Equity Strategy Amid Market Volatility: Survey Insights

Last month, we hosted a webcast about market volatility and equity compensation. The discussion centered on the effect on equity compensation from macroeconomic trends like inflation and stock market declines, and how they intersect with the still-tight labor market.

During the discussion, we polled attendees on their views about equity compensation in the current environment. We focused our analysis on what the issuers in our audience (roughly 120 attendees representing 107 companies) had to say. Here’s what we learned.

* * *

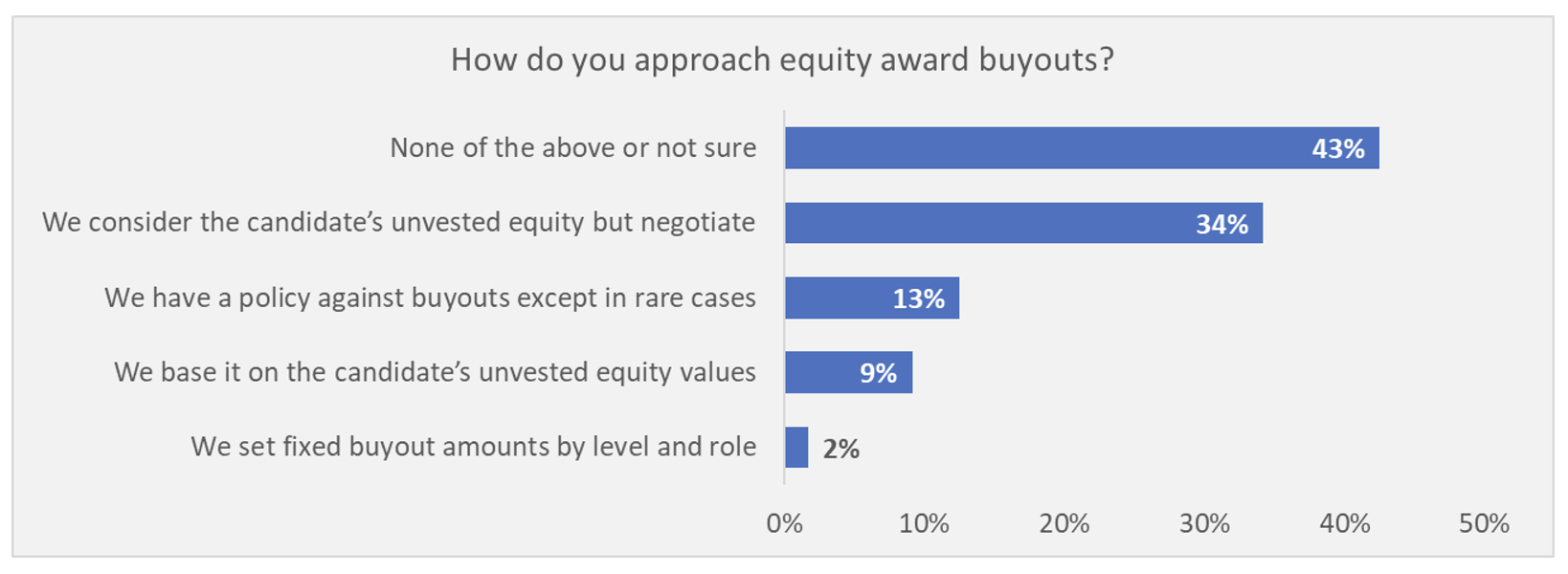

Our first question was about equity award buyouts. When a job candidate faces forfeiture of equity in their old company, how does the new company propose to make them whole?

The results reveal no hard-and-fast rules. Some companies never do buyouts (13%). Others mechanically match the forfeited amount (9%) or have fixed buyouts for a role (2%). But larger than those groups combined, more than a third simply use the buyout as a negotiation point.

This approach makes sense when you consider the value proposition of a job. It’s often a mix of nonmonetary features like role, location, and team culture plus monetary features like base pay, bonus, and equity. Candidates holistically weigh what they would give up at one organization against what they gain in the other, and a buyout is just one piece of that picture. As a result, multiple strategies—or a flexible strategy—can position a company to win.

