to carry out an event study on the return impact of the misstatement.

2. Identify key dates

Management first did a news analysis in order to determine whether there would be any news relevant to investors other than the four interim earnings releases. They were unable to find any information regarding their accounting and/or revenue processes, so they elected to consider only the four dates where there are earnings announcement.

3. Collect data

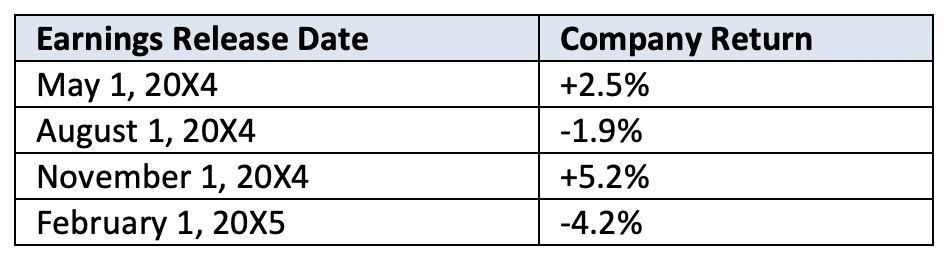

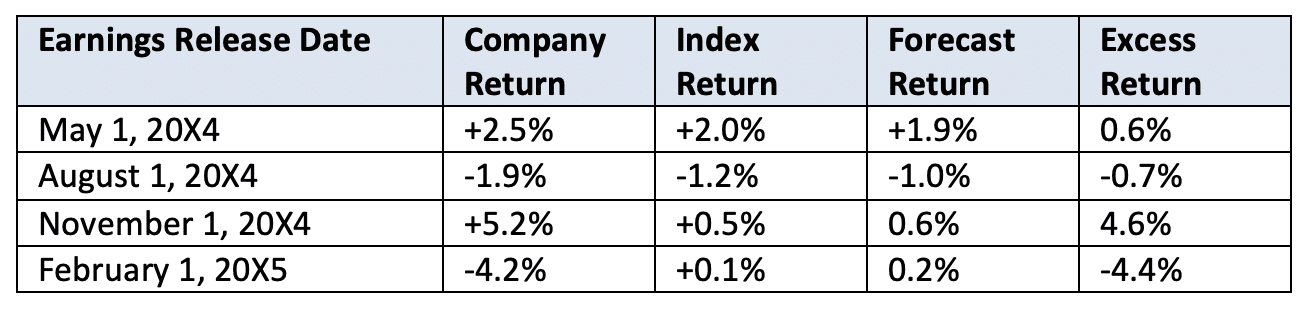

First, CEC looks at the returns from each of the key disclosure dates:

The company believes its returns are best explained by the index average for the Lucky Charms industry (SIC Code 7777) and gathers the returns of this index as well.

4. Calculate excess returns

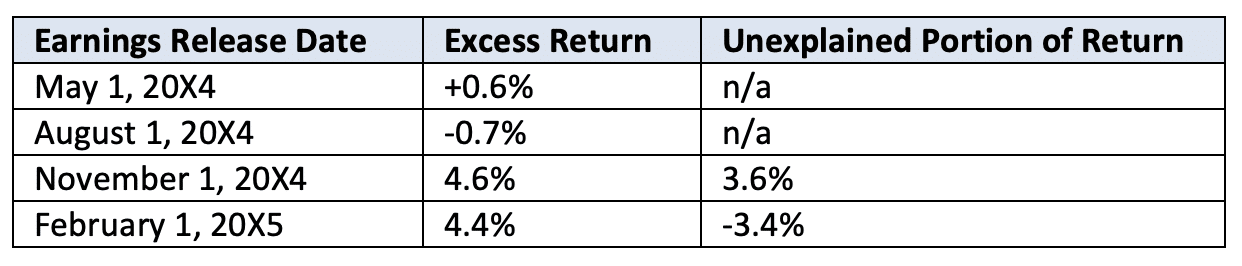

To determine the unexpected portion of the return, the company runs a regression on the relationship between the industry returns and CEC returns. The regression, run over the one-year period, shows that the average return for CEC can be predicted as:

CEC = 0.1% + 0.9 * Index Return + Random Movement

The table shows the results for each quarter.

5. Conduct statistical analysis of returns

Based on the regression in step 4, the company notes that 95% of the time, the excess return is less than 1%. In our analysis, we’ll refer to moves outside of this 1% range as having statistically significant price impact due to the day’s news. This is the amount that may be explained by the misstatement event.

**************

What if a restatement didn’t matter?

