Deferred Tax Assets after Tax Reform and IRS Notice 2018-68

The Negative Discretion Dilemma

Complicating the 162(m) Waterfall

Last year, the Tax Cuts and Jobs Act (TCJA) put equity compensation design and accounting in a tailspin as companies responded to deferred tax write-downs, 162(m) revisions, and more. By late spring of 2018, most companies had returned to a steady state, at least with regard to their long-term incentive awards. Still, one question loomed large: Which outstanding equity awards would be grandfathered under the 162(m) updates? IRS Notice 2018-68 gives an answer to this question.

The Negative Discretion Dilemma

For most companies, grandfathering the tax deductibility of outstanding performance-based awards as of November 2, 2017 is a seven- or eight-figure question. The TCJA outlined that in order to be grandfathered in—that is, in order to remain deductible above the $1 million limit—a written binding contract must have been in effect as of November 2, 2017. This raised concerns about whether the existence of negative discretion conflicted with the assertion of an existing binding contract. However, many experts suspected that as long as there was no precedent of exercising negative discretion, its mere existence wouldn’t block grandfathering.

Put simply, negative discretion is the ability for the compensation committee to reduce or eliminate payments. It shows up in most long-term incentive agreements. Unlike in the annual bonus plan, it’s extremely rare to see negative discretion exercised on long-term equity awards. We’ve historically considered it a token clause serving as a catch-all for highly unusual and egregious situations. At least in the accounting world, we tend to treat highly unusual situations as improbable (and thus basically nonexistent) until they occur. For these reasons, many experts—including ourselves—assumed that performance-based awards would remain deductible if granted before November 2, 2017.

Enter IRS Notice 2018-68. The notice addresses comments from stakeholders about identifying covered employees and how to apply the grandfathering rules. Example 3 of page 16 suggests that the mere presence of discretion precludes grandfathering, at least for the portion of the award where there is payment flexibility. For instance, if discretion allows for a 25% reduction in award payout, only the base 75% that is not adjustable may be grandfathered and considered deductible. The 25% subject to discretion is not deductible regardless of whether the discretion is exercised. Since negative discretion clauses in many equity award agreements are carte blanche (they don’t state a limit), in these cases no portion of the award will be grandfathered.

An argument can be made that if a negative discretion clause is very vague and there is clearly no intent to leverage it (also suggesting its enforceability is questionable), then perhaps it’s functionally absent and the awards can qualify for grandfathering. However, that’s ascribing quite a bit of intent to IRS Notice 2018-68 where the language in the notice doesn’t quite open the door to drawing such a conclusion. Therefore, it goes without saying that if you are interested in taking this position, work closely with counsel to document your case and why the position is reasonable in light of your particular circumstances.

Complicating the 162(m) Waterfall

This clarification from the IRS is a major turn of events. Post-TCJA provisional adjustments focused on bringing deferred tax asset (DTA) balances in line with the new corporate tax rate. However, most companies assumed their outstanding performance-based awards would remain deductible for covered employees.

To give a simple example, suppose Company ABC has five covered employees and the outstanding value of performance equity that had been expensed as of November 2, 2017 was $20 million. Under income tax accounting, this means that if the statutory tax rate is 21% then a deferred tax asset of $4.2 million should be recorded in the balance sheet. Now assume none of those awards can be grandfathered because the plan allows for negative discretion, which means the $4.2 million DTA needs to be reversed with a corresponding charge to income. The story is messier if the company already took a deduction on some or all of those awards because they vested earlier in 2018. If subject to the $1 million cap, that deduction may need to be reversed—or the DTA for still-outstanding awards may need to reflect it. (More on that last part in a bit.)

Another complicating factor is how equity compensation is matched with base, bonus, and other compensation to determine when the $1 million deductibility cap is hit. For purposes of our discussion here, we assume use of a “salary-first” approach, whereby salary and bonus are factored in before equity compensation. With Company ABC above, for example, we assume the covered employees earn over $1 million in base and bonus such that none of their equity compensation is deductible. Companies with lower base and bonus levels—or that use something other than the salary-first approach—will have a different outcome.

