Get Ahead of the EU Pay Transparency Directive

In 2023, the European Union approved the Pay Transparency Directive, which aims to close gender pay gaps by introducing minimum requirements for mandatory pay gap reporting and transparency. Each of the 27 EU member states must translate these requirements into law and implement them on or before June 2026. This might seem like a while away, but given the number of countries involved and the potential complexity in how each EU member country chooses to implement the directive, it’s essential for companies with employees in the EU to start getting ready now.

Many of the directive’s requirements echo mandatory pay gap reporting rules in the United Kingdom. However, the UK’s framework has been criticized for lacking an enforcement mechanism and prioritizing measurement over results. The Pay Transparency Directive attempts to address these by requiring companies to take action when pay inequities are identified. For example, if a gender pay gap of at least 5% is determined for any employee group, the company will have to either explain the reason for the gap or close the gap within six months. Otherwise, if these steps are not taken, the company will have to perform a joint pay assessment and develop an action plan with worker representatives.

As part of this assessment, employees who are identified to have sustained damages due to unequal pay have the right to claim and obtain full compensation (including full recovery of salary, bonuses, and compensation for lost opportunities). Additionally, companies carry the burden of proof in cases where direct or indirect pay discrimination is found. These have raised the stakes for compliance with the EU directive.

An important analytical tool will be the use of multivariate regression, which can help explain pay gaps in a gender-neutral manner. If such gaps can be appropriately explained, this will allow companies to avoid (or mitigate) the disclosure and damages risks associated with breaching the 5% watermark in the EU rule.

In the rest of this article, we’ll provide an overview of the directive’s requirements and discuss five steps HR and compensation leaders can take to stay ahead.

Overview of the Directive Requirements

Mandatory Pay Gap Reporting

The directive’s mandatory pay gap requirements focus on basic statistics that compare the average and median pay differences between male and female employees. Here’s a roundup of what companies need to provide:

- Average gender pay gap (average total pay for females divided by average total pay for males)

- Median gender pay gap (median total pay for females divided by median total pay for males)

- Average gender pay gap in “complementary and variable” pay components (same as (1), but only captures variable pay such as bonuses, overtime, and allowances)

- Median gender pay gap in variable pay components (same as (2), but only captures variable pay elements)

- Proportion of female and male workers receiving variable pay

- Proportion of female and male workers in each quartile pay band

- Gender pay gap by category of workers (this is one of the most important aspects of the reporting and is discussed further in the Joint Pay Assessment section below)

Results will be made available to employees, workers’ representatives, and other government entities. These stakeholders will have the right to ask for details regarding the statistics provided. Additionally, the appropriate government body will make the results publicly available to allow for a comparison of results. While not required, companies may also choose to publish the results on their website or in management reports.

The wide availability of pay gap reporting results creates reputational risk and may trigger certain compliance measures or other penalties if gender pay gap figures are significantly high (more than 5%). This means a system of controls is necessary to ensure the calculations are performed correctly and accurately. (This is an area where we’ve helped many companies design and implement repeatable and automated reporting processes for reporting required statistics.)

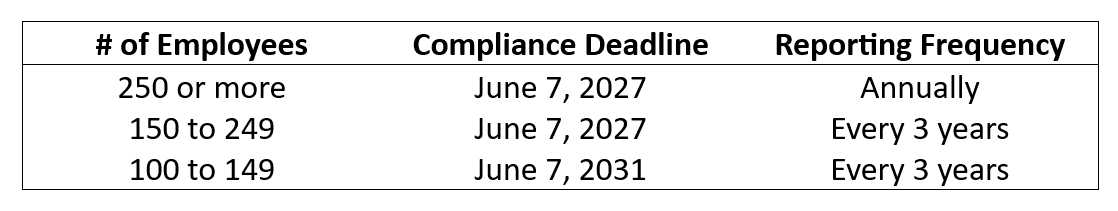

The reporting timelines and frequency for the above requirements vary depending on the size of the employee population, as the following table shows.

There’s no immediate obligation for companies with fewer than 100 employees to comply with the directive. That said, EU member states may choose to require pay gap reporting even from smaller companies. We’ll flag EU countries where this is the case as we continue to monitor developments.

A Gender-Neutral Pay Structure

Under the Pay Transparency Directive, EU member states must require employers to have pay structures in place ensuring “equal pay for equal work or work of equal value.” The directive doesn’t specifically say how companies should assign a value to each job. Instead, it provides a subjective framework for basing each job’s value on skill, effort, responsibility, working conditions, and any other relevant gender-neutral factors specific to the job or position. These gender-neutral factors may include tenure, level of experience performing the job, performance or competence in the role, specialized training or certification relevant to the job, among others.

