Managing the Latest Changes to 162(m) per ARPA

In recent years, tax and HR departments have been required to keep a close eye on the deductibility of employee compensation, which is governed by Section 162(m) of the Internal Revenue Code. The Tax Cuts and Jobs Act of 2017 (TCJA) expanded limitations for highly compensated employees while generally simplifying the rules by removing exceptions and introducing the concept of “once covered, always covered”. Then, in 2021, the American Rescue Plan Act (ARPA) ratcheted the complexity back up by limiting deductions for an additional five, rotating employees.

We wrote about the impact of ARPA on 162(m) soon after its passage. Due to the delayed effective date—tax years beginning after December 31, 2026—and the fact that it wasn’t accelerated as proposed in other legislation, many companies are behind the curve in accounting for the reduced deductibility. In fact, the time to adjust deferred tax asset (DTA) balances has already arrived.

We’ll begin with a refresher on 162(m) and what’s changing as a result of ARPA. Then we’ll walk through the steps companies need to take today and how to make systems more robust for managing the added complexity going forward.

IRC Section 162(m) and ARPA

What hasn’t changed is that Section 162(m) limits the compensation a public company can deduct in a taxable year. The limit is $1 million for each covered employee. Prior to ARPA, the covered employee list comprised the CEO, CFO, and the next three highest-compensated officers.

One of the primary provisions of TCJA stipulates that covered employees from previous tax years are and always will be limited, which gave rise to the phrase “once covered, always covered”. Thus, companies will have a minimum of five covered employees each year, plus any historically covered employees (who will only be relevant if their compensation exceeds $1 million in the year).

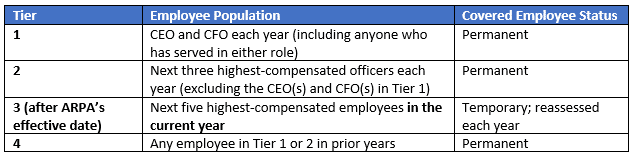

Effective for tax years ending after December 31, 2026, ARPA doubles the covered employee list from five to 10. Critically, the new group (employees six through 10) doesn’t fall under “once covered, always covered.” It’s a temporary group that must be reassessed each year. We can think of the covered employee list as consisting of three separate groups:

Important to note is that Tier 2 focuses on officers as defined in the Securities Act of 1934, whereas the new Tier 3 can be any employee. This makes line of sight critical. Previously, a process around 162(m) could narrowly review the officer pool. Now, companies must consider the compensation for all employees.

Population Tracking

Most companies have solid tracking for the first two tiers, which remain unchanged even after ARPA comes into effect. This ever-growing list of always-covered employees should be clearly in view, including ex-employees with outstanding equity awards that may settle later, such as vested stock options or midstream performance awards that will receive pro-rata or other treatment once the relevant performance period ends.

Tier 3 is now also relevant for most companies. Any tranches vesting in 2027 or beyond that are already amortizing (for example, most performance awards) would need to be assessed for deductibility.

For companies with a stable group of highly compensated employees, or with Tier 3 employees that have total compensation under $1 million, the additional complexity from ARPA may be fairly manageable. However, many public companies will likely see the expanded list capture atypical compensation situations such as major hiring events, one-off retention grants, and outsized annual bonuses. How should you prepare for this larger, revolving list of covered employees?

Implications for Today

Although the expanded covered employee list doesn’t go into effect until 2027, now is the time for companies to enhance their tracking and reporting practices. Any equity award with a vesting period of three years or longer brings 2027 compensation into view.

Options, restricted shares, and ESPPs that are expensed under straight-line amortization are likely safe from any changes to the reporting process before ARPA becomes effective. However, if a company elects to use the graded amortization method for time-based awards, even these may be relevant now. Otherwise, the implications of the expanded covered employee list leading up to 2027 are mostly limited to performance awards. The overarching principle is that if shares are being amortized now but no deduction is expected later, there’s no need to build up a DTA.

Now, this assumes we know the five employees who will comprise the Tier 3 group in 2027. Without a crystal ball or other line of sight, we must instead rely on a robust analysis. One potential solution is to focus on the current grouping of employees six through 10 as if ARPA were in effect this year. However, this may lead to large (ideally offsetting) adjustments if this list changes. Therefore, a simpler approach may be to haircut the DTA balance with an on-top adjustment based on the most likely population of covered employees. Tax teams may prefer this high-level adjustment to provision in order to avoid a discrete adjustment later.

In any case, the DTA balance will need to be appropriately scaled up or down in 2027 to align with the final list of covered employees. Accurate forecasting now can avoid large true-ups down as the effective date approaches.

Implications for Tomorrow

Tax teams already have many factors to consider when forecasting tax benefits and the effective tax rate: projected stock prices, future grants, option exercise rates, and performance-based payouts, to name a few. Now they must carefully manage five temporary covered employees each year.

Echoing our previous article on this topic, we’ve seen numerous methods of incorporating Section 162(m) rules into forecasts of future tax deductions. The simplest is to flag awards that went to employees who may be covered under 162(m), whether permanently or for a single year. While simplistic, this allows for easier identification of upcoming equity settlements, consideration of salary and bonus changes, and potential retirements (which could thrust another employee onto the covered list). Adding such a flag for manual review should be the bare minimum for any forecast.

Important to determine is whether to take a “salary first” or “equity first” approach. As the descriptors suggest, when determining deductibility in a given year, you would consider either (a) salary and bonus compensation first or (b) the value of exercised equity compensation first. For many large companies, salary and bonus are predictable and can exceed $1 million outright. In that case, it’s easy to apply the salary first method since all equity settlements are automatically nondeductible.

If salary and bonus are less than $1 million, or the company chooses to apply the equity first approach, time-based restricted shares are typically considered first. Stock price fluctuations affect even those settlements, but the timing and amounts are usually easier to predict than stock option exercises and performance-based awards. If the equity awards of any covered employees may be eligible for tax deductions, we highly recommend running multiple scenarios that flex stock prices and other material drivers.

With an additional five employees in the mix following ARPA—and the probability that some will be covered employees for only one year—the complexity of forecasting DTA balances and excess tax benefits increases considerably. At larger companies where all 10 covered employees may receive over $1 million in salary and bonus compensation, there isn’t much left to be done. All future equity compensation will be nondeductible. However, companies with employees who approach the $1 million cap have their work cut out for them because just one settlement can mean the difference between staying under the cap and exceeding it. By extension, an individual settlement event can be partially deductible. A robust forecasting process is necessary to identify such events and apply a pro rata tax rate or other custom adjustment accordingly.

Wrap-Up

In 2017, TCJA required companies to review their methodologies and rebuild procedures surrounding 162(m). Now, ARPA is requiring another review and rebuild.

The reintroduction of temporary covered employees means companies will need to put new controls in place. They’ll also need to apply more precision when first establishing DTAs for stock-based compensation and then recognizing tax benefits upon settlement. Many companies are already in the vesting window that will be impacted by the five new covered employees from ARPA. That means action may be needed today. We strongly support using the best technology you can, and we’re always happy to share our thoughts on your specific situation.