Where We Go from Here

So what do we do now? The good news is that you don’t need to restate any prior periods. The SEC released Staff Accounting Bulletin (SAB) 118 in December 2017 specifically to allow for situations where a provisional tax adjustment—or even no tax adjustment—is recorded due to uncertainty. In SAB 118, the SEC did suggest disclosing any such areas of uncertainty which might result in an adjustment once the necessary information becomes available.

Even so, 162(m) compliance was hard enough to begin with thanks to the grant-by-grant tracking that’s needed for any covered employees with non-equity compensation near or below $1 million. Now that TCJA has introduced even more complexity, here’s what needs to happen to help stay compliant with 162(m).

1. Perform a thorough review of award agreements and employment agreements. Determine whether they include discretion that may preclude grandfathering. Keep in mind that there may be partial deductibility if negative discretion contains a floor. Also consider other terms of any agreements, as renewals may in some cases constitute a material modification. This analysis is usually spearheaded by the legal team, but will of course liaise closely with HR/executive compensation, tax, and accounting.

2. Consider whether any material modifications have occurred. A “material modification” is an amendment to increase the amount of compensation payable, including an amendment that accelerates the payment without a discount for the time value of money. A material modification would also preclude grandfathering. This is particularly important for any new covered employees (mostly likely the CFO). A material modification to awards that were originally granted before November 2, 2017, when they were not covered employees, could eliminate deductibility because they are now a covered employee. Example 4 in the IRS Notice describes this case.

3. Write down DTA balances as necessary. Before the TCJA, many companies already had ways to handle 162(m) deductibility limits. If base salary and bonus were above the $1 million cap for a covered employee, any time-based equity awards would receive a tax rate of 0% when calculating DTAs. Now performance-based awards are added to the mix. In these cases where base and bonus exceed the $1 million cap, simply use a tax rate of 0% on all awards.

For covered employees with non-equity compensation under $1 million, the process is more complicated. If equity awards are partially deductible, the first step is to determine how much of the $1 million cap is available after considering base salary, bonus, and other compensation. You should calculate the available deduction separately for each year in the future since it will likely change as salary and other elements of compensation fluctuate. Remember that covered employees will accumulate over time because the TCJA introduced the “once a covered employee, always a covered employee” principle. That means the pool of employees with deductibility limits will grow over time.

The next step is to predict which awards will settle in each year. Time-based restricted shares are the easiest since they generally settle on the vest date. Predicting stock option exercises or the final payout of a performance award can be more difficult, and these are exactly the types of performance-based compensation that are no longer uncapped under 162(m). Therefore, start with the most predictable awards and layer in less predictable awards until the $1 million cap is reached.

Finally, use your year-by-year, award-by-award waterfall to apply tax rates that represent the expected deduction from each award. This may lead to different tax rates for tranches of the same award. If this year’s tranche is expected to be fully deductible, it gets the full statutory tax rate; if next year’s tranche is only expected to be partially deductible because of an increase in salary, it gets a lower tax rate. Managing a complex waterfall and tranche-level tax rates may require a more flexible reporting process. Applying a flat tax rate to gross expense figures simply won’t produce an accurate DTA balance.

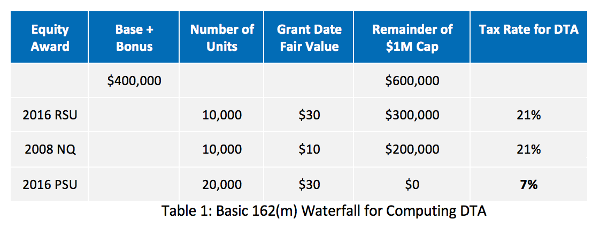

Consider the following example of a company analyzing its outstanding equity awards for one covered employee. Let’s assume no equity awards have settled yet in the year, and base salary plus bonus is $400,000, which leaves $600,000 remaining under the 162(m) cap. The employee has three awards expected to trigger a taxable event in the year: 10,000 time-based restricted stock units; 10,000 soon-to-expire stock options; and 10,000 performance-based stock units which are tracking to pay out at the 200% maximum (Table 1).

While the total expense value would suggest a gross tax deduction of $600,000 for the performance-based units ($30 * 20,000), the company can only deduct $200,000 under 162(m) after considering the restricted stock units and stock options. DTA should be built up accordingly. Since one-third of the value of the performance-based award is expected to be deductible, one-third of the DTA should be recorded, or a tax rate of 7%.