These principles are very similar to the “equal pay for substantially similar work” framework in the United States. They may seem theoretical, but the directive has created a more practical application. That is, if there’s a gender pay gap of at least 5% for any category of workers, and this gap cannot be explained by gender-neutral factors—or isn’t remediated within six months—it will trigger a joint pay assessment. Companies would almost certainly want to avoid this outcome, which means that a thoughtful approach towards identifying groups of comparable employees is critical.

When we help companies perform a pay equity audit, one of the most important steps is collaborating with management to create a framework to assess which employees perform comparable work. This isn’t always straightforward. A framework that works well for employees of an entity operating in Country A may need to be tweaked or overhauled for Countries B, C, and D because of differences in the organization structure, labor market, or something else. A thoughtful and customized approach toward employee grouping is critical to ensure that the analysis yields robust outcomes.

Joint Pay Assessment

As mentioned above, a company with more than 100 employees in a particular EU country has to conduct a joint pay assessment when all of the following apply:

- The average gender pay gap is at least 5% in any worker category

- The employer hasn’t justified the pay gap based on gender-neutral criteria

- The employer hasn’t remedied the unjustified pay gap within six months of report submission

When a joint pay assessment is triggered, companies will have to analyze and disclose the following information:

- Proportion of female and male employees for each category of workers

- Average female and male employee pay levels and variable pay amounts for each category of workers

- Any differences in average pay levels between female and male employees in each category of workers

- Reasons such differences in average pay levels are based on objective, gender-neutral criteria (if any), as established jointly by the workers’ representatives and the employer

- Proportion of female and male workers who benefited from any improvement in pay following their return from parental leave or carer’s leave, if such improvement occurred in the relevant category of workers during the period in which the leave was taken

- Measures to address differences in pay if they aren’t justified based on objective, gender-neutral criteria

- An evaluation of the effectiveness of measures from previous joint pay assessments.

Pay and Career Progression Transparency

Besides ensuring pay equity, the EU directive aims to improve pay transparency. To this end, it mandates that companies provide information about pay ranges, use gender-neutral job titles in job postings, and give employees access to the criteria used to determine pay, pay levels, and pay progress.

Employees also have a right to request certain pay information, such as the average pay by gender for employees in their group who perform work of equal value. The company will need to provide this information to the requesting employee in writing within two months.

Additionally, companies may not ask applicants about their pay history. Those familiar with the US regulatory landscape will notice many similarities with the recent slew of pay transparency requirements and salary history bans implemented by states such as New York, California, and Colorado.

Five Steps to Get Ahead of the Curve

As noted in the timeline above, covered companies have time to comply with the Pay Transparency Directive’s requirements. Nonetheless, given the risks involved, there’s a tremendous benefit to starting early and making an action plan. Here’s a five-step plan for companies to get ahead of the curve.

1. Collect all relevant HR data and pay information.

Do this early so you have time to ensure that the HRIS systems contain all the information needed to perform the calculation. We regularly work with companies on these types of “big data” projects, and the global data collection and cleanup involved can be a surprisingly significant undertaking.

To kick the tires in the data collection process, consider starting with a country the team is most familiar with. (For many global companies headquartered in the US, this will be US data even though it’s outside the EU.) From there, cascade the data collection to one or two additional countries to understand the differences in data between them. For example, countries may have different ways of categorizing workers or dealing with variable pay components and benefits.

To manage the complexities involved, establish a cross-functional group of internal stakeholders who are familiar with the compensation data. At the same time, engage an outside consultant for practical implementation strategies as well as outside counsel for guidance on the legal landscape.

2. Run a pilot test of the required gender pay gap calculations.

The next step is running collected data through the mandatory gender pay gap reporting calculation. The statistics that need to be reported are fairly straightforward. Still, there are nuances involved in determining which parts of the data are included or excluded in certain calculations. Additionally, as we mentioned, there’s the challenge of establishing a framework to identify employees with jobs of equal value.

As with data collection, we recommend a phased approach. Pilot the calculation for one country only, then cascade it to one or two additional countries at a time. This way, you’ll be able to iron out any wrinkles in the process as they appear.

The outcome of this process is a set of gender pay gap results, both at an aggregate level as well as for each category of workers. For any employee group with a gender pay gap of at least 5%, it will be important to identify whether there are valid reasons that explain the significant gap. If so, you’ll need to provide gender-neutral factors that drive the observed gender pay gap. Otherwise, you’ll need to adjust the pay of disadvantaged employees to correct the gap. This can become a challenging manual process depending both on the number of employee groups that need to be evaluated and the number of employees involved.

