Equity Methods Tops Client Satisfaction Ratings in Stock Compensation Reporting for Four Consecutive Years

“Intelligent and responsive.”

“Class act organization.”

“Equity Methods is a premier service provider company. Amazing professionals who are incredibly intelligent and always willing to help solve a problem. Without any hesitation, I highly recommend them above all their competitors.”

This is just some of the latest feedback that analyst firm Group Five gathered from clients of our financial reporting services.

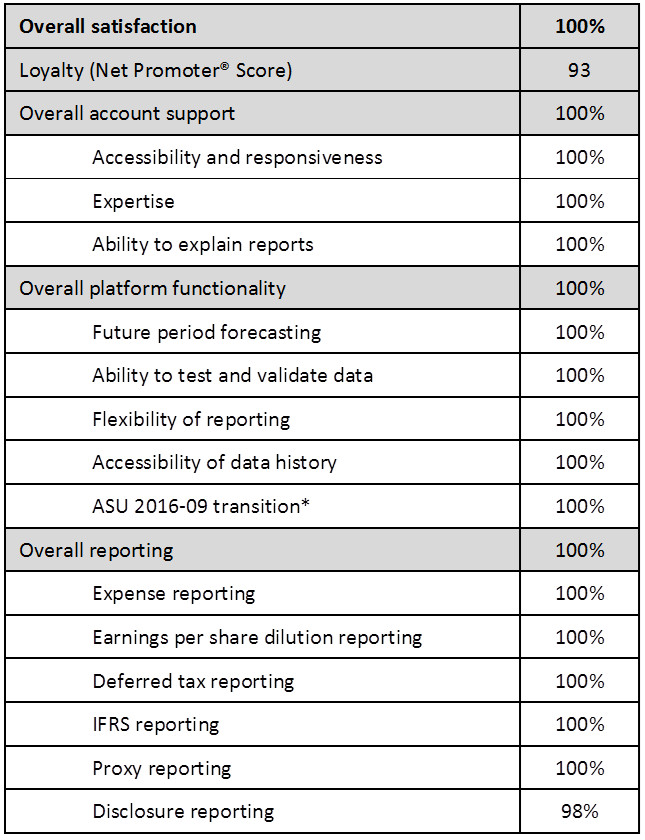

Group Five’s stock plan administration benchmarking report for 2017 is complete. And for the fourth year in a row, Equity Methods tops the list in client satisfaction. Once again, we earned an overall client satisfaction rating of 100% favorable. Our Net Promoter Score is 93 versus the industry average of 48.

Here’s the breakdown:

How do we do it? By being different. We bring automation and process control via technology, but at the same time every single Equity Methods consultant is deeply expert in accounting and finance. We go the distance for our clients by collaborating on their toughest problems, reducing friction in service delivery, and delivering our work product in plain everyday English.

In that spirit, every year at this time, I review topics that are top of mind in the field of stock compensation accounting. This time, I’d like to begin with some trends I’m seeing within our clients’ environments—namely, the exceptional pressures and expectations they face, which I think will change how companies work with service providers.

“The CFO needs it yesterday…”

Information is moving at an increasing velocity. Our clients are devoting more energy to satisfying internal requests for analytics, what-if analyses, and variance explanations. The questions are generally something like, “What if we divested business unit ABC?” or “What if the stock price fell by 15%?” Finance leaders abhor surprises, which is prompting more detailed analytics, forecasting, variance analysis, and more flavors of management accounting than I’ve ever seen before. Not only are the needs greater, but the time demands are also stricter.

We’ve responded by investing in two capabilities. First, we continue to design faster and more flexible algorithms so that we can pivot quickly when novel requests arise. We’ve explored technologies like Hadoop while continuing to refactor algorithms to be faster and more flexible. Second, our team of professionals is the best it’s ever been. I’m personally so proud of the six consultants we recently promoted this past August. The expertise they’ve acquired enables them to ask better questions and size up unusual requests quicker, giving them a critical edge as they design a solution.

Flexibility and adaptability

As both information and time demands intensify, I increasingly think the classic client-vendor model is outdated. Many use terms like “partner” and “trusted advisor,” which are fine, but I’d like to introduce a more specific idea: Our clients need us to behave as extensions of their teams.

This changes the entire dynamic. Think about what great team members do. They adapt to curveballs, pick up the phone at 7:20 pm when there’s an urgent need, and take personal responsibility for a project’s outcome. They go where they’re needed. Procurement departments love their service level agreements (SLAs), and they’re well-intended, but even SLAs are too rigid for a dynamic world where needs are constantly changing and the only winning formula is flexibility. This is what we aspire to deliver to our clients.

Automation

The cry from CFOs and CAOs for more automation is eternal, but still worth mentioning. Our mission is to deliver a customized yet automated solution for our clients’ stock-based financial reporting. When we ask what attributes their executive leadership find most valuable, our clients often say that it’s peace of mind from knowing there’s one less manual, person-dependent, spreadsheet-based process.

The push to automate continues for many reasons. First, audits of internal control over financial reporting (ICFR) are becoming more detailed. Second, many companies have felt the difficult consequences of turnover—namely, the transfer of ownership over a highly manual process. Finally, if information demands are intensifying, an automated process is the way to handle them.

Integration across functions

ASU 2016-09 is having a profound effect. We predicted that the removal of the APIC pool will, on balance, create more complexity. Recently, we worked with Bloomberg on an article about how Fortune 500 companies are witnessing drastic fluctuations in their effective tax rates due to ASU 2016-09. We’re seeing the same thing in our client work, as well as much more P&L volatility because excess tax benefits and windfalls are no longer buried in APIC. All in all, you can expect auditors to devote much more scrutiny to the deferred tax accounting for equity awards. This means corporate accounting and tax teams will be better off with more integrated (and automated) processes.

Another area where team integration matters is between compensation and corporate accounting. It’s no secret that TSR awards can inadvertently trigger major surprises in the proxy. Always model TSR costs before locking down the terms of a grant. This way, you’ll know about potential problems before they become unsolvable.

Much More to Come

We’re grateful to the many Equity Methods clients who generously gave their time to complete the Group Five survey. And, as always, thank you for your feedback.

- Read the summary report to learn more about this year’s results.

- Visit the knowledge center for more on the above topics.

Tell us about any other topics you’d like to see us cover.

Don’t miss another topic! Get insights about HR advisory, financial reporting, and valuation directly via email:

subscribe