David Outlaw, CEP

Managing Director, Valuation & HR Advisory Services

Reporting

We provide companies of all sizes with financial reporting services for stock-based compensation.

Valuation

Get fair value measurement and modeling for all sorts of equity-based awards and securities, whether business as usual or special circumstances.

Complex Securities Valuation

HR Advisory

Our HR advisory services provide the insight you need to improve program design, grant more equity, and tell a cleaner story in your proxy and financial statements.

CEO Pay Ratio

Resources

Dive into our library of publications on a wide range of stock-based compensation topics.

About Us

We’re dedicated to bringing insight, control, and expanded capability to your compensation strategy.

Support the case for your compensation with clear and thoughtful analytics.

You’ve found every domestic and international employee in the company. You’ve determined a CACM and gathered pay data from all of your payroll systems. You’ve adjusted for exchange rates and annualized mid-year hires. You’ve identified your median employee (somewhere in the Midwest). And now you finally know your CEO pay ratio.

At this point, it feels like you must be done, but you are not there yet.

Helping dozens of companies prepare their pay ratio analysis has taught us that collecting data and calculating a ratio is only the beginning. Stopping there can leave you woefully unprepared for questions from executives, the board, employees, and investors. And if you use all of the collected data for compliance only, you’ll miss useful insights such as comparisons by department, geography, or even gender.

We develop analytics to help you communicate more effectively with your pay ratio stakeholders, including:

Even if your company handles pay ratio analysis internally, you can benefit from:

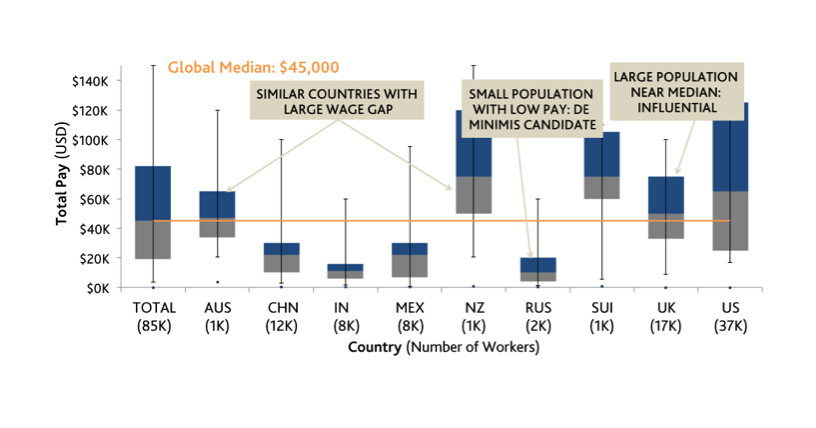

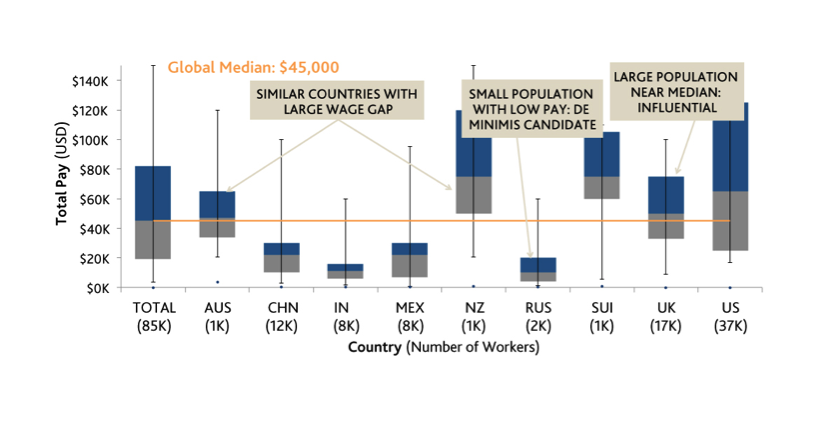

Summarize pay by jurisdiction or business unit to understand how each group affects the pay ratio and analysis—as well as how they compare to one another.

Summarize your entire dataset to understand the clustering and distribution of your pay. Gain easy insights to how changes in pay or approach can affect your pay ratio.

Here’s a resource center for HR, finance, and accounting professionals who want to get on top of Dodd-Frank CEO pay ratio disclosure rules.

Contact UsThe CEO pay ratio disclosure rule brings with it an evolving set of challenges. The rule itself is a mix of general principles and explicit guidance that leaves no shortage…

The pay ratio rule is still with us. Here are the most material methodology decisions the majority of companies will face in the second year of disclosure.