In our simplified case about CEC, we assume the stock price moved out of the range of expectations when the restatement information came out. But a restatement can be minor enough not to impact the stock at all. Remember, a little-r restatement is supposed to be information that wouldn’t have reasonably impacted investors decision-making process.

In this case, we would want to confirm that there wasn’t information masking a negative return (for example, if there were a restatement and a big earnings surprise in the same release, the restatement may have stopped the price from moving up). If indeed that wasn’t the case, we can likely conclude that investors didn’t react to the restatement. Since the disclosures had no price impact, there would be no clawback.

**************

6. Establish causation and control for contemporaneous events

In general, this is an area where the company can choose an analysis with as much or as little rigor as they believe appropriate, often depending on the facts and circumstances. For this analysis, we’ll consider that no other significant information was released on the relevant dates.

7. Make a determination

Based on this, the company considers three choices:

- Carry out a robust analysis of the two dates with statistically significant returns, determine what other information was released, and—based on similar events for CEC and other companies—look to determine what a reasonable return attributable to each component of the news was. In this case, this may be an analysis of the stock price impact of being above or below street earnings expectations

- As a reasonable estimate, assume that half of the third-quarter increase was due to the extra penny of earnings from the misstated earnings, and half of the decline was due to the EPS adjustment. As a result, the company could conclude that the price was likely overstated by 1-3%, requiring a clawback in the amount of 2% of target shares

- Similar to choice 2, CEC may go through the same analysis but elect to take the next higher clawback and go to 5% in order to satisfy shareholders’ concern about underestimating the clawback

All of these are reasonable, but the cost of choice 1 may be quite high, especially given the relatively low impact. Moreover, it’s unlikely that the conclusion would be all that different, while either 2 or 3 would give CEC a reasonable outcome at a much lower analytical cost.

Case 2: Four Clover Corporation

Big-R restatement

Four Clover Corporation (ticker: LUCK) is a leading picker and distributor of natural four-leaf clovers. In the spring of 20X5, it was identified that the company had incorrectly accounted for the cost of inventory due to data processing errors. The result was a material error to the company’s 20X4 10-K, filed February 28, 20X5.

On May 1, 20X5, the company filed an 8-K with Item 4.02, stressing that the prior financial statements should not be relied upon due to the error. On May 8, 20X5, the company released an amended 10-K showing a 20% reduction in net income.

1. Determine the vesting subject to clawback

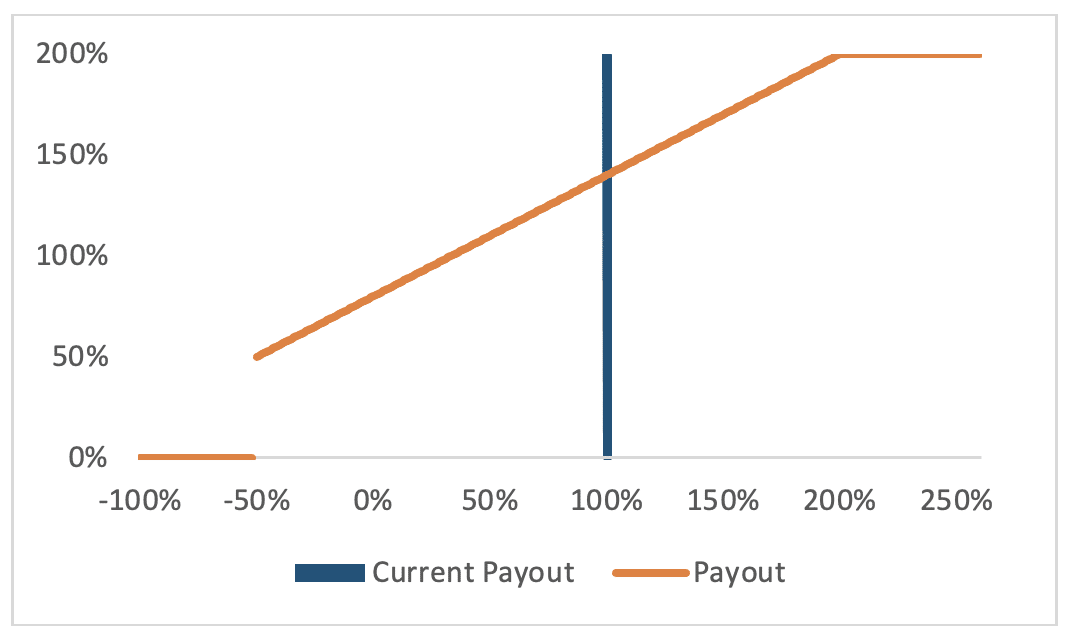

Four Clover had a performance equity award that vested in the amount of its return, with a minimum vesting of 50% for a return of -50% and maximum of 200% if the stock price more than doubled. Given their return was in the linear performance range, any percentage loss would result in an equal loss in vesting of the target percentage of shares.

