Group Five 2024 Benchmarking Results Plus Our Take on What’s Ahead

It’s that time again! After a break in 2023, Group Five has published a new edition of its signature benchmark survey of equity compensation financial reporting service providers. This is the 10th time in a row that we received the industry’s highest client satisfaction and loyalty ratings.

As is our custom, we’re marking the occasion with a discussion of what we see as the key equity compensation financial reporting themes for the coming year.

In 2025, we expect:

- A broader spotlight on compensation

- More information, faster

- A potential IPO comeback

- A more quantitative proxy

- A shift in priorities under the Atkins SEC

More on each of these themes later. First, let’s review the study results.

*****

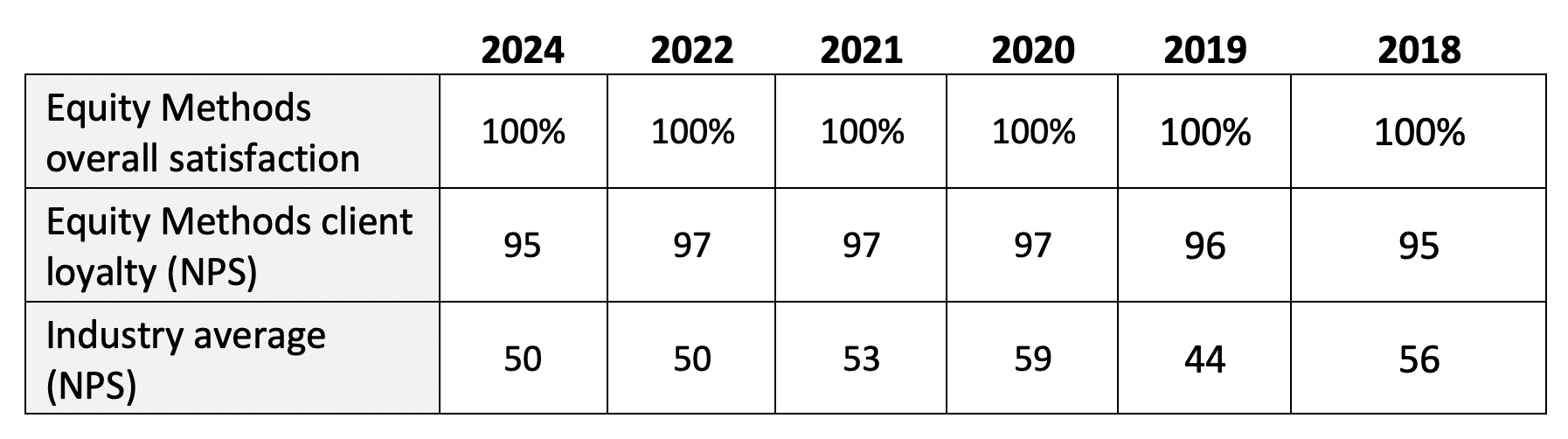

We’re honored to be recognized again with the industry’s top satisfaction and loyalty scores. Group Five uses the Net Promoter Score (NPS) to measure client loyalty—our NPS is 95, and the industry average is 50.