On September 21, 2017, the SEC released additional pay ratio guidance. The new guidance primarily reiterates and clarifies flexibility that the rule already allowed, with one substantial update. In this blog post, we go over the highlights of the interpretive guidance and updates to the Compliance and Disclosure Interpretations, and we discuss the ideas posed in the Department of Corporate Finance guidance regarding statistical sampling.

Weighing in at a whopping 294 pages, the CEO pay ratio rule is a mix of general principles and explicit guidance that leaves no shortage of questions. In this booklet, we share some of the common questions that have come up and offer insights that may prove relevant in the course of your preparation.

An emerging hot topic regarding the new CEO pay ratio rule is whether using statistical sampling to identify the median employee can simplify the process or trigger additional complexity. This Issue Brief explains why sampling may prove to be more trouble than it’s worth.

Managing Director, Valuation & HR Advisory Services

“I’m a teacher at heart — always happy to field questions and help clients understand, whether it’s at a high level or deep in the details.” David is a managing…

Read moreGetting Your TSR Design Details Right

Design Attribute Checklist for Relative TSR Awards

Long-Term Incentive Plans: The Universe of Design Possibilities

Equity Award Modifications: Connecting the Theory to Practical Cases

Five Ways that West Coast Companies Design ESPPs

Equity Compensation in Corporate Transactions

Top 5 Performance Award Accounting Concepts for Compensation Professionals to Know

Managing Director, Valuation & HR Advisory Services

“Securities that raise capital, manage cash flow, and provide performance incentives seem insanely complicated. But they don’t have to be.” Josh Schaeffer is a managing director and practice leader for…

Read moreFalse Positive, False Negative: Beyond the Surface of Gender Pay Equity

Economic Value Added: What You Need to Know in Anticipation of Greater Emphasis from ISS

Convertible Bridge Notes: An Introduction to Their Uses, Accounting, and Valuation Considerations

Design Features that Drive the Fair Value of a Convertible Security

Employee Terminations: Working Through the Consequences

Pay Ratio Disclosure: A Checklist of Key Considerations

Anti-Dilution Provisions in a Warrant Offering

Managing Director

Nathan O’Connor is a Managing Director at Equity Methods, a consultancy that helps hundreds of public and private companies model, value and account for equity compensation and other complex securities.…

Read moreHighlights from the 26th Annual NASPP Conference

Tricky Equity Compensation Issues Faced by Private and Newly Public Companies

CEO Pay Ratio: 40 Frequently Asked Questions and Answers

Equilar Executive Compensation Summit 2018 Conference Roundup

What You Need to Know: Contingent Consideration (Earnouts) Valuation

Managing Director, Valuation & HR Advisory Services

Managing Director, Valuation & HR Advisory Services

Managing Director

President & CEO

“I’m a teacher at heart — always happy to field questions and help clients understand, whether it’s at a high level or deep in the details.” David is a managing…

Read moreGetting Your TSR Design Details Right

Design Attribute Checklist for Relative TSR Awards

Long-Term Incentive Plans: The Universe of Design Possibilities

Equity Award Modifications: Connecting the Theory to Practical Cases

Five Ways that West Coast Companies Design ESPPs

Equity Compensation in Corporate Transactions

Top 5 Performance Award Accounting Concepts for Compensation Professionals to Know

“Securities that raise capital, manage cash flow, and provide performance incentives seem insanely complicated. But they don’t have to be.” Josh Schaeffer is a managing director and practice leader for…

Read moreFalse Positive, False Negative: Beyond the Surface of Gender Pay Equity

Economic Value Added: What You Need to Know in Anticipation of Greater Emphasis from ISS

Convertible Bridge Notes: An Introduction to Their Uses, Accounting, and Valuation Considerations

Design Features that Drive the Fair Value of a Convertible Security

Employee Terminations: Working Through the Consequences

Pay Ratio Disclosure: A Checklist of Key Considerations

Anti-Dilution Provisions in a Warrant Offering

Nathan O’Connor is a Managing Director at Equity Methods, a consultancy that helps hundreds of public and private companies model, value and account for equity compensation and other complex securities.…

Read moreHighlights from the 26th Annual NASPP Conference

Tricky Equity Compensation Issues Faced by Private and Newly Public Companies

CEO Pay Ratio: 40 Frequently Asked Questions and Answers

Equilar Executive Compensation Summit 2018 Conference Roundup

What You Need to Know: Contingent Consideration (Earnouts) Valuation

“It’s an honor to serve our clients. And one way to honor them is to make it easy to work with us.” Takis Makridis is responsible for the strategy, service…

Read more