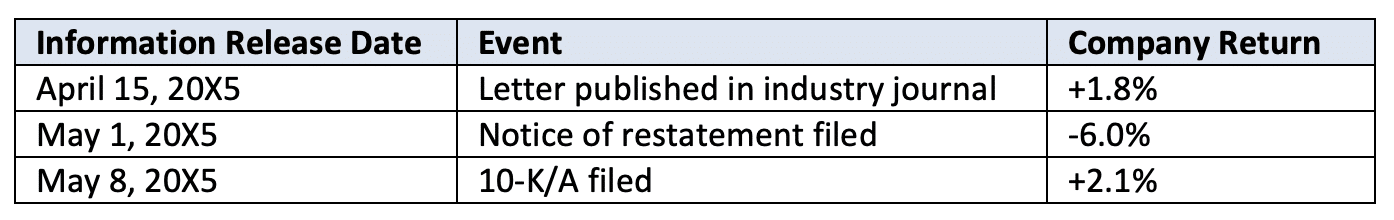

2. Identify key dates

Upon their analysis, management noted that an industry expert sent Lucky Charms Quarterly a letter, published April 15, 20X5, indicating that Four Clover’s inventory costs appeared abnormally low due to the increased cost of harvesting four-leaf varieties.

3. Collect data

First, we look at the returns from each of the key disclosure dates:

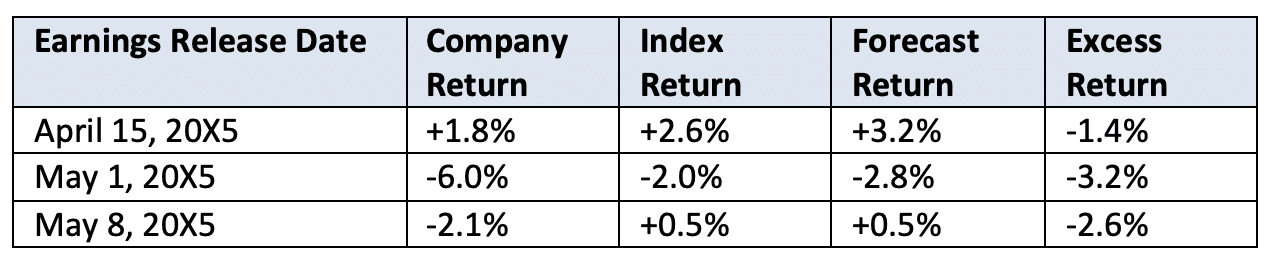

4. Calculate excess returns

The company runs a regression of its returns against the Lucky Charms industry. The results are:

LUCK = -0.2% + 1.3 * Index Return + Random Movement

The table shows the breakdown by date.

5. Conduct statistical analysis of returns<

In this case, the random movement term acceptable range is up to 1.5%. In our analysis, we’ll refer to moves outside of this 1.5% range as having statistically significant price impact to the day’s news.

**************

What choices didn’t we look at?

These are simplified examples. In a real-life situation, we might consider additional questions such as:

- Were there any abnormal returns immediately before or after our key dates, showing information may have moved prices before or after the news?

- After the news, was there a stock price recovery that could lower the price impact?

- What’s the right period to calibrate our regression?

- Was the level of inflation different for different periods?

**************

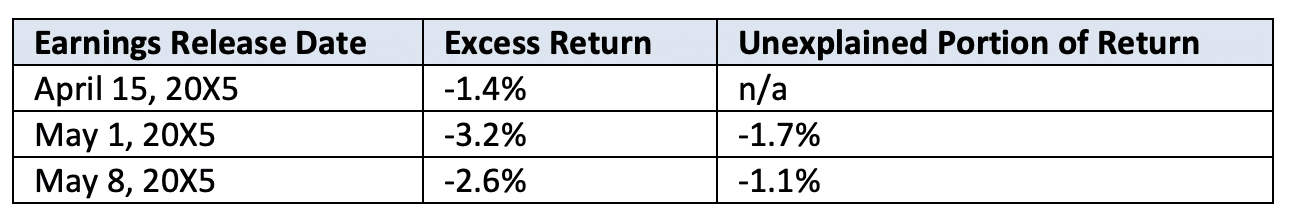

6. Establish causation and control for contemporaneous events

Four Clover looks at each of the event dates to determine whether there was any potential impact. The following are items they consider relevant.