* * *

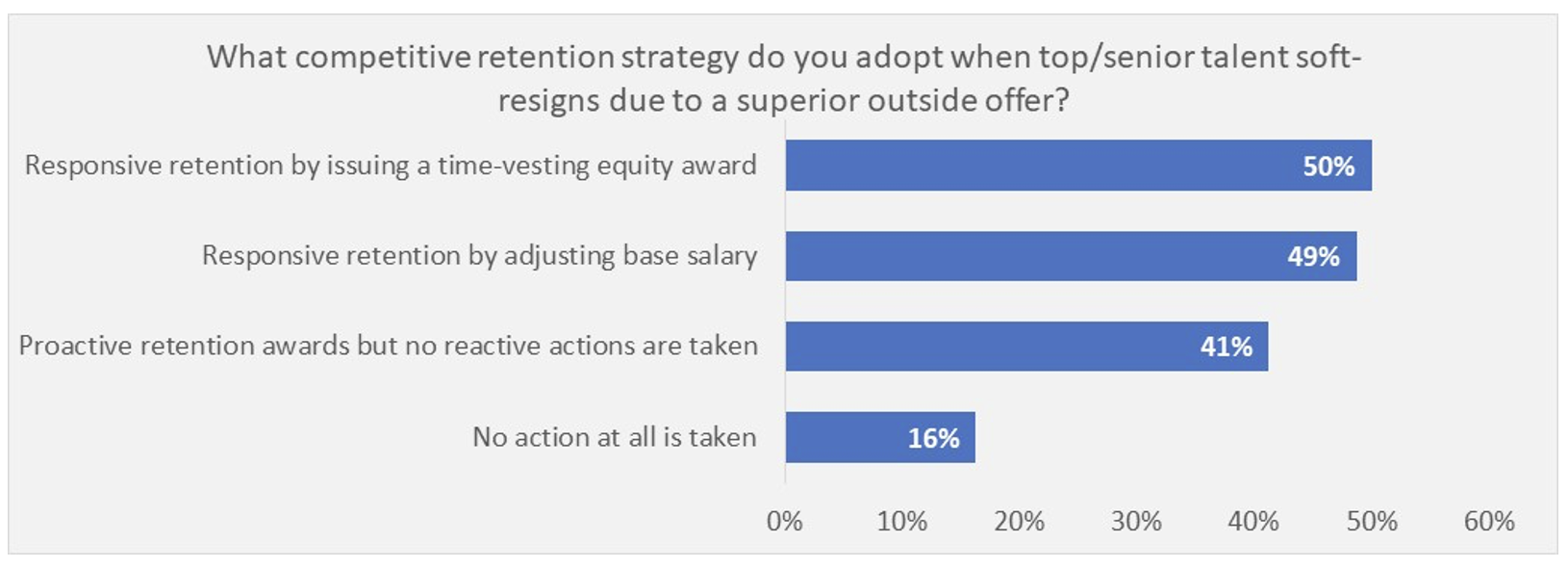

Next, we asked our audience how their company handles “soft resignations,” when a key person brings an outside offer to the table and indicates they’re open to a counteroffer.

Only 16% report that they do nothing at all. (In our experience, this is often the case with mission-driven organizations where compensation isn’t a primary lever to begin with, or companies with more formulaic pay structures that do not allow meaningful deviation.) Between 40% and 50% of companies say they counteroffer with a base salary adjustment, counteroffer with a special equity award, or grant proactive retention awards to key talent. This is consistent with what we’ve seen over the last two years as many companies have pulled out all the stops to attract and retain talent.

