Tax Settlement Forecasting During High-Volatility Periods

One word that seems to summarize life during COVID-19 is uncertainty. Whether it’s the global economy or safely attending a baseball game, so much of life is in wait-and-see mode.

The fog of uncertainty also has descended on equity compensation as companies consider the pandemic’s impact on new, existing, and potentially modified awards. We’ve written before about tax settlement forecasting as a response to income statement volatility. Now, with a new normal setting in, we’ve noticed an uptick in questions about forecasting given the unknowns in today’s world.

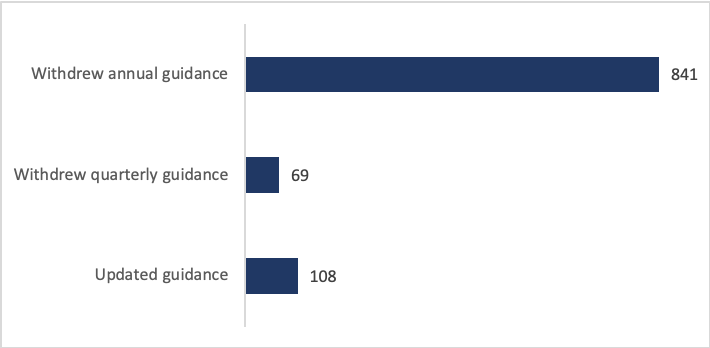

As of this writing, the overall market has recovered many of the losses suffered earlier in the pandemic. However, for many companies, volatility remains high and uncertainty even higher. One statistic that stands out is the level at which companies are withdrawing earnings guidance in response to COVID-19.

Companies Changing Earnings Guidance, March 16—May 24, 2020

(Source: IR Magazine)

The sheer volume speaks to the difficulty companies are having with even short-term forecasting. While we don’t have a crystal ball to reveal how the future will unfold, we have seen some practices prove highly effective during volatile times.

More on those in a moment. First, let’s review why tax settlement forecasting matters.

Getting a Handle on the Future

With Accounting Standards Update No. 2016-09 bringing tax windfalls and shortfalls to the P&L, there’s been a critical need for companies to predict the impact of equity award settlements. In fact, according to our most recent survey of stock-based compensation accounting best practices, 61% of respondents have some form of tax settlement forecasting in place.

But difficult-to-predict assumptions like stock price movement and the timing of option exercises can stymie even the most well-intentioned analyses. High-quality forecasts will flex all key inputs. These include future stock price, option exercise rates, performance award payout percentages, and future grant populations.

These were tricky enough to get right before COVID-19. With the extreme uncertainty and volatility we’re seeing today, it’s nearly impossible. Ironically, our experience is that having flawless inputs isn’t the key ingredient for successful tax settlement forecasting. For forecasts to be valuable, they just need to present a range of potential outcomes that reflect the various directions that the business and broader economy can go in.

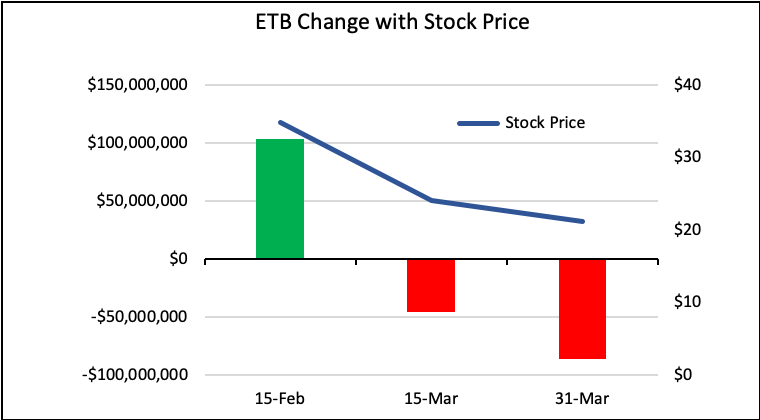

To underscore the importance of flexing your tax settlement process, let’s look at a sample company to see how the excess tax benefit (ETB) or deficiency would have changed simply based on the annual grant settlement date. This chart shows real data for how much the company’s Q1 2020 annual grant settlements would have changed over a matter of weeks.

If the company issued their annual grant in mid-February, the annual awards settling would drive an excess tax benefit of about $100 million. If this same company timed the annual settlement just a month later, in mid-March, the outcome of Q1 would look very different with a tax deficiency of nearly $50 million. What about settling just a few weeks later at the end of March? Then the total deficiency would approach $90 million.

Very few predicted that the novel coronavirus would have such a dramatic effect on equity markets in such a short time. But as stock prices plummeted, companies with worst-case scenarios on the shelf were able to answer tough questions while others were left scrambling for answers.

Basics of Tax Settlement Forecasting

Without getting too much into the details of tax settlement forecasting, let’s revisit the basic building blocks plus some timely considerations for each assumption.

Project future tax settlement events over time. Flex the rate at which vested and outstanding options will exercise, as well as at what level performance awards will be achieved. Also consider whether modifications could occur to restore underwater incentives and lead to settlements that otherwise wouldn’t occur.

Layer in hypothetical future grants. Cross-functional collaboration becomes critical here. For a long-run forecast of tax settlements, layer in future grant amounts that are converted to shares at the expected stock price at the time of grant. In addition, consider whether plan designs may occur to rejuvenate the equity program and require new assumptions in the forecast.

Compute excess benefits or deficiencies at settlement. Here the calculation is fairly straightforward: excess benefit/deficiency = (intrinsic value at settlement – GAAP fair value) * shares settled * tax rate. Make sure you know what the applicable tax rate is for each award, including jurisdictions with recharge agreements.