- On April 15, 20X5, in the same issue of Lucky Charms Quarterly as the letter, there was discussion of a positive outlook for charms in general with a focus on lucky plants. The company looked at the returns of leading providers of lucky bamboo, money trees, and lucky ferns and found an average of 1.5% positive excess return.

- On May 1, 20X5, having studied the impact of restatements with no change to EPS, the company estimated that 0.5% of the stock price fall was due to the restatement.

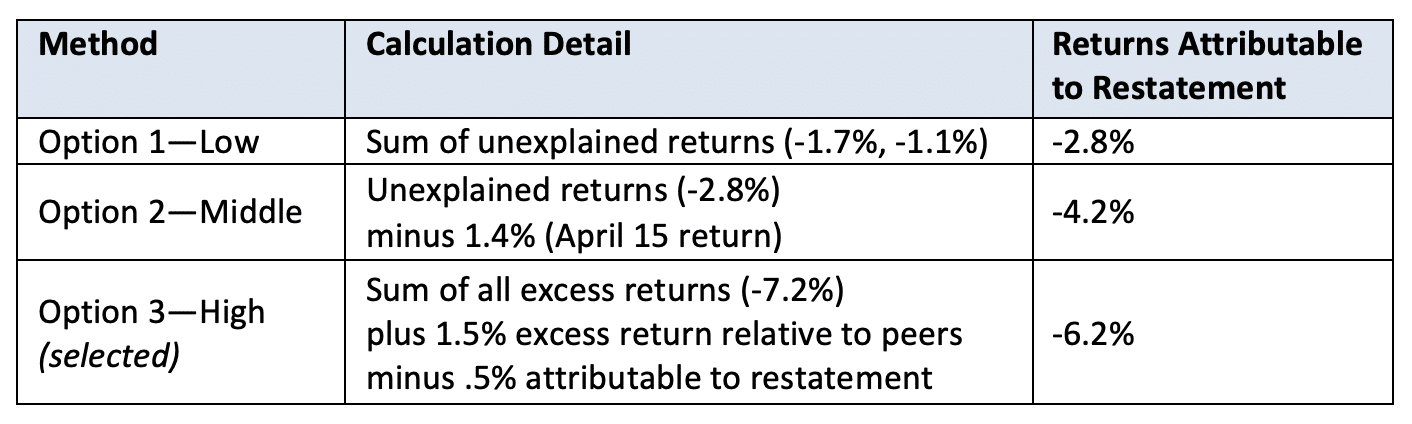

7. Make a determination

In this case, Four Clover decided to be conservative and take what they believed to be the maximum possible perceived impact. To do so, they took the sum of the negative excess returns (-7.2%), and adjusted it downward based on the average return from the plant group in April, and upward based on the 0.5% return attributed to the restatement. The resulting clawback was 6.2% of the award target.

The company also considered the low end of the range as -2.5% based only on the unexplained portion (-2.8%) adjusted for the clawback but decided the higher number was more appropriate. The company also considered a middle option, combining the unexplained returns with the excess return on April 15.

Taking only the sum of unexplained returns, the company believed this method did not take into account sufficient factors, and that the clawback was too low. Relying exclusively on the unexplained returns doesn’t assign any impact to the restatement announcement, which clearly caused the stock to drop. Combining the unexplained returns with the April 15 drop brings in more of the relevant dates, but has yet to check all of the boxes of an event study.

For a thorough study, the company included the negative returns assigned to the restatement announcement. The company also considered their peer’s movement at this time. Combining all of these factors, 6.2% of the award is subject to a clawback.

Event studies are well established in academic research and are commonly used in litigation. But they also help companies comply with SEC clawback rules. Even if it uses some other method for determining recoupment, a company may still use many of the key components of an event study.

Questions? Please contact the authors—we’re happy to help.

[1] We expect steps 3 and 4 to be the biggest difference between litigation and clawback-related event studies. In litigation, the defense will commonly state that any return that can be explained based on the index and an ordinary range of returns cannot be proven, beyond a reasonable doubt, to be due to the impact of the restated financials. In case of a clawback, however, a company may elect to use a standard of what was likely to be caused by the misstatement in order to appear conservative in their clawback.

[2] For those unfamiliar with Close Enough Corp., they started prior to World War II as a producer of hand grenades. After this business slowed, they became a leading provider of horseshoes, ranging from those for use on a farm to those for throwing and ornate decorative shoes for display.