* * *

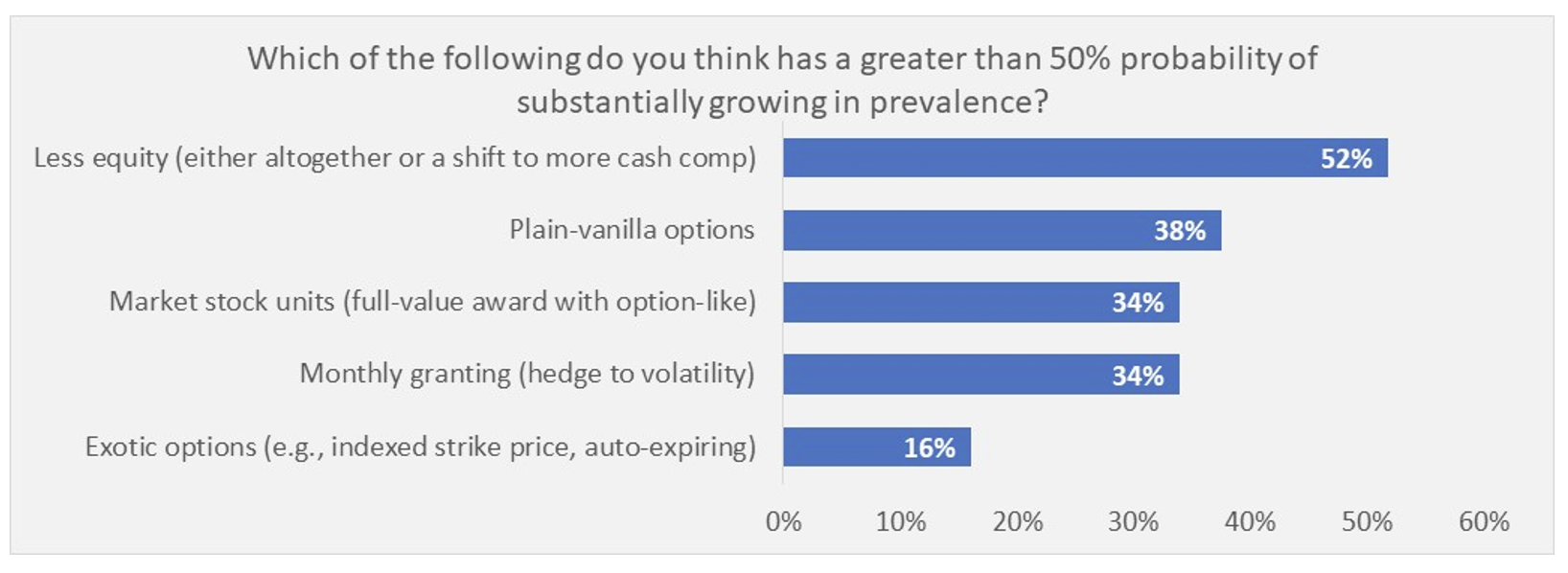

The third and final question was forward-looking. We wanted to know how our audience expected equity practices to evolve.

More than half expect less equity to be granted in the future. While surprising at first glance, this likely means a return to normal. Equity usage has surged in the last one or two years, an unsustainable trend for some companies given limited share pools.

Some respondents expect to see more plain vanilla options (38%) or market stock units (34%). Either type of instrument is more leveraged than RSUs, with more downside risk and upside potential. This leverage can be highly motivating in a down market because the rewards of a recovery tend to be greater.

Another 34% expect granting to occur monthly rather than annually. The aim is to hedge against issuing grants at an especially high or low point in a volatile cycle. This practice is currently rare but may become more prevalent as companies look for ways to manage market challenges.

Only 16% of our audience expect indexed options or other exotic instruments to take hold. It’s more likely that companies will get creative with the tools they have, rather than swap them for entirely new ones that may come with their own unknown challenges.

* * *

After a decade-long bull market and the chaotic novelty of 2020-21, the market is experiencing a downturn that may last for the foreseeable future. This new phase, like the last two, will require responsive equity strategy. Balancing the needs of attracting and retaining talent on one hand with shareholder interests on the other is tricky in the best of times, but especially so in a down market. We’ll continue to report our thoughts and insights here in the Knowledge Center as our clients’ practices evolve. If you would like to discuss your particular situation, please contact us.