Equity Methods Achieves “Unprecedented” 100% Client Satisfaction Rating, Says Latest Group Five Benchmarking Study

Every year, Group Five, the leading independent monitor of customer satisfaction for providers of share-based payment administration and reporting solutions, releases its benchmarking study. We live and breathe stock-based compensation and support some of the world’s most complex equity programs. Our clients depend on us for outcomes spanning basic ASC 718 compliance all the way to areas of management accounting that are essential to decision-making. So, this survey really matters to us.

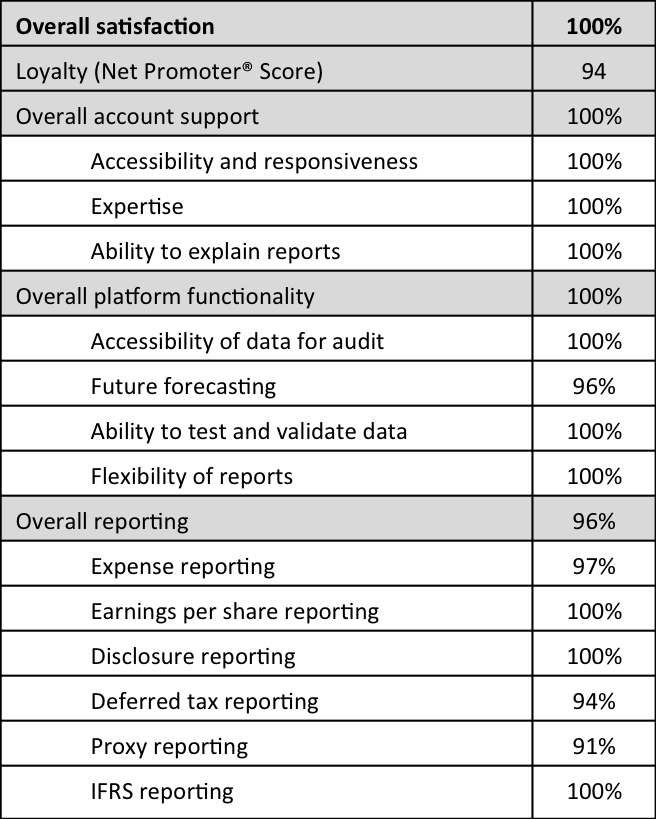

We’re pleased to report that Equity Methods garnered a 100% favorable overall satisfaction rating from clients surveyed in the study.

That’s not all. We also earned a Net Promoter® Score (NPS) of 94. (NPS is a metric of Fred Reichheld, Satmetrix, and Bain & Company. It measures the willingness of plan sponsors to recommend a service provider.)

Both ratings are unprecedented in the benchmarking study’s 17-year history.

What does this mean? It means that for the second straight year, Equity Methods is rated first among financial reporting service providers for client loyalty and overall satisfaction.

Here are the details:

Group Five 2015 Financial Reporting Benchmark Study

Results for Equity Methods

With 1,019 public US companies participating (up from 885 last year), the Group Five study has the highest participation of public companies among all studies in the stock plan industry. It’s the only independent forum for plan sponsors to make their opinions and priorities known to service providers. You’d better believe we take it seriously.

I believe a big reason for these gratifying results is that, some time ago, we made a deliberate decision to focus on enabling solutions and business outcomes using custom technology. We mobilized our engagement teams to help clients move beyond compliance to drive productivity and insight across all areas of equity compensation, from planning and forecasting to tax optimization and the proxy.

These qualities are especially important now that the equity compensation landscape is shifting beneath everyone’s feet.

First, according to our stock compensation accounting survey, high-performing companies are investing in management reporting to move stock-based compensation accounting up the value chain. The specifics look different for each company, but here are some of the central themes:

- Forecasting and budgeting. Finance executives are under more pressure than ever to explain future costs, variances, and long-range plans in detail. Insightful dashboards and analytics that shed light on equity compensation are now increasingly expected by the CFO’s office.

- Direct tracing of expense to individual cost centers. Stock-based compensation is one of the few costs still lingering at the ‘top of the house’ in many companies’ general ledgers. To facilitate better transparency into divisional profitability and resource consumption, finance leaders are pushing to have stock-based compensation allocated down to the cost center level.

- Execution of international recharge programs. These offer the potential to save hard cash, reduce the after-tax cost of equity, and repatriate cash tax-free to the US. But they also require an investment in infrastructure and process.

- Collaboration during the award design stage. With the explosion in performance-based equity designs that contain countless bells and whistles relative to a stock option, there is more risk than ever of surprises that negatively affect shareholders (via the proxy), executives, or both. Analytical modeling is the best defense, and is a vital means through which finance can help executive compensation avert major problems.

These are exciting trends for finance functions looking for greater influence on business decision-making. Arguably the largest impediment are internal processes that render mere compliance with ASC 718 so daunting that high-impact management accounting opportunities go unanswered. For that reason, we view excellence in basic compliance as a strong foundation for executing in strategic areas like those listed above.

Second, the FASB and SEC have spent much of 2015 creating and finalizing proposals that affect equity compensation. At the FASB, a number of potential amendments were introduced to simplify ASC 718. The most controversial of these is the proposed APIC pool elimination, which could expose the income statement and effective tax rate to greater volatility. Much more popular is the FASB’s proposed share withholding revision. It switches the liability trigger to the maximum statutory rate, making tracking and compliance easier. A third change would provide the option to stop applying a forfeiture rate and, instead, recognize forfeitures as they occur. We expect to see final guidance before 2016.

The SEC’s Dodd-Frank rule-making will likely result in much more complexity, primarily affecting the proxy. This August, the SEC finalized its rules around pay ratio. Starting in fiscal year 2017, companies will need to calculate the total annual compensation of their median-compensated employee and show this in relation to the CEO’s total annual compensation. Already, companies are commissioning pro forma analyses to understand the drivers behind their ratio and to provide a richer story for the proxy.

Also coming down the pike is final guidance on clawback provisions and a new pay vs. performance disclosure. Both will considerably influence how awards are designed and reported in the proxy.

Third, as we alluded to above, awards continue to become more diverse, making flexible reporting processes more important than ever. Per the Group Five survey results, companies now issue stock options (81%), restricted stock (87%), performance awards (67%), and SARs (15%). Our own survey reveals consistent results and delves further into the types of performance awards being granted. For example, just under 50% of companies we surveyed now issue relative total shareholder return (TSR) awards, and a full 20% of respondents issue hybrid awards (combining both a TSR metric and operational metric).

Also, ESPPs (34%) remain strong and are gaining momentum as companies seek cost-efficient ways to achieve broad-based employee ownership. Many leading organizations are introducing non-vanilla ESPPs that include longer look-back periods, reset provisions, or rollover provisions. In our client work, we have often found that the added cost of a more employee-friendly ESPP is significantly outweighed by its positive impact on morale and engagement.

Finally, finance organizations are looking for service providers that can become long-term partners. For providers, this means responding quickly to events such as new award designs, modifications, corporate transactions (including spin-offs), and acquisitions. Speed, grace under pressure, adaptability to new information and emergent requirements, and dexterity in working with changing data structures are all essential.

Partnership also means the ability to grow new capabilities with a company over time. Management reporting is not a one-shot deal. Usually, finance executives set concrete and measurable goals annually to achieve increasingly ambitious goals. Service providers must be able to help execute these new priorities each and every year.

Group Five, a corporate services research and consulting firm, conducts its Stock Plan Administration Benchmark Study every year. The full 2015 report is available for purchase on their website. For a complimentary copy of the summary report, click here or on the Download Now button at the top of this page.