Don’t Overlook the Item 402(x) Disclosures Under the SEC’s New 10b5-1 Rules

This time last year, the SEC adopted new and amended rules regarding insider trading arrangements and disclosures. The updates garnering the most headlines pertain to Rule 10b5-1 of the Securities Exchange Act of 1934, particularly around 10b5-1 plans, and updated requirements for Form 4 and 5 filings.

But there’s another aspect of the rule update that can be easy to miss since the situation comes up less frequently. The SEC also added Item 402(x) to Regulation S-K, which requires disclosure of option grants awarded close in time to the release of material nonpublic information (MNPI).

Item 402(x) disclosures have arisen to address concerns of opportunistically timed option grants. For example, if a company were to issue an option with a low strike price just before releasing an 8-K with positive news, that would immediately push the stock price up. In this sense, the new rule finds itself tied to the backdating scandals of the late 1990s and early 2000s. The difference is that this time, the SEC is concerned with mere opportunistic—or even coincidental—timing, not outright cheating. The disclosure is also a close cousin to Staff Accounting Bulletin No. 120 (SAB 120), which deals with financial reporting for “spring-loaded” awards.

The updated rules were effective as of February 27, 2023, and the Item 402(x) disclosure will be required for fiscal years beginning on or after April 1, 2023 (with an additional six-month deferral for smaller reporting companies). That means companies with a March 31 fiscal year will be the first issuers reporting this disclosure, and it’s coming up in their 2024 proxy statements.

In this article, we’ll break down what this new disclosure requires and provide some insights into how issuers can navigate its implications during the coming fiscal years.

What is Item 402(x) of Regulation S-K and what does it require?

The Item 402(x) disclosures have two elements: narrative and tabular. The goal of both elements is to give investors insight into the company’s policies and practices regarding option grants issued in close proximity to the release of MNPI.

Narrative disclosure: Companies must disclose their policies and practices on the timing of option grants in relation to when MNPI is released. (Technically, the rules also cover “option-like instruments” such as SARs, but we will simply use “options” as shorthand in this article.)

This narrative disclosure must include how the board determines when to grant such awards, whether and how the board or compensation committee weighs MNPI when determining timing, and whether the company has timed MNPI disclosures for the purpose of affecting executive compensation.

Tabular disclosure: While the narrative disclosure may end up looking similar for many companies—at least those that follow typical best practices—the rule also requires a tabular disclosure that will provide objective and standardized data regarding option grants issued in close proximity to a release of MNPI.