3. Perform a statistically robust pay equity audit.

A statistical regression-based pay equity analysis isn’t technically required to comply with the EU directive. Still, it can be beneficial, especially if pay gaps of at least 5% exist. The directive states that a company can justify pay gaps using objective, gender-neutral criteria. Simple average or median pay gap calculations don’t account for these factors, but a regression model can.

One of the core outcomes of a pay equity audit is to identify employees whose pay differs most from what the model predicts (these are also referred to as outlier employees). In other words, statistical modeling is used to flag individual employees who appear to be underpaid compared to their peers. Without statistical modeling, the alternative would be to manually sift through hundreds, if not thousands, of individual employees to assess whether they’re paid equitably. This is simply not feasible for companies with large employee populations.

When we help our clients with pay equity audits, we provide a tool with a list of employees who have large pay disparities for further forensic review by the company. A common question is why manual review is still required. The short answer is that while statistical modeling can point to potential issues, ultimately the data is a simplification of true employment and pay situations. In our experience, there are numerous gender-neutral factors that can explain pay differences, but aren’t captured in the data (and therefore cannot be accounted for in the statistical model).

Once the list of outlier employees is generated, the company may then involve a cross-functional group, including the compensation team in partnership with HR business partners or business unit executives, to review each outlier employee. A similar process will need to be developed to comply with the EU directive’s requirement.

To learn more about the various elements of a pay equity audit, request a copy of our pay equity FAQ booklet.

4. Analyze results and take corrective action if needed.

The best-case scenario is that no significant gender pay gaps are observed for any worker category (i.e., gender pay gaps are below 5%). In this situation, a joint pay assessment will not be triggered. However, this may still result in an outcome where the overall gender pay is significant. This can occur, for example, if more male employees are concentrated in higher-paying roles in the organization and more female employees comprise lower-paying, junior roles in the organization.

In this situation, the company can focus on improving the representation of females in higher-paying roles. This may involve reviewing hiring rates, retention rates, and promotion rates to identify bottlenecks that hinder career progression for female employees. An emerging best practice is to repurpose the pay equity analysis and apply similar statistical modeling techniques to determine if there are potential job classification, retention, or promotion disparities based on gender or other protected class categories.

Another possibility is that a gender pay gap of at least 5% appears for certain categories of workers, which isn’t unusual when pay gap calculations are based on simple average comparisons. In our experience, this outcome is often explained by:

- Data issues such as incorrect pay data or job title. Proposed action item: Obtain correct data from the hiring manager or HR business partner and update the information in the HRIS system

- Imprecisions in creating comparable employee groups. Proposed action item: Refine the approach of grouping employees that perform jobs of equal value

- Other gender-neutral criteria that isn’t accounted for in a simple average pay gap calculation. Proposed action item: Use the results of the most recently performed statistical pay equity audit and outlier review process (as discussed in step 3)

If an unexplained gender pay gap of at least 5% does appear among certain categories of workers, you’ll need to take steps to close the gap. Often, this will involve pay increases. To manage potential legal risks, work with counsel on the amount and timing of any pay adjustments.

5. Communicate results with senior leaders.

Complying with the EU directive can be a large-scale undertaking for global companies, particularly those with a significant presence in the EU. Between this reality and the associated legal and reputational risks, it’s essential to keep senior leaders and the board of directors apprised. Initially, this will require significant education and level setting to get everyone on the same page.

We recommend focusing on the following points during an initial briefing and while discussing the results of a trial run:

- Why is there a significant gender pay gap (if present)?

- When will the gap be resolved?

- What is the company’s philosophy for fixing pay gaps?

- What initiatives and action items have been developed or planned to close the gap?

- Where should the remediation budget come from?

As senior leaders get more familiar with the process, introduce them to the process and methodology, particularly if the results continue to show significant gender pay gaps. We recommend focusing on the following questions:

- How do the results compare to the prior run?

- What are the main factors driving the change?

- What categories of workers have a gender pay gap?

- How do we set realistic but ambitious improvement goals?

For more insights into communicating pay equity results to the board of directors, see our issue brief, “The Questions Boards Are Asking about Diversity, Equity, and Inclusion.”

Wrap-Up

Although the EU’s mandatory pay gap disclosure is still a few years down the road, many HR functions are starting to prepare now. An early start gives companies enough time to set up and refine the process while improving their internal pay equity efforts. Instead of viewing the Pay Transparency Directive as another box to check in the compliance routine, leading companies are thoughtfully weighing the new requirements as part of a cohesive global pay equity strategy.

As EU member states translate the directive into national law, we’ll monitor and share developments in this area. In the meantime, we’ll continue to partner with our clients and their legal counsel to set up internal processes to comply with the core requirements of the directive.

If you have any questions about the topics in this article or pay equity studies in general, please contact us.