Equity Methods Overall Satisfaction and NPS vs. Industry Average

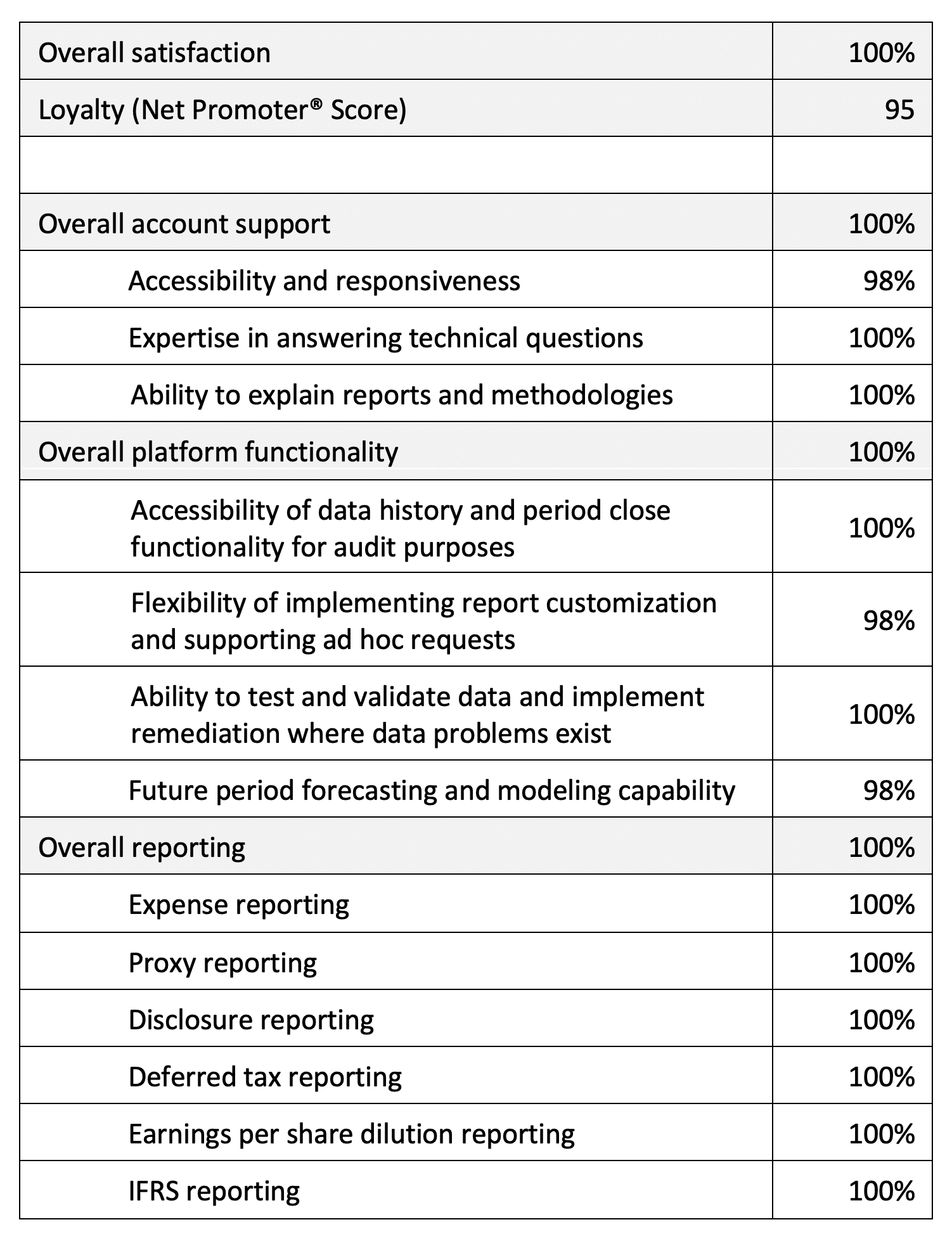

A Detailed Breakdown of the 2024 Results

Group Five’s analysis of respondent feedback reveals that client support is the biggest reason for our loyalty rating. We’re delighted. As hard as we work on reporting accuracy and state-of-the-art technology—two other frequently cited positives—we firmly believe that our values of plain language, empathy, and flexibility are cornerstones of authentic and high-impact client service.

Our clients and our ability to create real value for them are the “why” for doing what we do. Although our North Star is to continue innovating and evolving the way we do business, we love hearing comments like the following:

- “Equity Methods is always responsive to our needs and is always a willing collaborator in delivering better services to our customers.”

- “The Equity Methods team is always on time, accurate, professional, and great to work with. Couldn’t ask for a better partner to assist with our financial reporting.”

- “Equity Methods is very professional and knowledgeable regarding equity compensation, especially responsive, able to explain accounting matters and provide practical solutions, great to work with, and consistently delivers a great work product.”

- “Very professional and knowledgeable. They’re extremely responsive to requests and proactive on process improvements.”

- “We’re very satisfied with their professionalism and willingness to provide effective and customized services for our company’s needs.”