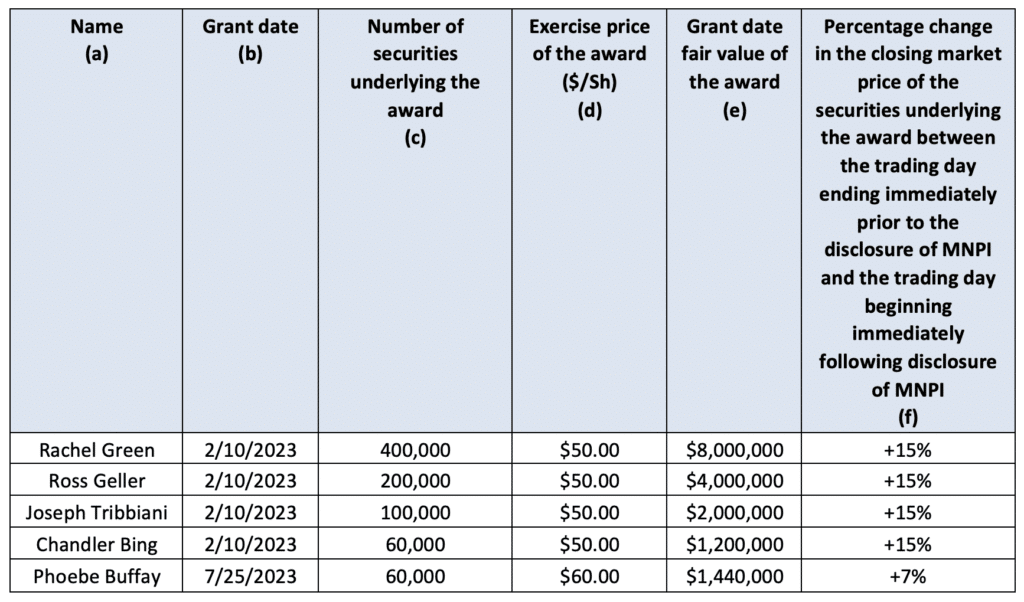

The table covers any option grants issued to named executive officers (NEOs) within four business days before or one business day after the release of a Form 10-Q, 10-K, or 8-K that discloses MNPI. For simplicity, we’ll refer to the grant timing requirement from Item 402(x) as the “four-and-one window.” When option awards are issued during the four-and-one window, the issuer is required to disclose various details on the terms of each individual grant. These include the grant date, the size of the grant, and ultimately the percentage change in the closing stock price between the trading days preceding and following the release of MNPI.

Below is a mockup illustrating how the table may look. It reflects a hypothetical case where the annual grant occurs near the time of the 10-K filing and an NEO receives a new-hire grant near the time of another release of MNPI.

What can you do now to prepare?

In most cases, the best way for companies to comply with the Item 402(x) disclosure is to avoid the need for the tabular disclosure in the first place. While the narrative portion is required no matter what, no table is required if no grants would fall into its scope.

Thus, by ensuring that the standard granting calendar doesn’t fall into a four-and-one window, companies can avoid the most onerous (and scrutinized) part of the disclosure. The best part of this solution is that it’s not a workaround or a loophole. If a company is granting outside of that window, then that company is doing the right thing in avoiding even the appearance of the opportunistic granting that the SEC is trying to shed light on.

Beyond being a solid compliance strategy, following a preset and thoughtful grant calendar is also simply a governance best practice. In our experience, the vast majority of companies follow this sort of practice—we expect that many companies won’t have to change anything about their schedule at all, and many others will need only small changes to an existing schedule. For those companies without existing procedures and schedules, such as some newly public companies, Item 402(x) creates one more reason to quickly get on board with best practices.

While a bit of thoughtful scheduling will get most companies where they need to go, there remain a few additional open questions or trickier areas to manage.

The first has to do with off-cycle grants, such as new hire or retention grants. Since these may tie to employment start dates, it may be less straightforward to avoid timing that falls in the four-and-one window. While the rule avoids circularity by excluding disclosure of the executive option grant from the type of 8-K MNPI triggering a four-and-one window, times of executive turnover may be particularly volatile and involve more frequent disclosure of other MNPI. One solution to these situations, when workable, would be to make the new hire grant official at the next prescheduled date following the start of employment instead of on the start date itself.

The second area has to do with the relationship between this Item 402(x) disclosure and SAB 120. There are key differences between the two, but we expect best practices to evolve to kill two birds with one stone. One important difference is that Item 402(x) clearly keys on options and option-like instruments, whereas SAB 120 covers all equity grants. Another difference is that Item 402(x) has the explicit four-and-one rule, whereas SAB 120 has no bright line—and therefore may incorporate wider windows. The best strategy will be one that avoids triggering consequences under either rule.

Parting thoughts

Item 402(x) is yet another piece of the expansion of compensation disclosures that has been a theme of the SEC’s in recent years. As such things go, however, this one is relatively painless. The disclosure is easy to minimize without overhauling compensation programs that already work well. It doesn’t tie companies’ hands, so if a grant in the four-and-one window is unavoidable, the table is simple to complete and the narrative disclosure can provide the needed context.

But making the disclosure painless in practice requires being on top of it in advance. For calendar year companies who won’t disclose until their 2025 proxy, the 2024 option grants will be the first ones affected. That means that now is the time to plan properly for next year’s grants to avoid inadvertently triggering the disclosure in year one.

If you would like to discuss your specific case or have any questions on this or related topics that you would like to unpack, please contact us or your Equity Methods consultant.