Run scenarios to factor in uncertainty into your forecast. Run the forecast at multiple stock price scenarios, option exercise rates, and PSU payout factors to see how each component will impact your overall tax benefits/deficiencies. To account for recent volatility, you may need additional stock price scenarios and more advanced stock option exercise models than in the past.

Pulling It All Together

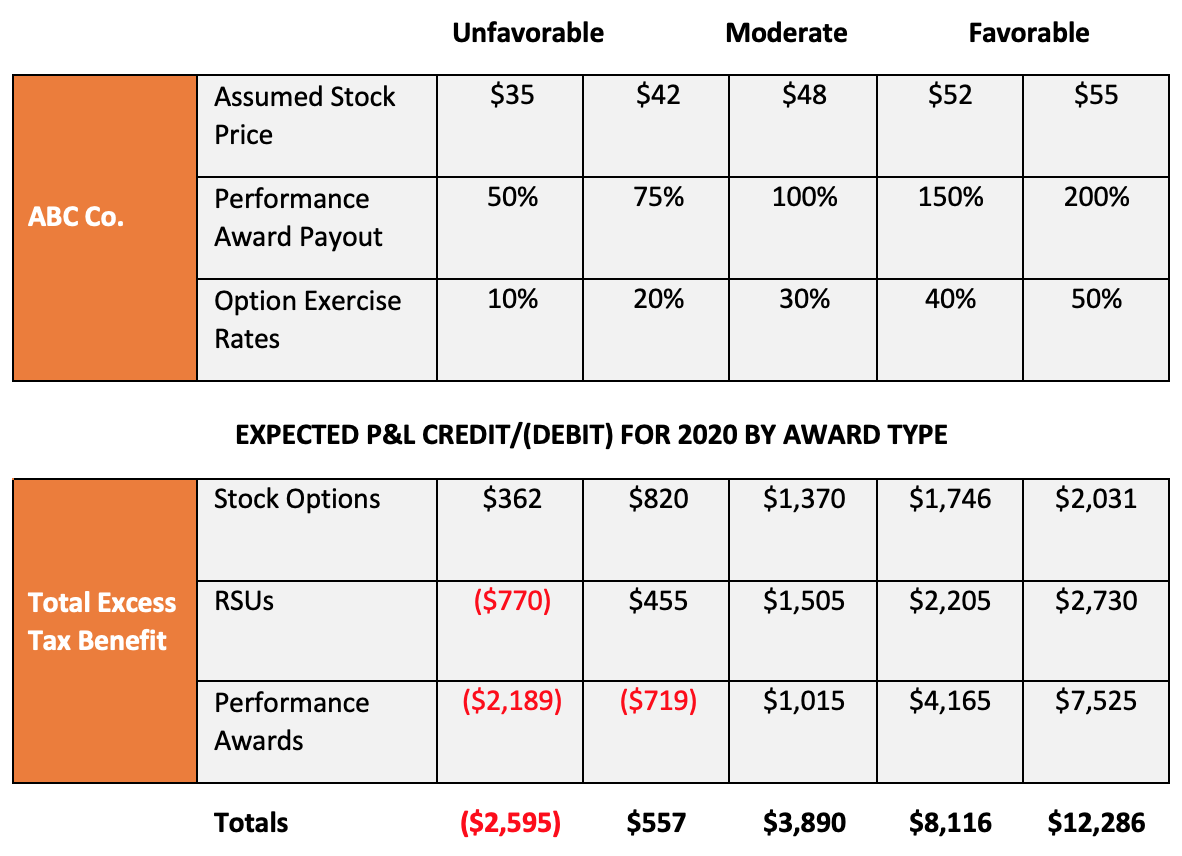

Keeping in mind that the goal of tax settlement forecasting is to provide insight and set expectations, let’s put the basic principles above into action. The table below shows an example of a single year forecast that flexes the key variables of price and settlement rates.

This summary table starts with multiple different forecasted stock prices for the year, which will generally be the single most important variable to flex. As COVID-19 has reminded us, stock prices can move significantly in a short amount of time—so even if your stock price has been stable for some time, this variable is worth modeling to see its sensitivity to price shocks both positive and negative. With that in mind, consider:

- Forecasted stock prices when layering in future-year hypothetical grants. Each price scenario should scale grant values to the respective number of shares and appropriate option strike prices (i.e., in lower price scenarios more shares will be granted at lower strike prices while providing the same overall value to employees).

- Different levels of performance award payouts. While many companies’ outstanding performance awards are tracking below target, it may be too early to tell what the final payout will be. Depending on the materiality of your PSU award program, testing the impacts of different performance metric payouts can help prepare you if the payout level changes swiftly.

- Ways that stock price affects option exercise rates. This approach is fairly advanced in that the table scales up option exercise activity at higher forecasted stock prices, while having lower option impacts in the low-price scenarios. This is meant to mimic employee exercise activity that would expect to have higher levels of exercises at greater stock prices, while projecting lower exercise activity as the value decreases in the projections. At the very least, your model should ensure that no underwater options have exercise activity projected in the lower stock price scenarios, as this would artificially inflate the tax deficiencies from the option population.

Wrap Up

Overall, the most effective way we see to manage the uncertainty of tax settlement forecasting is through a flexible process. COVID-19 has been a reminder that scenario modeling—especially that which provides insight across a range of possible outcomes—is essential to avoiding surprises on the income statement.

For more on tax settlement forecasting, we encourage you to read our issue brief. You can also stay apprised of industry trends via our Knowledge Center. And, of course, don’t hesitate to reach out with questions at any time.