- “We’ve had a variety of complex issues over the past several years and they have become our go-to subject matter experts in helping us ensure we’re correctly accounting for equity compensation.”

I’d like to reiterate that we have the best clients and the best team members in the world. We’re in this together. Thank you all.

Now, let’s talk about our expectations for the new year.

Theme 1: A Broader Spotlight on Compensation

Executive compensation has never left the spotlight thanks to the Dodd-Frank Act, proxy advisor scrutiny, and institutional investors expanding their charters to drill more deeply into questions on stewardship and governance.

However, the spotlight is widening to include more specifics on executive compensation and how broad-based compensation—especially stock-based compensation, or SBC—is considered.

We follow the chatter among active investors (the kind who make frequent buy/sell decisions using financial statements and related data). Although most common in the technology, life sciences, and financial services industries, concerns about spiraling SBC expense and dilution are growing across market sectors. Of particular interest are metrics such as SBC as a fraction of revenue, number of employees, and EBITDA.

The typical pressure point is over-granting equity, especially if growth stalls and dilution becomes a drag on equity value. Investors are also interested in under-granting scenarios and whether the talent strategy can support the broader business strategy. The CHRO and CFO also need to determine how much more equity can (and should) be granted to best back up the organization’s scaling objectives.

Against that backdrop, on November 4, the Financial Accounting Standards Board (FASB) issued ASU 2024-03. This long-awaited ASU mandates detailed disaggregation of income statement expenses. Employee compensation, which includes SBC, must be separately disclosed for each expense caption. One-time employee termination benefits must also be disclosed separately.

It’s not lost on us that two of the six required disaggregations are compensation-related, and one of the six (depreciation, depletion, and amortization, or DD&A) is applicable only to oil and gas companies.

Investors are looking for more data and transparency in the income statement to better understand companies’ financial performance. ASU 2024-03’s focus on compensation is intended to address these concerns and reflects the reality that the modern organization is built on human capital. Yet, until this point, investors have had much less insight into human capital metrics than into traditional metrics such as capital expenditures and cash flow.

The rule is effective for annual reporting periods beginning after December 15, 2026, and interim periods beginning after December 15, 2027. Early adoption is allowed.

In our conversations with CFOs and CAOs, a recurring theme is that the finance function has the opportunity to not merely “report the news” but deliver an effective narrative around what’s happening in the “real” business they’re reporting on. The story matters. And when the market doesn’t understand the story, equity value suffers. ASU 2024-03 may have mechanical and operational challenges, but the storytelling dimension shouldn’t be forgotten.

For every piece of data shared externally, five pieces of data should be sliced and diced internally. This is to avoid releasing information that invites questions and scrutiny the company is ill-prepared to address—from trending and fluxes to scenario modeling and variance analysis.

The nature and scope of internal reporting will continue to escalate as market interest in SBC grows and ASU 2024-03 comes into effect. Leading companies will prioritize best-in-class processes that supply internal stakeholders with superior analytics (think granularity, visualization, and formatting flexibility).

How should you prepare for the compensation dimensions of ASU 2024-03? Here are three steps to get you started:

Assess your readiness. Mock up disclosures and identify operational weaknesses in compliance, if any. For instance, companies using high-level allocation ratios may want to use employee-level mapping to summarize expenses by each expense caption. If employee demographic tagging is unavailable in the reporting tool, you’ll need to work with HR to integrate the required data into the reporting function, allowing for more detailed expense tracking. By the end of your readiness assessment, you should know whether early adoption is desirable and internal processes can support it.

Evaluate internal reporting needs. Internal reporting must evolve to provide more detailed insights into variance analysis and forecasting/budgeting processes. Remember, the level of granularity available should vastly exceed that which is being reported externally. Otherwise, meaningful variance and what-if analyses become harder to do.

Communicate proactively. Make sure your investor relations team, in collaboration with other internal stakeholders, is prepared to communicate the impact of the disaggregated expenses and trend analysis. The aim is to avoid surprises down the road. We expect investors to draw inferences about future performance from how compensation costs are trending across P&L line items. For example, research tells us that compensation cost growth on the R&D line is associated with greater future performance than growth on the SG&A line.