4. Regularly forecast excess tax benefits. For companies where all covered employees hit the $1 million cap between base salary and bonus, the ongoing process is simple: Apply a 0% tax rate when calculating DTAs for covered employees’ equity awards.

However, things get much trickier for covered employees under $1 million in non-equity compensation. This is because the available deduction for the remainder of the year is constantly changing. Under US GAAP, DTA is built up based on an award’s expense, which is a function of the grant-date fair value (barring awards with a variable fair value). However, it’s the taxable income at vest that’s being deducted on the tax return. So whenever shares settle, you need to calculate the taxable income and reassess the available deduction under the $1 million cap. As a result, it’s quite possible to have a mismatch between the DTA on the books (built from a hypothetical deduction at the grant-date fair value) and the true deduction that will be available (considering share price fluctuations).

If stock prices go up (leading to excess tax benefits), you’ll need to reduce the tax rate for unsettled shares to reflect the shrinking amount under the $1 million cap. If stock prices go down (creating tax deficiencies), you’ll need to increase the tax rate for those shares.

Other complications are option exercises that can occur sooner (or later) than expected and performance awards that can pay out at higher (or lower) amounts than expected. Layering these into the waterfall of expected future deductions makes having a robust process even more critical.

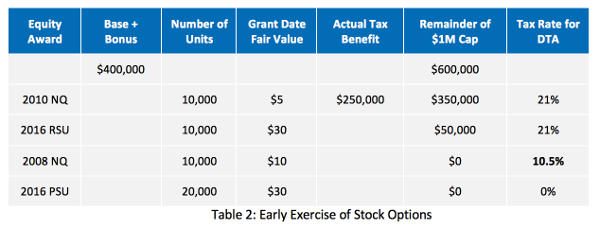

Let’s revisit our basic example from above. Imagine now that a 2010 stock option award with a lower strike price unexpectedly exercises early in the year, before any of the other expected settlements. The stock price on exercise date is $40 and the strike price for the 10,000 units is $15, creating a tax benefit of $250,000. Immediately the DTA is overstated for other awards because there will not be space under the $1 million cap for their full value to be deducted. Therefore, the applied tax rate for each award needs to be reassessed (Table 2).

The performance-based award is no longer expected to result in any deduction. The 2008 stock options are expected to be half-deductible based on $50,000 remaining under the cap and an expense value of $100,000 ($10 * 10,000). Of course, as time passes, estimating the portion of an award that will be deductible shouldn’t rely solely on the upfront grant-date fair value, but instead a real-time assessment of the expected realizable value. The DTA will not exactly mark to market as it does under IFRS, but it will need to consider a number of factors.

While it’s impossible to predict every change in share price, option exercise, and performance factor, thoughtful forecasting can be a powerful tool. Best practices include modeling the impact of different stock price scenarios and applying behavior-based exercise assumptions. Cutting-edge tax groups are then blending the results of their tax settlement forecasting with the effect of actual settlements to construct dynamic, actionable dashboards. Even before Notice 2018-68, our most recent survey of accounting best practices found that 61% of respondents are utilizing tax settlement forecasting. We expect this number to continue to rise.

Concluding Thoughts

Worth noting is that the discussion above applies only to awards that have accounting grant dates before November 2, 2017. Example 8 of the notice clarifies that if the compensation committee didn’t approve an award (which is generally a condition of having an accounting grant date), then it’s not grandfathered in—even if an employment agreement stipulates a granting of shares.

With so much to consider, remember that 162(m) only applies to covered employees. You can hand out as much performance and non-performance compensation you want to non-covered employees and everything remains deductible.

Also, if there’s one silver lining in the updates to 162(m), it’s that it makes award agreements easier to draft. No longer must companies include umbrella or gateway goals simply for tax compliance, nor gain shareholder approval before running out of a share pool, nor force goals to be set within 90 days of the performance period start even when the forecast models aren’t locked down until day 100.

We’ve focused our attention here on how 162(m) affects equity compensation awards. For more about 162(m), check out Mike Melbinger’s blog at Winston & Strawn.