Theme 2: More Information, Faster

As scrutiny of stock-based compensation intensifies, finance leaders are thinking about SBC information differently. Historically, the focus has been on accuracy and auditability, which prompts detailed Excel-based reports that are easy to tick and tie. While the need for accurate core data will never go away, it’s being overshadowed by a thirst for decision-useful information that answers critical business questions. Finance and HR leaders might want to know:

- Why expense went above or below forecast

- How the share pool would react if the share price changed by X%

- How a cost center’s expense would look over time if it were to consolidate with two other cost centers

- The effect that a positive or negative forfeiture variance would have on next year’s expense

- The American Rescue Plan’s implications for the tax deductibility of equity

Questions like these tend to be nuanced and specific to the organization. Working with some of the world’s largest companies and smaller organizations at the beginning of their scaling journey, we receive dozens of questions about the need for future visibility, predictive analytics, and scenario analysis.

Decision-useful information has a shelf life, so speed and retrievability are key. It also transcends departments. Imagine Controllership having access to a robust data analytics cube while their colleagues in Tax are stuck grinding through manual Excel workbooks. Not only is this inefficient, it prevents functions from working from a single, common source of truth.

Hence, companies prioritize maintaining consistent, interconnected, cross-functional information that’s both easily retrievable and usable to quickly answer what-if questions.

Theme 3: A Potential IPO Comeback

The IPO market has been slow for the last few years because of macroeconomic uncertainties. However, due to lower interest rates and a robust economic outlook, we expect the IPO window to reopen in 2025. Some brand names on the docket are Stripe, Klarna, StubHub, and SpaceX.

The rise of AI and other tech innovations has also led to a boom in startups, many of which have received several rounds of funding and are considering a public debut.

As companies gear up for an IPO, SBC becomes increasingly complex and critical for attracting and retaining key employees. On the Finance side, professionalizing SBC reporting processes must be an early priority. A sprawling, clunky SBC process can be a source of material weakness or runaway dilution due to weak governance of granting patterns.

Top challenges that pre-IPO companies face include:

Upgrading the stock administration system. Companies should look seriously at their stock administration system and determine whether it needs to be upgraded before an IPO. Many systems used in a private environment will be inadequate in delivering the required participant and executive experience.

Data accuracy and cleanup. This is especially important when transitioning administration systems but is still a necessary step even when the system isn’t being swapped. Once in the public eye, companies will receive heightened scrutiny from outside stakeholders around how award terms are captured in the data.

Compensation strategy and long-term incentive design. Some private companies shift from options to restricted stock units years before going public. Others wait until their IPO. Either way, it’s a good idea to do share pool modeling, adjust award terms to reflect good governance practices (e.g., double trigger termination provisions), and revisit equity eligibility. Many companies also launch an employee stock purchase plan (ESPP) at IPO and consider when and how to layer performance equity into their award mix.

Market awards will require companies to engage external experts to perform Monte Carlo simulations for fair value measurement. Additionally, a separate setup in the reporting process will be required to ensure these awards are correctly accounted for.

Since an ESPP would be entirely new to the IPO company, it’s crucial to establish a granting strategy, develop the best-fit plan, craft employee communication materials, and ensure an administration and a reporting solution are available and ready to go before launching.

Stock compensation accounting. The bar for stock compensation accounting is much higher for publicly held companies. As such, granularity, speed, and accuracy become mission-critical priorities—both to avoid a material weakness or misstatement and to arm finance leadership with best-in-class analytical capabilities.

There are immediate S-1 filing requirements for an IPO. Companies will need to carefully review the financials from the past three years and prepare executive compensation tables. They’ll also need to build out an end-to-end process for the entire equity pool and the broader base of internal stakeholders.

During this exercise, it’s important not to narrowly focus on SBC as an accounting or external reporting issue. Set up a solution that can work across different functions—such as Tax, FP&A, and the statutory reporting teams—and that will scale effectively as the company matures.

Theme 4: A More Quantitative Proxy

The pay vs. performance (PvP) disclosure required under Section 953(a) of the Dodd-Frank Act is now entering its third year.

Coming on the heels of other SEC rulemaking and commentary, PvP ratcheted up the complexity by introducing a mark-to-market framework for outstanding equity awards. With over 30 Compliance and Disclosure Interpretations (C&DIs), dozens of SEC comment letters on actual PvP disclosures, and complex mathematical calculations underlying the disclosure content, the rule operates much like an accounting standard.

2025 marks the first time for calendar year companies to show five years of results under the PvP rules. This extended period allows for a more comprehensive view of performance and compensation trends, highlighting volatility over time. It remains to be seen how and whether investors fold PvP disclosures into their proxy voting policies and shareholder engagement rubrics. Still, it’s hard to imagine they won’t consider PvP content now that we’re approaching the full five-year lookback window.

And that’s just PvP. Dodd-Frank clawbacks are also now online, and although they affect only a subset of companies (those that had a financial statement restatement), they’re drawing considerable attention. The disclosure requirements in the event of a clawback—or even cases where the restatement doesn’t actually trigger a clawback—are being closely scrutinized by the SEC and investors.

Errors and inconsistencies in proxy content are another area of focus. The footnotes to the various proxy tables require an intimate understanding of ASC 718 accounting principles in addition to interpretive SEC guidance.

Finally, we’re seeing litigation over information in the proxy. Earlier this year, Apple prevailed in its defense against the International Brotherhood of Teamsters pension fund. The plaintiff had alleged that Apple misled investors based on how it presented Tim Cook’s target equity award value vis-à-vis that award’s disclosure in the Summary Compensation Table.

If Apple’s proxy language had been slightly less precise and appropriate, it could have tipped the scale in the other direction. So, be careful about how you pair the numerical content in the proxy, which generally hinges on ASC 718 principles, with the narrative disclosure requirements.

Theme 5: A Shift in Priorities Under the Atkins SEC

It’s natural to wonder what changes may come from a new presidential administration.

We don’t believe the Trump administration will have a highly active SEC under Paul Atkins. Apart from prioritizing enforcement of new rules, we expect to see a middle-of-the-road agenda. It’s possible that the new SEC will focus on topics like cryptocurrency that have little to do with equity and executive compensation.

One casualty of the election is likely to be the climate rule. This rule has been stuck in the judicial review process, with a bleak prospect of emerging in its current form. But even if it got unstuck, the new SEC would need to prioritize its launch, which Atkins would be unlikely to get behind.

On the other hand, we don’t expect to see any rollback of SEC rulemaking on executive compensation and insider trading. The markets have generally welcomed these rules, meaning it would be controversial and politically unpopular to eviscerate them. More importantly, most of the new rules were implemented pursuant to Dodd-Frank—that is, they were required by congressional statute. While the SEC could tinker with certain terms, this seems like it would be an unforced error.

One aspect of executive compensation the Atkins SEC may prioritize is proxy advisor regulation. The Clayton SEC adopted a rule to regulate proxy advisors and the Gensler SEC watered it down before it went live. This triggered a flood of criticism for being a political move as there wasn’t yet any evidence on the rule’s efficacy. It’s plausible that the Atkins SEC could rewind to 2020 and allow the rule to come online.

If proxy advisors become more regulated, the balance of power will shift to issuer companies, giving them a louder megaphone to rebut proxy advisor claims. While this shouldn’t weaken corporate governance, it would motivate companies to adopt or outsource analytical procedures for pressure-testing the statements in a proxy advisor report.

The next four years are likely to present companies with an opportunity to continue shoring up their proxy disclosure processes. For a few years now, we’ve been automating the underlying tables for our clients as they strive to bring efficiency to the overall process and reduce both the risk of errors and cycle time. The need for robust proxy calculations will remain. And, if proxy advisor regulation does move forward, we anticipate companies investing in additional analytics to help them decide whether to publicly rebut proxy advisor reports.

In Closing

We love hearing from our clients and are deeply gratified to learn that we continue to deliver excellent service. We appreciate your taking the time to respond to Group Five’s benchmarking survey. Your input is extremely important to us, and we value any additional chance to get your feedback.

Visit our knowledge center for more on the above topics.

Tell us about any other topics you’d like to see us cover.